You are now reading:

ASEAN Consumer Sentiment Study 2024 (Thailand): Increased spending despite inflation fears

What does the ASEAN consumer think and feel about the economy? How has spending and financial behaviour changed? Get the latest highlights from the region’s barometer of consumer sentiments.

What does the ASEAN consumer think and feel about the economy? How has spending and financial behaviour changed? Get the latest highlights from the region’s barometer of consumer sentiments.

Explore key business trends and sentiments today.

View reportyou are in UOB ASEAN Insights

You are now reading:

ASEAN Consumer Sentiment Study 2024 (Thailand): Increased spending despite inflation fears

The World Bank projects Thailand's GDP to grow by 2.4 per cent this year, up 0.5 per cent from 2023. Growth is mainly supported by domestic consumption and tourism, which has nearly recovered to pre-pandemic levels.

While inflation is expected to remain within the target range until the end of 2024, the sentiment among Thai consumers is bleak. According to the ASEAN Consumer Sentiment Study 2024 – Thailand, consumers in the country are less optimistic than the regional average.

In fact, a recent survey highlighted that Thai consumer confidence has sunk to a 13-month low in August this year – in light of slow economic growth and uncertainty over government policies. Add to the fact that the country’s unemployment rate had hit a two-year high in the second quarter of 2024, consumer outlook remains cautious.

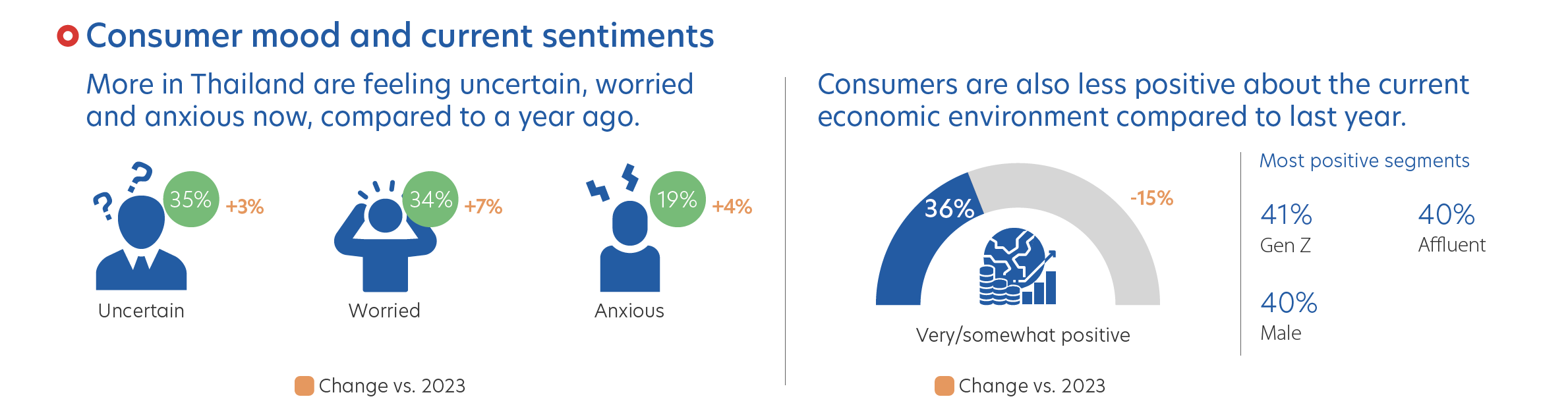

The mood in Thailand has declined compared to the last survey, with even fewer people feeling optimistic about the economy. Only 36 per cent of respondents feel positive about the current economic environment, a 15 per cent drop from last year. The drop is even larger when discussing future economic performance. Last year, 62 per cent of Thais felt positive about the country’s future economic outlook; this has sunk to 35 per cent this year. One in three respondents (34 per cent) are feeling worried, a significant increase compared to a year ago.

Figure 1: Survey results of respondents’ mood in today’s economic situation

Much of the pessimism is fed by fear. More than four in five Thais (83 per cent) expect a recession in the next six to 12 months. This concern is particularly pronounced among Gen Z respondents.

