You are now reading:

ASEAN Consumer Sentiment Study 2024 (Vietnam): Positive outlook guided by strong economy

What does the ASEAN consumer think and feel about the economy? How has spending and financial behaviour changed? Get the latest highlights from the region’s barometer of consumer sentiments.

What does the ASEAN consumer think and feel about the economy? How has spending and financial behaviour changed? Get the latest highlights from the region’s barometer of consumer sentiments.

Explore key business trends and sentiments today.

View reportyou are in UOB ASEAN Insights

You are now reading:

ASEAN Consumer Sentiment Study 2024 (Vietnam): Positive outlook guided by strong economy

Vietnam's economy is growing at a healthy rate, with the World Bank forecasting a GDP growth of 6.1 per cent in 2024 and 6.5 per cent in 2025. This is due to a number of factors, including strong exports, rising foreign direct investment, and increasing domestic consumption.

This economic growth seems to have trickled down. According to the ASEAN Consumer Sentiment Study – Vietnam report, Vietnamese consumers are sharing positive sentiments about their country's current and future economic environment, which is higher than the regional average.

Like many in the ASEAN region, Vietnam is also dealing with rising inflation and increased household expenses. However, Vietnamese consumers appear keen to adapt, with many taking measures to reduce spending.

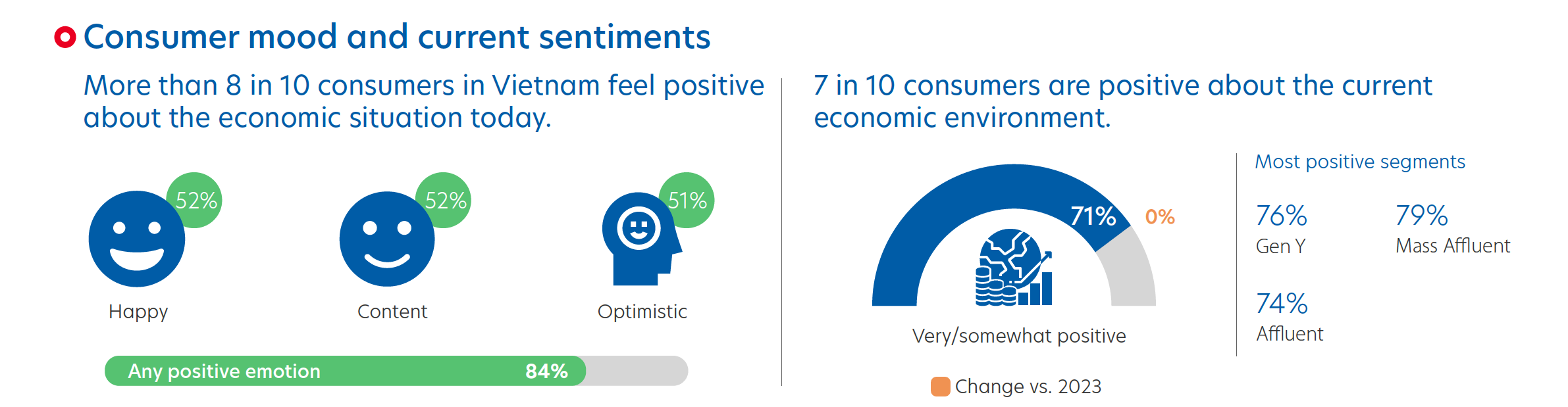

In line with last year’s trend, Vietnamese consumer sentiment is positive and outperforms regional averages. Seven in 10 Vietnamese consumers feel good about current and future economic performance, which is 17 per cent higher than the regional average.

Figure 1: Survey results of respondents’ mood in today’s economic situation

On personal finances, nine in 10 Vietnamese consumers expect to be in the same or better financial position next year.

