We achieved steady income growth, and maintained a resilient balance sheet and strong capital position.

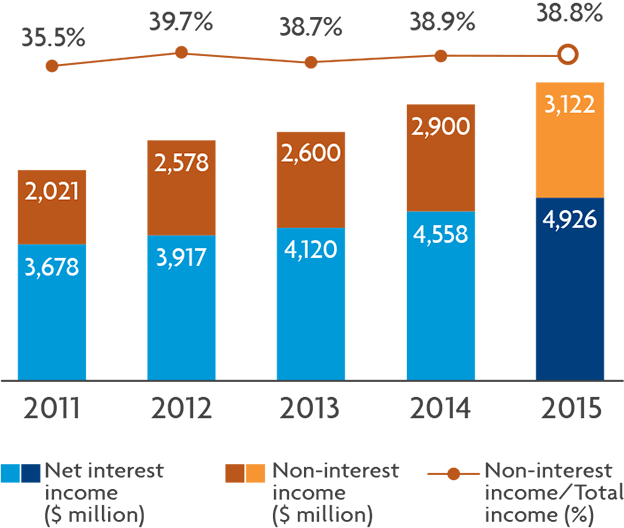

Total Income

Total income grew 7.9% to reach $8.05 billion, led by a broad-based increase in core income and higher gains on sale of investment securities.

Net interest income grew 8.1% to $4.93 billion, driven by healthy loan growth and improved net interest margin. Net interest margin increased 6 basis points to 1.77%, benefiting from rising short-term interest rates in Singapore.

Non-interest income rose 7.7% to $3.12 billion in 2015. Fee income grew 7.7% to $1.88 billion with credit card, fund management and wealth management activities registering steady growth. Trading and investment income increased 16.8% to $954 million due to higher gains on sale of securities as well as healthy growth in treasury customer income.

Net Profit After Tax

The Group reported net profit after tax of $3.21 billion for 2015, a marginal 1.2% lower from a year ago as prior year results included a higher write-back of tax provisions.

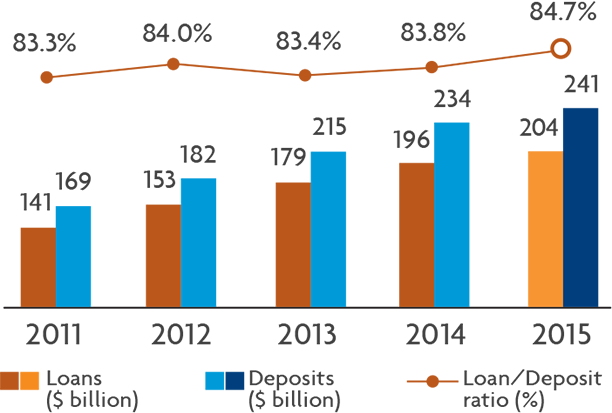

Customer Loans/Deposits

Net loans registered a broad-based increase of 3.9% from a year ago to $204 billion in 2015.

Customer deposits grew 2.9% to $241 billion, mainly led by growth in Singapore dollar and US dollar deposits.

The Group’s funding position continued to be strong with loan-to-deposit ratio at 84.7% in 2015.

From 2013, customer deposits include deposits from financial institutions relating to fund management and operating accounts. Previously, these deposits were classified as “Deposits and balances of banks”.