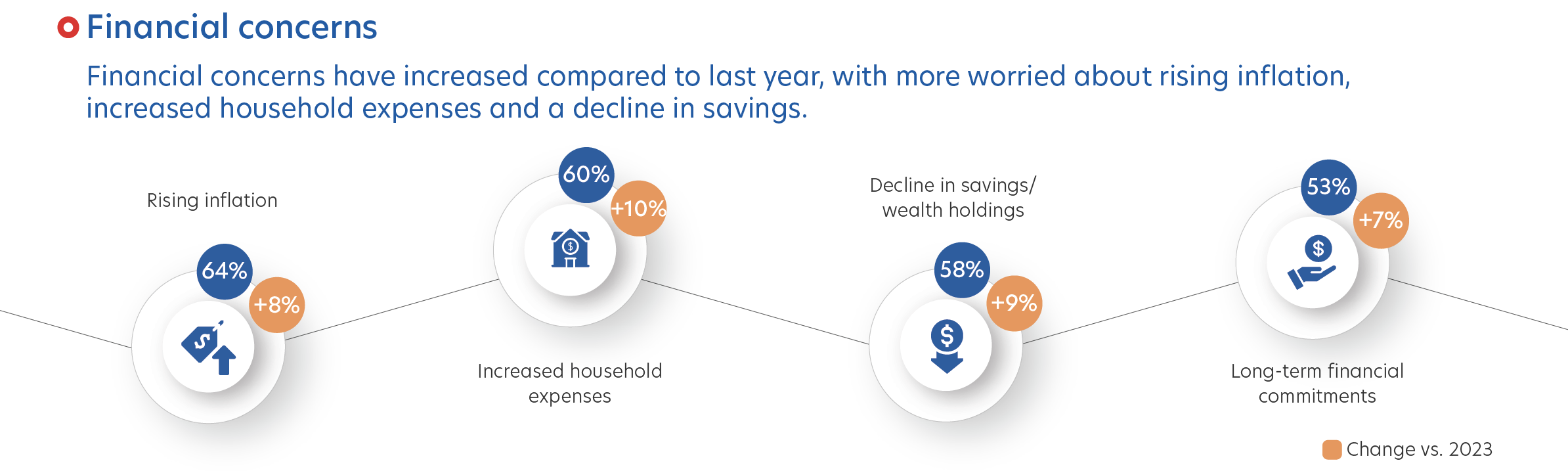

Financial concerns, too, remain a key worry, with 80 per cent expressing anxiety over finances. Rising inflation was still the foremost issue for Thai consumers (64 per cent). Such concerns are not unfounded; Thailand’s consumer price index hit its all-time high in May 2024, with inflation also peaking during the same period. Meanwhile, news such as a planned rise in energy prices continues to stoke fears.

To cope, over half of Thai consumers (51 per cent) spent less on non-essential items while 45 per cent started a secondary source of income. Bargain hunting is also on the rise, with 44 per cent looking for offers or discounts when shopping.

Figure 2: Respondents’ top financial concerns

Work-related worries, particularly about losing bonuses and job security, are also prevalent, especially among mass consumers. Top worries include the possibility of losing bonuses, lack of job security, and potential pay cuts.

Inflation is making its mark, with 42 per cent of consumers reporting that they are allocating more into expenses. These generally go into essentials like utilities (46 per cent), groceries (31 per cent), and home food delivery (30 per cent).

Figure 3: Increased spending on essentials

For some groups, discretionary spending is also on the rise. Gen Z, Gen Y, and Affluent consumers are driving spending increases on experiences, including dining out, travel, and entertainment. Nearly two-thirds (63 per cent) of Thai consumers spent money overseas in the past year, primarily for leisure travel (48 per cent). Singapore, Vietnam, and Malaysia are the top overseas spending destinations.

When looking at specific areas of financial management, Thais seem to be in a good position. Around two in five Thai consumers save about 20 per cent of their income every month. Over half of those surveyed invest more than 10 per cent of their annual income.