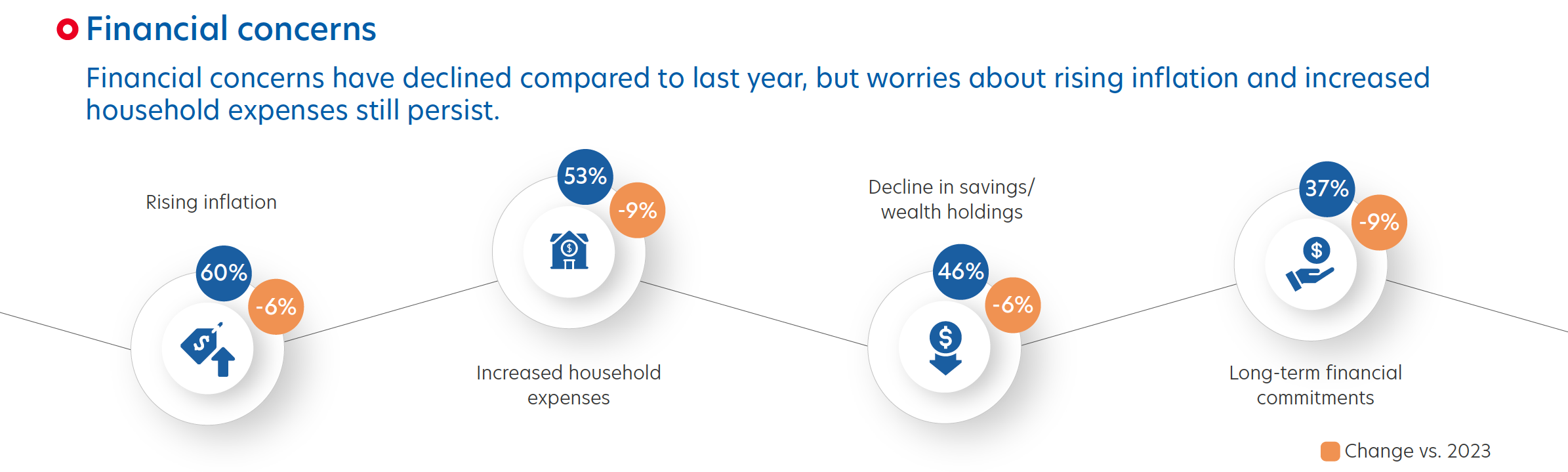

Vietnamese respondents are not immune to monetary concerns. Like many of their ASEAN neighbours, they worry about inflation and rising household expenses. The fear of rising prices may be fuelled in part by the government-mandated wage increase in July 2024. Nonetheless, respondents remain upbeat, with fewer people expressing these concerns as compared to last year.

Figure 2: Respondents’ top financial concerns

Work-related concerns, especially the possibility of pay cuts, loss of bonuses, or job loss are also on the minds of Vietnamese respondents. The top three financial concerns include the inability to: put aside money for savings (33 per cent), maintain one’s current lifestyle (32 per cent), and taking care of parents' financial and healthcare needs (30 per cent). Gen Z and the Mass segment are most concerned about work-related and financial issues.

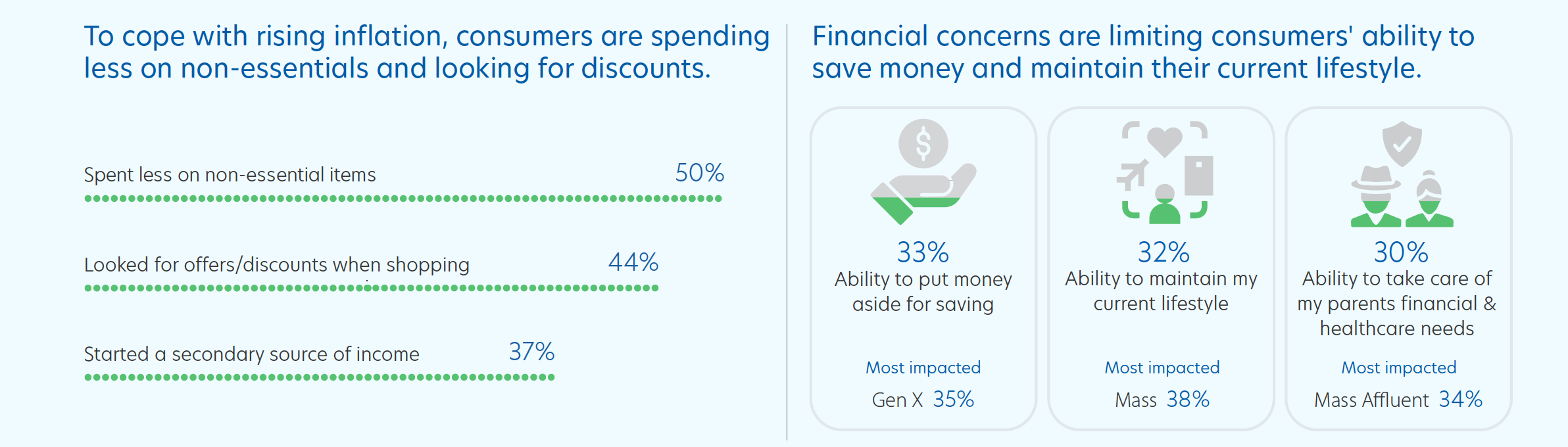

Vietnamese respondents still feel the pinch, with many reporting that their spending has increased on essentials. A significant group of consumers are also spending more on child education (42 per cent), healthcare (33 per cent), and utilities (33 per cent). Budget allocation for expenses has increased from the previous year, particularly amongst Mass Affluent consumers.

