Get a gift worth S$439 or S$350 cash credit when you apply now!

AirPods Pro (2nd generation) with MagSafe Charging Case and 2 units of AirTag (worth S$439):![]()

- Applicable to new-to-UOB credit card customers, who successfully apply to be the principal cardholder for a Metro-UOB Card between 1 October 2024 and 30 November 2024 (both dates inclusive)

- Spend a min. of S$1,000 on the card in the first 30 days from the card’s approval date and pay the annual fee for the card’s 1st year membership

- SMS registration required.

OR

- Applicable to the first 200 new-to-UOB credit card customers per month who successfully apply to be the principal cardholder for a Metro-UOB Card between 1 October 2024 and 30 November 2024 (both dates inclusive)

- Spend a minimum of S$1,000 per month for 2 consecutive months from card approval date.

- SMS Registration required.

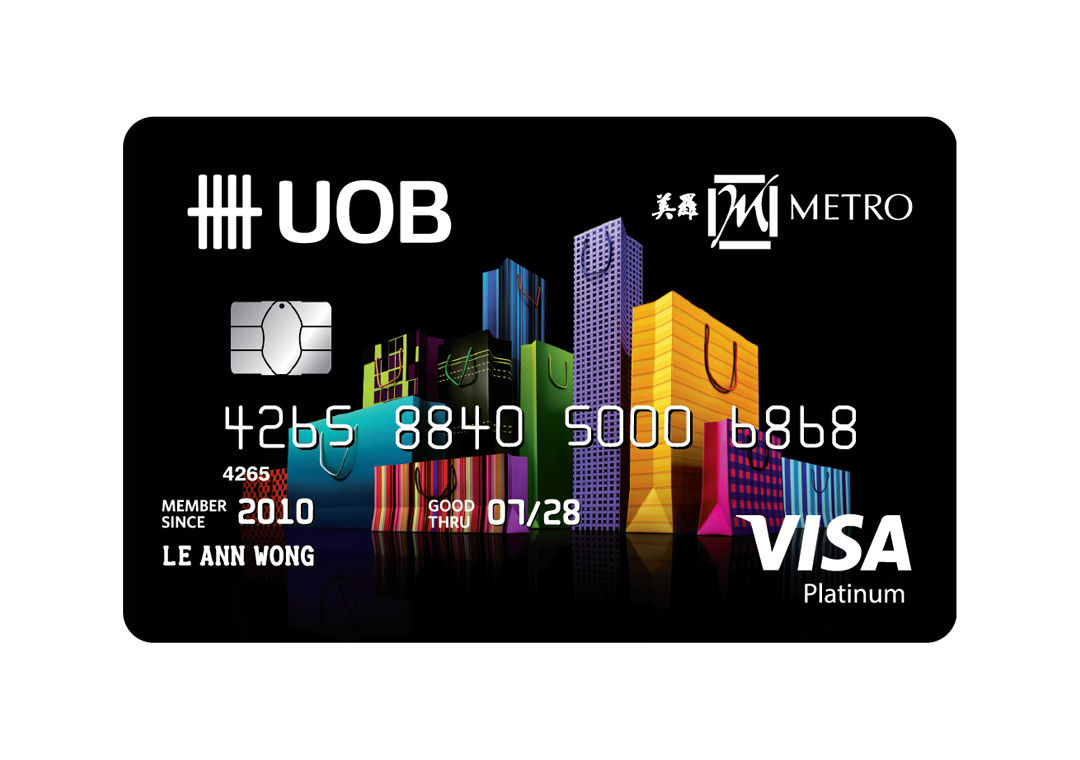

For all your shopping desires

With 10% off regular priced items and 5% Metro$ Rebates on your purchases at Metro all year round, fill your cart to your heart's desire when you spend with the Metro-UOB Card.

Benefits

10% off regular-priced items all year round

Enjoy instant 10% discount on regular-priced items with blue tag

20% off on your birthday month

A generous 20% off regular-priced items with a blue-price tag along with other exciting offers.

Invitation to Double Metro$ Day and exclusive previews

Earn Metro$ twice as fast and gain exclusive entry to Metro events and previews

Things you should know

Eligibility and fees

Eligibility

Minimum age 21 years oldFor Singapore citizens and permanent residents

- Minimum annual income of S$30,000

For foreigners

- Minimum annual income of S$40,000

Documents Required: Click here

Fees

Principal card*- S$196.20# yearly

- First year card fee waiver

Supplementary card

- FREE first card

- S$98.10# yearly for subsequent card

*Not eligible for Secured Card Applications.

