UOB SmartPay

Benefits

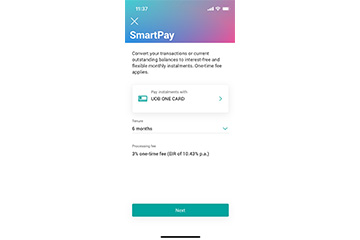

Interest-free monthly installments

Interest-free monthly instalments with one-time low processing fee from 3%.

How it works

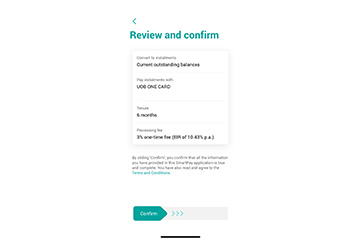

| Tenure | 3 months | 6 months | 12 months |

| One-time processing fee | 3% | 3% | 5% |

| Effective Interest Rate | 18.18% p.a. | 10.43% p.a. | 9.5% p.a. |

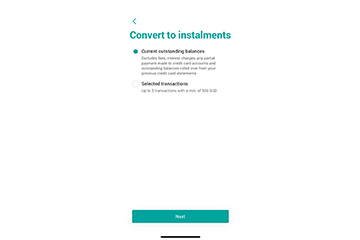

| For example, based on a retail purchase of S$3,600: | |||

| Monthly Instalment | S$ 1200 | S$ 600 | S$ 300 |

| One-time processing fee (Charged with first instalment) |

S$ 108 | S$ 108 | S$ 180 |

For frequently asked questions, click here.

Up to S$200 cash rebate with UOB SmartPay

From 1 Aug to 30 Sep 2024, simply convert a minimum of S$3,800 to UOB SmartPay 12 month plans to get S$100 cash rebate*.

What’s more, include your travel spends in your SmartPay plan to double your rewards with an additional S$100 cash rebate*.

To register for this promotion, please SMS the following to 77862 by 30 Sep 2024: SPTR ‹space› last 4 alpha-numeric characters of your NRIC/passport number (eg. SPTR 123A).

Capped at the first 500 customers. Terms and conditions apply![]()

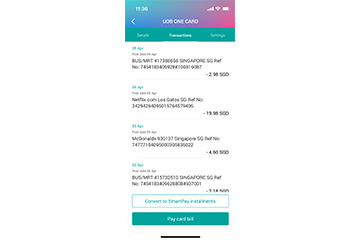

Other ways of applying

UOB Personal Internet Banking

Most fields will be prefilled for a hassle-free experience! You will be notified on the outcome of your application by the next working day!

Forgot your password? Reset it instantly using your UOB Card!

UOB TMRW

Manage your card with UOB TMRW

Pay bills at over 300 billing organisations

Real time view of your card transactions

Manage your Credit Card limit

Report & block a lost card quickly

Related products

KrisFlyer UOB Credit Card

Unlock more KrisFlyer miles and exclusive privileges with the KrisFlyer UOB Credit Card.

KrisFlyer UOB Debit Card

Earn KrisFlyer miles and interest when you spend and save on your KrisFlyer UOB Debit Card and Account.

UOB Visa Signature Credit Card

Earn up to UNI$10 on overseas (including online), petrol and contactless transactions, and UNI$1 on all other spend with no cap.