In response, half of Vietnamese consumers are spending less on non-essentials. For example, more than two in five (44 per cent) are looking for discounts and offers to save on expenses. Meanwhile, 37 per cent have begun looking for a secondary source of income.

Figure 3: Ways of coping with inflation and most worrying financial situations to be in

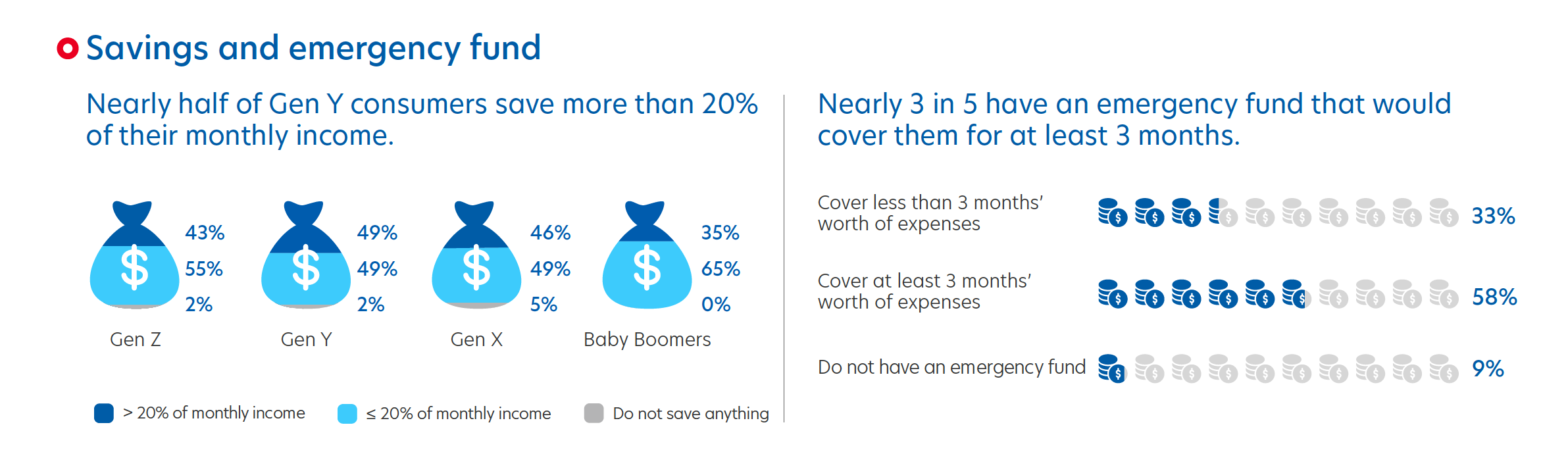

Despite rising expenses, Vietnamese consumers are putting more money into savings (32 per cent) and investments (36 per cent), and less into mortgages. Almost half of Vietnamese consumers save at least 20 per cent of their monthly income, 6 per cent higher than the regional average.

91 per cent of respondents have an emergency fund, with 58 per cent having savings that could cover expenses for three to six months (vs. 54 per cent regionally). Notably, Gen Z consumers are saving more than the other age groups.

Figure 4: Proportion of Thai consumers saving monthly and having an emergency fund

Significant portions of the Vietnamese population own insurance coverage. Health insurance tops the list, with 86 per cent of those surveyed reporting they have it (16 per cent higher than the regional average). Vietnamese consumers also reported higher ownership percentages across other insurances like life, motor, personal and term insurance compared to their peers. For example, 63 per cent of Vietnamese consumers have motor insurance, compared to the regional average of 50 per cent.

Vietnamese consumers are also financially savvy, with 63 per cent of respondents investing more than 10 per cent of their annual income. This exceeds the regional average by 10 percentage points. Investing is particularly common among Gen Y and Mass Affluent consumers.

Many have also started planning for their later years, with a good number (73 per cent) having at least a fair understanding of the amount needed for a comfortable retirement. A significant majority (93 per cent) have started saving for retirement, surpassing the regional average of 89 per cent. Provident fund / life insurance benefits nomination and lasting power of attorney are the most popular legacy planning tools among Vietnamese.

