You are now reading:

Singapore Budget 2025: How to maximise benefits for your personal financial planning

Inspire the globetrotter in you with the first one-stop travel portal in Southeast Asia designed by a bank that inspires, helps you plan, and lets you book in one place.

Find out more

Skip to higher interest of up to 6% p.a. interest in just two steps. T&Cs apply. Insured up to S$100k by SDIC.

Find out more

Get instant cash at 0% interest and low processing fees. Enjoy S$100 cash rebate* on your approved loan amount!

Find out more

Invest in funds powered by Private Bank CIO – United CIO Income Fund and United CIO Growth Fund.

Learn more

Get PRUCancer 360 from just S$3.70 per week. Sign up now and enjoy 35% off your first-year premium. T&Cs apply.

Find out more

Meet UOB TMRW, the all-in-one banking app built around you and your needs.

Bank. Invest. Reward. Make TMRW yours.

you are in Personal Banking

You are now reading:

Singapore Budget 2025: How to maximise benefits for your personal financial planning

The UOB ASEAN Consumer Sentiment Study 20241 shows that Singaporeans remain most concerned about rising living costs. Despite lower inflation than the previous year, worries about high prices and increased household expenses persist.

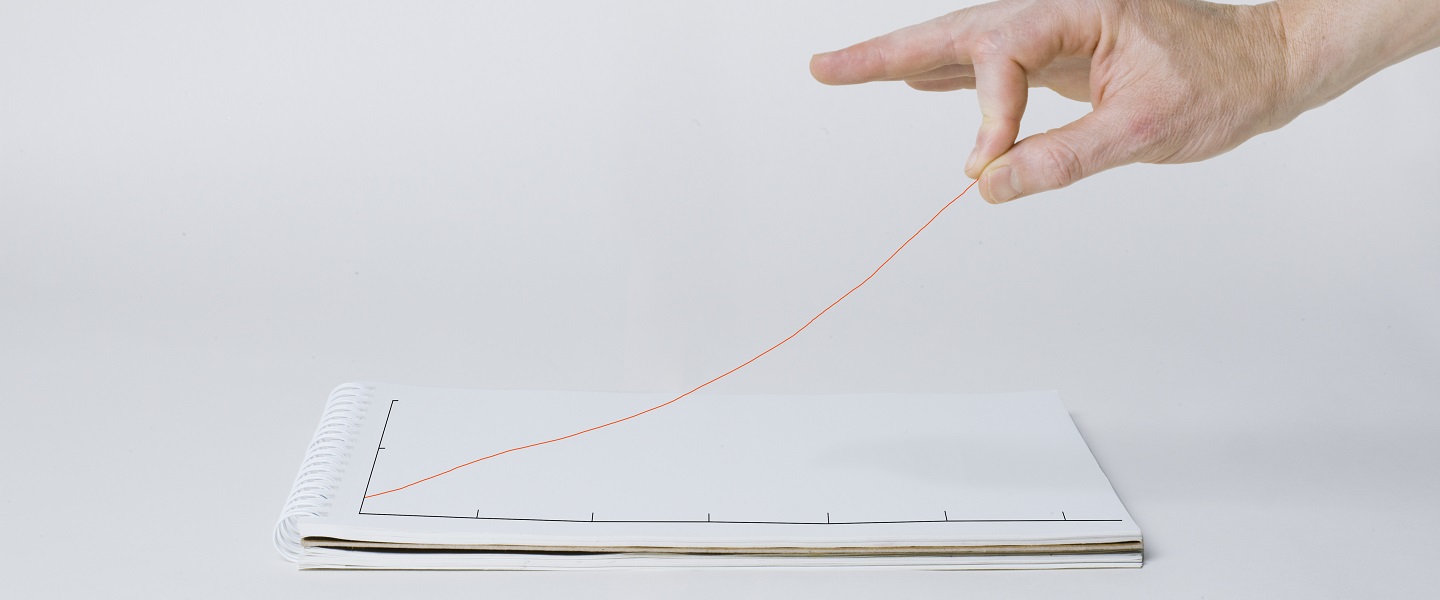

On 18 February 2025, Prime Minister and Minister for Finance, Lawrence Wong, announced comprehensive measures to support Singaporeans at different life stages (Figure 1)2.

Here are some ways to take advantage of Budget 2025 benefits, as well as policy changes taking effect from 2025, to boost your personal financial plan.

