“Highest Cashback Card” refers to the highest cashback based on a retail spend amount of S$2,000 per month for 3 consecutive months, in comparison to other banks' cashback cards across Singapore as of 1 March 2024. Please note that exclusions apply.

#UOB Year End Campaign 2024

Valid from 18 November 2024 to 5 February 2025, both dates inclusive. Click here for full terms and conditions and here for FAQs.

^S$4.50 off McDelivery (Free Delivery) Promotion

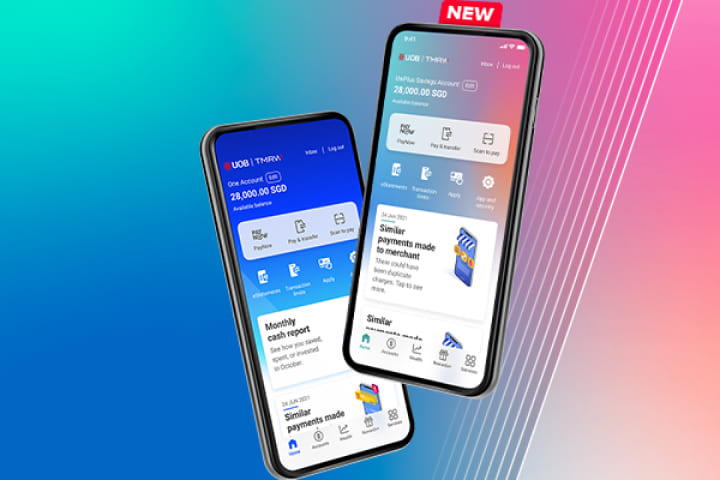

McDelivery Coupons will be released on Fridays via UOB TMRW app till 27 December 2024. Coupons are valid for redemption within 30 days from the release dates via McDonald’s app. Coupons can be used to enjoy S$4.50 off deliveries every day (equivalent to free deliveries) with min. S$20 spend on UOB One Credit and Debit Cards via McDonald’s app. McDonald’s free delivery coupon expiry dates and terms and conditions apply. Click here for FAQs.

1Up to 20% Cashback (for new-to-UOB credit card customers only)

New-to-UOB credit card customers who successfully apply between 1 September 2024 to 31 December 2024 and who qualifies for Quarterly Cashback will get enhanced partner cashback of up to 10% on the total DFI Retail Group (such as Cold Storage, CS Fresh, Giant, Guardian, 7-Eleven, Marketplace, Jasons, Jasons Deli), Grab, McDonald’s, Shopee Singapore and SimplyGo transactions successfully posted to the Card Account for the first spend quarter. Enhanced cashback will be capped at S$100 per month. Click here for full terms and conditions.

2Up to 10% Cashback (for existing cardmembers)

Cardmembers who have been awarded the S$100 or S$50 quarterly cashback will get an additional 5% cashback and cardmembers who have been awarded S$200 quarterly cashback will get an additional 6.67% cashback on the total McDonald’s, DFI Retail Group (such as Cold Storage, CS Fresh Giant, Guardian, 7-Eleven, Marketplace, Jasons, Jasons Deli), Grab (excludes mobile wallet top-ups), Shopee Singapore transactions (excludes ShopeePay), SimplyGo (bus and train rides) and UOB Travel (excludes online and flight only bookings) and additional 1.67% cashback on Shell transactions successfully charged and posted to the Card Account in each statement month. All Cardmembers who have been awarded the quarterly cashback will get an additional 1% cashback on Singapore Power utilities bill (excluding payments via AXS) successfully charged and posted to the Card Account in each statement month. Additional cashback will be capped at S$100 per month.

3Enjoy up to 3.33% cashback based on a retail spend of S$2,000, S$1,000 or $$500 and min. 5 transactions per statement month for each qualifying quarter to earn the quarterly cashback of S$200, S$100 or S$50 respectively. Please note that exclusions apply. Please refer to the full set of Terms and Conditions.

With effect from 21 July 2024, transactions with the transaction description “NORWDS*” will be excluded from the awarding of cashback. Please click here for the full terms and conditions.

W.e.f. 1 October 2024, transactions with the transaction description “AMAZE*” and Merchant Category Codes 5965 Direct marketing –Combination Catalog and Retail Merchants, 5993 Cigar Stores and Stands, 8699 Organizations, Membership-Not Elsewhere Classified (Labor Union) and 8999 Professional Services (Not Elsewhere Classified) will be excluded from the awarding of cashback. Click here for the full terms and conditions.