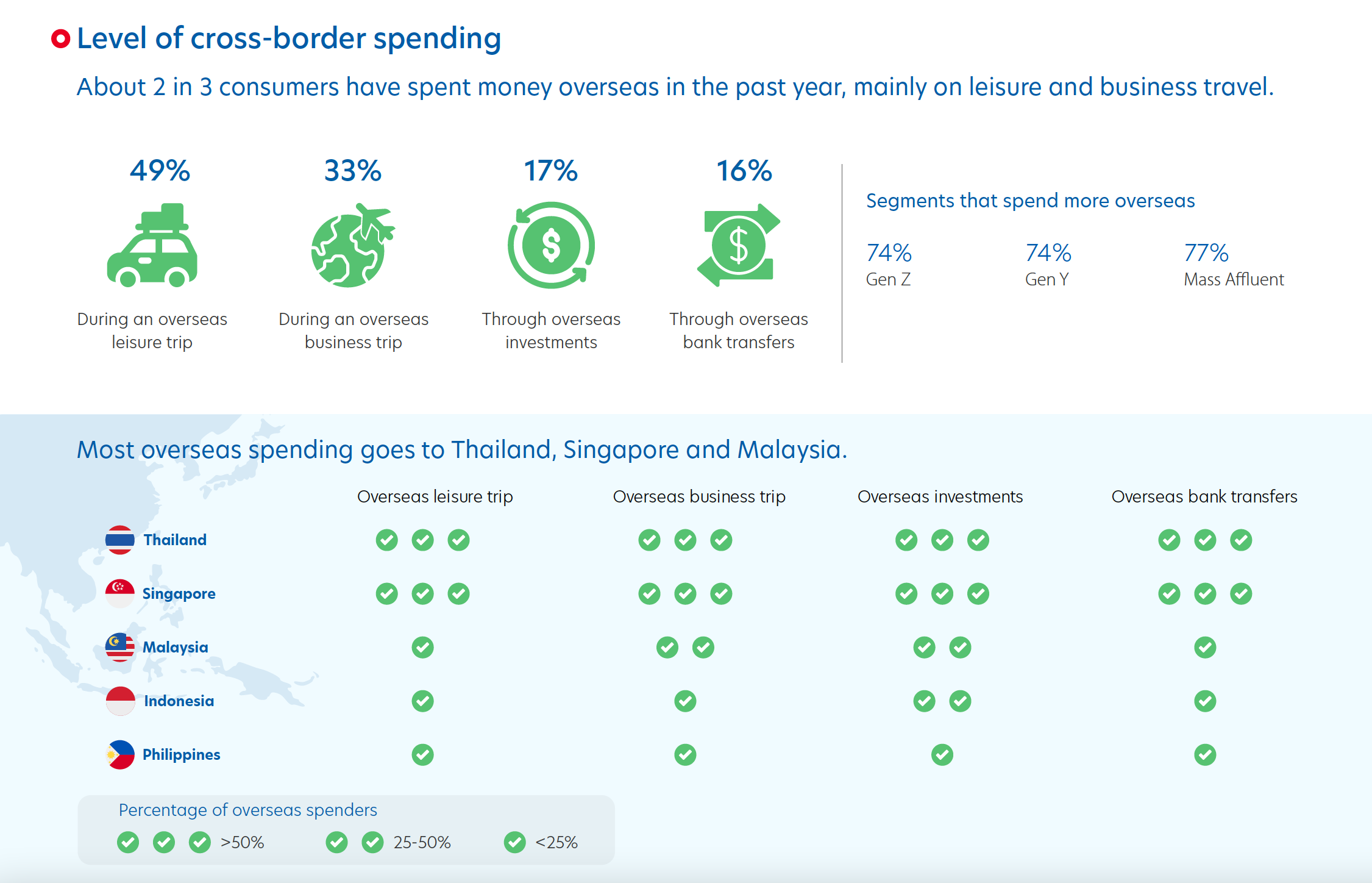

Vietnamese consumers show a strong preference for overseas spending, with 71 per cent reporting that they have spent money overseas in the past year. This is higher than the regional average by five percentage points. Overseas spending was primarily driven by leisure trips (49 per cent), business trips (33 per cent), and overseas investments (17 per cent). Thailand and Singapore emerged as the top destinations for Vietnamese consumers' overseas expenditure.

Figure 5: Types of overseas spending

Around a quarter of consumers spent more on experiences like concerts, festivals, and even dining out compared to six to 12 months ago. This experiential spending is higher among Gen Z and Gen Y.

At UOB, we help businesses navigate the dynamic landscape of the ASEAN region to unlock its full potential. Contact us to find out about our tailored solutions, industry knowledge and market expertise.

The ASEAN Consumer Sentiment Study (ACSS) is UOB’s regional flagship study analysing consumer trends and sentiments in five countries: Singapore, Malaysia, Thailand, Indonesia and Vietnam. Now in its fifth year, the survey was conducted from May to June 2024 and captures the responses of 5,000 consumers across different demographic groups in the region. In Vietnam, 1,000 consumers were surveyed.

Some of the areas covered include:

This article shall not be copied or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.

Get the ACSS 2024 Vietnam infographics and report. Download now

06 Dec 2024 • 4 mins read

02 Dec 2024 • 4 mins read

28 Oct 2024 • 4 mins read