1. Budget wisely to build an emergency fund

Start now: UOB TMRW, All-in-1 Banking App | UOB Singapore

2. Take advantage of cash bonus for your first insurance or investment plan

3. Leverage government benefits for your next social outing

1. Maximise SG60 vouchers savings and tax rebates

2. Maximise tax savings while growing your retirement nest egg

Start now: SRS Account | UOB Singapore, Investments | UOB Singapore

3. Protect your finances against uncertainty

Start now: Life Insurance: Protection | UOB Singapore

4. Boost career resilience with SkillsFuture

5. Pay down high-interest debt

1. Maximise Community Development Council (CDC) and SG60 vouchers for daily savings

2. Funnel savings from family support benefits towards children’s education needs

Start now: Life Insurance: Savings | UOB Singapore

3. Maximise childcare subsidies for lower costs

4. Enhance family protection and estate planning

1. Prepare for medical & long-term care costs

2. Maximise CPF contributions for retirement income

3. Use SG60 vouchers strategically

It’s all about making these benefits work harder for you. Boost your financial security, save money, and grow wealth for the future by taking advantage of these new measures. Stay on top of government schemes that match your life stage and tweak your financial plan along the way.

Figure 1: Key Budget measures for Singaporeans and Singaporean households

| Benefit | Details |

| SG60 Package | |

| SG60 vouchers (aged 21 to 59) | SGD600 |

| SG60 vouchers (seniors aged 60 and above) | SGD800 |

| Personal income tax rebate | 60% for YA2025, capped at SGD200 |

| SG60 baby gift | Singaporean babies born in 2025 |

| SG Culture Pass | SGD100 credits (aged 18 and above) |

| SG60 ActiveSG Credit | SGD100 top-up for all ActiveSG members |

| Immediate support for households | |

| Assurance Package (cash) | SGD100 to SGD600 (aged 21 and above) |

| GST voucher scheme (cash) | SGD450 or SGD850 (aged 21 and above, lower and middle income) |

| CDC vouchers (Singaporean households) | SGD800 |

| U-Save rebates | Up to SGD760 (HDB households) |

| LifeSG Credits | SGD500 (Singaporean children aged 12 and below) |

| Edusave or Post-Secondary Education Account top-up | SGD500 (Singaporean children aged 13 to 20) |

| Equipping workers for life | |

| SkillsFuture Level-Up Programme | SGD300 per month for eligible part-time training from early 2026 (workers aged 40 and above) |

| SkillsFuture Jobseeker Support scheme | Up to SGD6,000 over six months starting Apr 2024 |

| Uplifting Employment Credit | Extended to end 2028 to offset wages for hiring ex-offenders |

| Enabling Employment Credit | Extended to end 2028 to offset wages for persons with disabilities |

| Senior Employment Credit (SEC) | Extended to end 2026 to offset wages for hiring senior workers |

| Supporting families | |

| Childcare fee caps | Lowered to SGD610 for anchor operators and SGD650 for partner operators in 2025 |

| Child Development Account (CDA) First Step Grant | SGD5,000 increase for each third and subsequent child born from 18 Feb 2025 |

| Large Family MediSave Grant | SGD5,000 to the mother's MediSave account for each third and subsequent child born from 18 Feb 2025 |

| Large Family LifeSG credits | SGD1,000 annually to families for each third and subsequent child, from age one to six |

| Enabling seniors to retire well | |

| Increased CPF total contribution rate | Additional 1.5% from 2026 (aged 55 to 65) |

| Five-year Matched MediSave Scheme | Government matches voluntary cash top-ups for eligible seniors from Jan 2026 |

| Sustainability for households | |

| Climate vouchers | Increased to SGD400 and extended to Singaporean private property households |

Source: UOB Global Economics & Markets Research, Ministry of Finance

3CPFB | Top up to enjoy higher retirement payouts

4IRAS | Tax on SRS withdrawals

5CPFB | When will the enhancements to MediShield Life benefits / increased premiums take effect?

6SSG | SkillsFuture Level-Up Programme

7SSG | SkillsFuture Jobseeker Support Scheme

8Child LifeSG Credits - SupportGoWhere

9Edusave Account/Post-Secondary Education Account Top-Up - SupportGoWhere (life.gov.sg)

10Large Families Scheme - SupportGoWhere (life.gov.sg)

11CPFB | Budget Highlights 2025

12Supplements (careshieldlife.gov.sg)

IMPORTANT NOTICE AND DISCLAIMERS:

This publication shall not be regarded as an offer, recommendation, solicitation or advice to buy or sell any investment product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. Any description of investment products is qualified in its entirety by the terms and conditions of the investment product and if applicable, the prospectus or constituting document of the investment product. Nothing in this document constitutes accounting, legal, regulatory, tax, financial or other advice. If in doubt, you should consult your own professional advisers about issues discussed herein.

The information contained in this publication, including any data, projections and underlying assumptions, are based on certain assumptions, management forecasts and analysis of known information and reflects prevailing conditions as of the date of the article, all of which are subject to change at any time without notice. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, United Overseas Bank Limited (“UOB”) and its employees make no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for its completeness or accuracy. As such, UOB and its employees accept no liability for any error, inaccuracy, omission or any consequence or any loss/damage howsoever suffered by any person, arising from any reliance by any person on the views expressed or information in this publication.

27 Nov 2024 • 3 MIN READ

22 Oct 2024 • 4 min read

07 Oct 2024 • 3 MIN READ