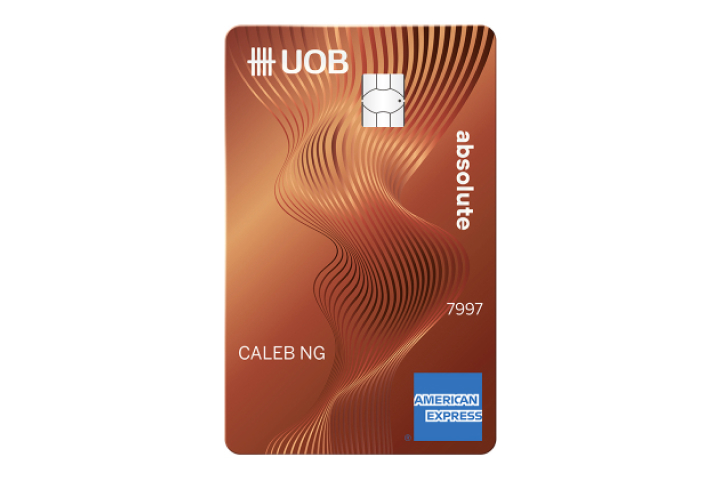

The highest cashback on your daily favourites.

-

Up to 20% cashback on daily spend at McDonald's, DFI Retail Group, Grab, SimplyGo, Shopee and UOB Travel

-

Up to 4.33% cashback on Singapore Power utilities bill

-

Up to 3.33% cashback on all retail spend

-

Fuel savings of up to 24% at Shell and SPC

-

Greater savings with up to 6.0% p.a. interest with UOB One Account