#Inclusive of Singapore's prevailing Goods and Services Tax (GST)

Apply & Pay within minutes

Applying for your credit card is now faster, simpler and more secure when you apply via UOB Personal Internet Banking or Singpass (MyInfo) - no more endless fields to fill in and documents to upload. Complete your application journey within minutes!

Digitize your approved card for mobile contactless payment (Apple PayNEW and Google Pay) on UOB TMRW app and use within minutes!

Click here to find out more common FAQs about your credit card

Click here to find out more about digital banking solutions

For existing Principal UOB Credit Card holders

Alternatively, if you are already a Principal UOB Credit Card holder, you can send an SMS application to 77672:

- <Yesme>space<Last 4 digits of existing UOB Card>space<NRIC#>

Important notice

- Metro$ Rebates earned are reflected on Metro’s charge slip. You can check your Metro$ Rebates balance and expiry date via UOB Personal Internet Banking.

- W.e.f. 1 August 2022, payments to IPAYMY, RWS-LEVY, SMOOVE PAY, SINGPOST – SAM, and Razer Pay and payments for utilities will be excluded from the awarding of UNI$.

- With effect from 21 July 2024, transactions with the transaction description "NORWDS*" will be excluded from the awarding of UNI$, cashback, and KrisFlyer Miles.

Terms and Conditions Governing Metro-UOB Card

Click here for Terms and Conditions.

Compare credit cards

Can’t decide which card to apply for? Here’s an easy way to find the one for you.

Before you begin, please prepare the following documents.

For salaried employees

- NRIC (front and back) and

- Latest billing proof (within the last 6 months) as per your local home address (e.g. telephone or utilities bills, etc) if differs from address in NRIC and

- Income documents (any of the following)

- Latest 12 months' CPF Contribution History Statement via Singpass login or

- Latest Computerised Payslip (Fixed income earner with Basic Salary ≥ $2,500) / Latest 3 months’ Computerised Payslip (Variable Income earner with Basic Salary < $2,500) or

- Latest Income Tax Notice of Assessment + Latest 12 months' CPF Contribution History Statement or

- Latest Income Tax Notice of Assessment + Latest Computerised Payslip (in Singapore Dollar currency)

For self employed

- NRIC (front and back) and

- Latest billing proof (within the last 6 months) as per your local home address (e.g. telephone or utilities bills, etc ) if differs from address in NRIC and

- Latest Income Tax Notice of Assessment

For commission based employees

- NRIC (front and back) and

- Latest billing proof (within the last 6 months) as per your local home address (e.g. telephone or utilities bills, etc ) if differs from address in NRIC and

- Latest Income Tax Notice of Assessment

For foreigners

- Valid Passport (with at least 6 months’ validity) and

- Employment Pass (EP or S Pass only with at least 6 months’ validity) and

- Latest billing proof (within the last 6 months) as per your local home address (e.g. telephone or utilities bills etc) and

- Income documents (any of the following)

- Latest Computerised Payslip (in Singapore Dollar currency) or

- Latest Income Tax Notice of Assessment + Latest Computerised Payslip (in Singapore Dollar currency) or

- Company Letter certifying Employment and Monthly Salary (in Singapore Dollar currency) dated within 3 months

For existing UOB Credit Cardmembers

- Latest income documents as above are required if you wish to update the Credit Limit on your UOB Cards; or if there has been a change in your employment.

Important notice

- For CPF Contribution History Statement submission, the maximum credit limit is calculated based on the CPF salary ceiling of S$6,000 per month. Please submit your latest Income Tax Notice of Assessment together with your CPF Contribution History Statement if your monthly salary is more than S$6,000.

- Print your Income Tax Notice of Assessment via https://mytax.iras.gov.sg with your Singpass or IRAS PIN.

- Note that if your income documents reflect a lower income than that in our bank records, we will have to reduce the current credit limit of your existing unsecured facilities to reflect prevailing earned income.

- We reserve the right to request for information and income documents if deemed necessary.

Related products and services

UOB Absolute Cashback Card

Highest limitless cashback rate in Singapore at 1.7%. No minimum spend. No spend exclusions.

UOB EVOL Card

Own every evolution with the UOB EVOL Card. Get rewarded for shopping at all your go-tos, in-app or online.

UOB One Card

You're a savvy spender and getting the most out of your card is your forte. The UOB One Card gives you the most cashback and helps you grow your savings. It's the smarter way to spend.

Other useful links

UOB Cardmembers’ Agreement

Click here for a copy of the UOB Cardmembers’ Agreement.

General information on UOB Cards

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Please refer to UOB Insured Deposit Register for a list of UOB accounts/products that are covered under the Scheme.