However, only 11 per cent of Thai consumers meet at least three of the financial literacy guidelines include savings, insurance, investment, and legacy planning. A quarter of those surveyed did not meet any of the guidelines. This is particularly pronounced among females, where nearly a third (32 per cent) didn't meet any of the financial literacy rules of thumb.

Most Thais are financially prepared for emergencies, with 57 per cent of respondents having at least three months’ worth of emergency funds. While 55 per cent of Thais have health insurance, only 15 per cent of Thai consumers are insured for death and total permanent disability.

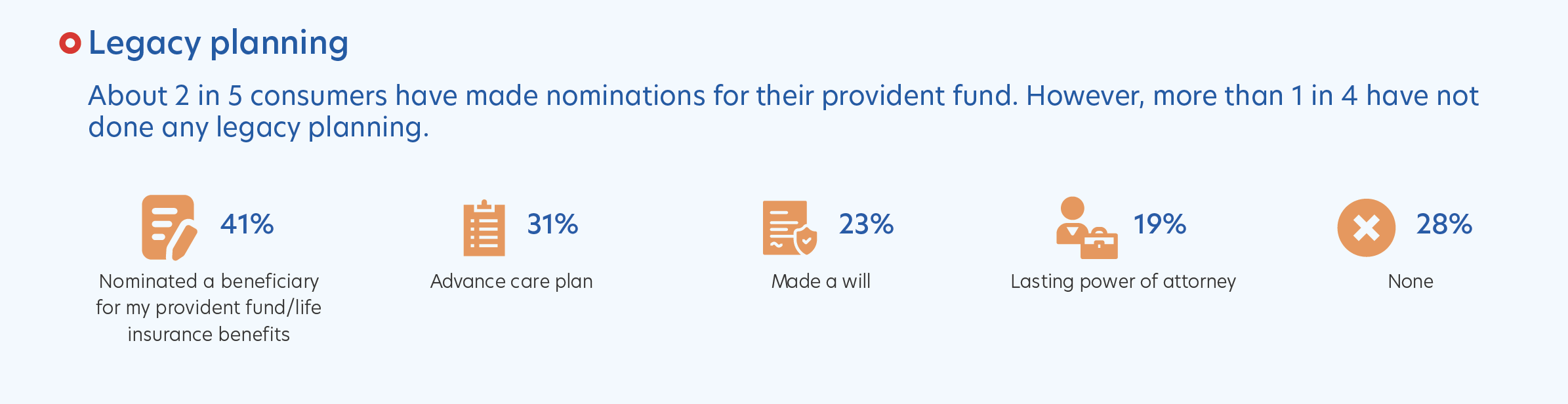

When it comes to retirement, 90 per cent have started setting aside money for their golden years. Over two in five Thais have nominated a beneficiary for their provident fund or life insurance policy. However, less than a quarter (23 per cent) have made a will.

Figure 4: Types of legacy planning that have been undertaken

Overall, the financial literacy in Thailand is patchy, with significant gaps in insurance coverage and legacy planning.

Consumers continue to prefer online channels (internet and mobile banking) for various activities, including local funds transfer, balance / transaction enquiries, and overseas money transfers. This is not surprising, as Thailand has a high internet penetration rate of 98 per cent. Smartphone penetration currently sits at 77 per cent and is expected to hit 97 per cent as early as 2029.

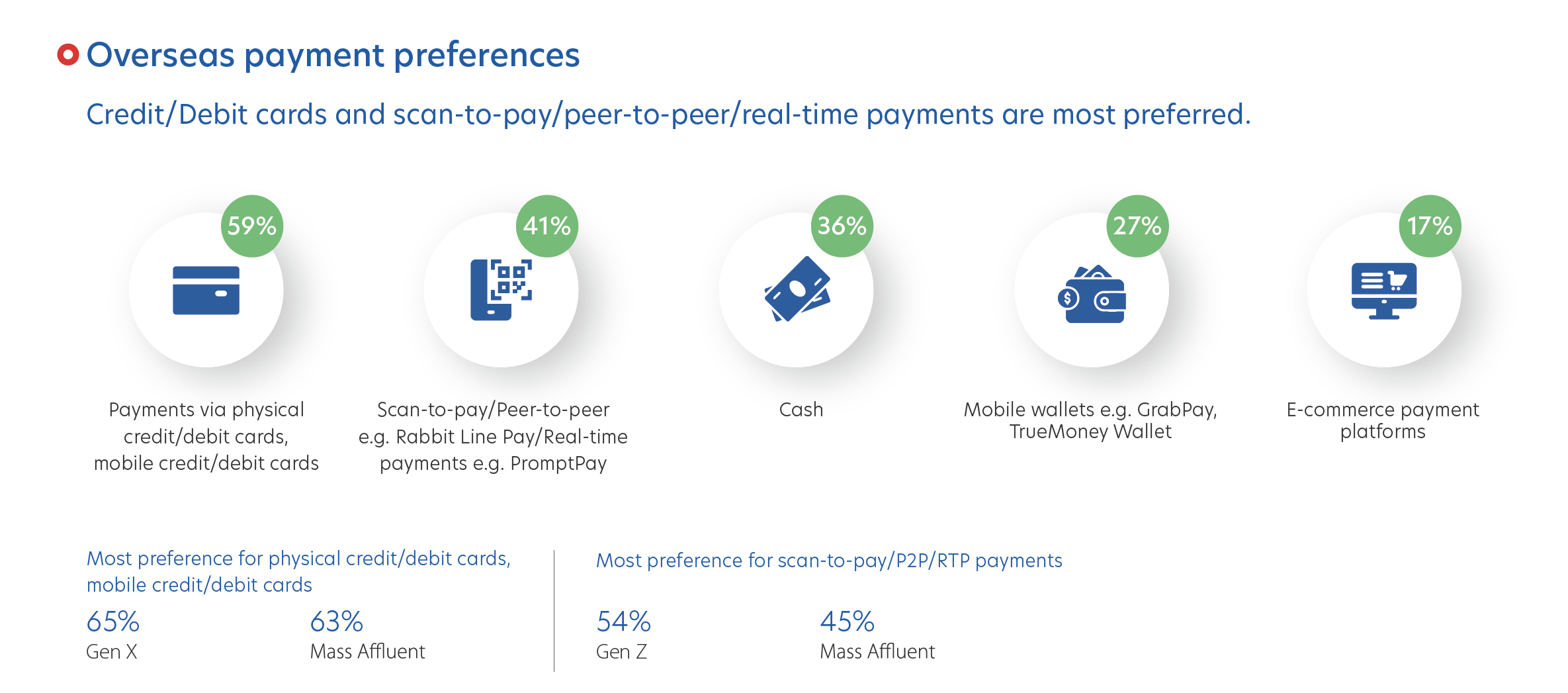

Thais are also using digital payments more frequently, as compared to last year. Notably peer-to-peer payment services and real-time payments have seen a significant increase in frequency of usage in the past six to 12 months. Scan-to-pay is the second most preferred payment method overseas, with Gen Z leading its adoption. It is surpassed only by physical or mobile credit/debit cards, which is the most preferred payment method overseas.

Figure 5: Preferred payment methods during overseas trips

A large majority (91 per cent) of consumers want banks to send them personalised offers, with 78 per cent preferring to receive personalised offers through their banking app. Other popular channels for personalised offers are email (64 per cent) and SMS (41 per cent).

At UOB, we help businesses navigate the dynamic landscape of the ASEAN region to unlock its full potential. Contact us to find out about our tailored solutions, industry knowledge and market expertise.

The ASEAN Consumer Sentiment Study (ACSS) is UOB’s regional flagship study analysing consumer trends and sentiments in five countries: Singapore, Malaysia, Thailand, Indonesia and Vietnam. Now in its fifth year, the survey was conducted from May to June 2024 and captures the responses of 5,000 consumers across different demographic groups in the region. In Thailand, 1,000 consumers were surveyed.

Some of the areas covered include:

This article shall not be copied or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.

Get the ACSS 2024 Thailand infographics and report. Download now

06 Dec 2024 • 4 mins read

02 Dec 2024 • 4 mins read

07 Nov 2024 • 5 mins read