For Drivers

Whether you are a first-time owner or looking to finance your next ride, secure your loan at top speed with Singapore’s first digital car financing service that enables instant car loan approvals.

Our Partners

Frequently Asked Questions

How do I apply for a Car Loan?

You are required to apply through the Car dealership where you are purchasing the vehicle. You have an option to use the digital loan application using Myinfo for submission of the application at our participating dealerships island-wide and via leading mobile and online classified marketplace, Carousell.

You can also download the application form in the UOB Website and mail the form together with the vehicle sales agreement (VSA), a copy of the NRIC/Passport & Employment Pass and latest income document to:

United Overseas Bank Limited

80 Raffles Place #13-00 UOB Plaza 1 Singapore 048624

Attn: Car Financing Department

How long is my approval? And will I be notified?

The digital loan application and approval process can be completed within 15 minutes at your Car dealership. We will keep you and your car sales consultant informed at every step of the process via SMS and/or email.

How do I make payment for my car loan?

1. By Funds Transfer from your UOB account via UOB Personal Internet Banking or UOB TMRW mobile app.

> Login to UOB Personal Internet Banking or UOB TMRW app

> Go to: 'Pay and Transfer' > Billers > New Payment > Billing Organisation: UOB Car/Property Loans Payment

> Fill in: Bill Reference No: 10 digit Car Hire Purchase Agreement No. / Amount (SGD): Loan payment amount

> Review & confirm details are correct, then click on 'Confirm' to proceed with the payment

2. By GIRO arrangement. GIRO application form can also be found in UOB website or UOB branch.

3. By Cash / Cashier's Order / Cheque. Cashier's Order or cheque should be made payable to UOB Ltd for A/C XXXX, where XXXX refers to the vehicle loan account number.

The vehicle loan account number and car plate number should also be written on the reverse of the cheque. You can also deposit cheque at any UOB Branches or drop into Fast Cheque Deposit box.

4. By Telegraphic Transfer - Please see details required below:

| Beneficiary Bank Name: |

United Overseas Bank Ltd, Singapore |

| Beneficiary Bank Swift BIC Code: |

UOVBSGSG |

| Beneficiary Name: |

<Borrower Name> |

| Beneficiary Account No.: |

<Borrower Account Number> |

| Payment Details: |

Ref: Payment of car loan for attention of RLOC Car Loan Redemption |

Please note:

For full settlement of car loan, you can make payment via above mode of payment except GIRO arrangement.

Confirmation Form on Redemption of Vehicle Loan sent to customer is required for payment made at UOB Branch*.

*Please refer to UOB website for the list of full banking services branch.

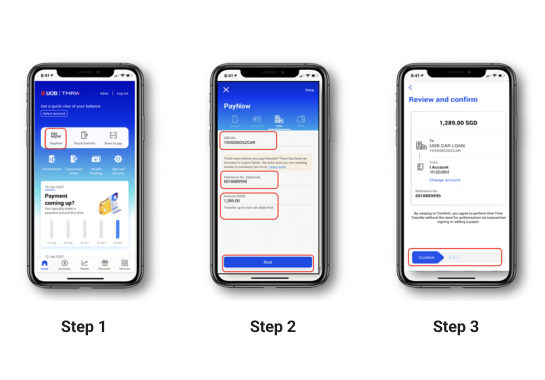

5. By PayNow via UEN

Download UOB TMRW from App Store or Google Play, launch the app and log in. On the home page, tap on PayNow

Step 2:

Fill in:

1. UEN No: 193500026ZCAR

2. Reference No: 10-digit Car Hire Purchase Agreement No. / Car Loan Account No.

3. Amount (SGD): Loan amount

4. Click 'Next'

Step 3:

Review & confirm details are correct, then slide Confirm to make the payment.

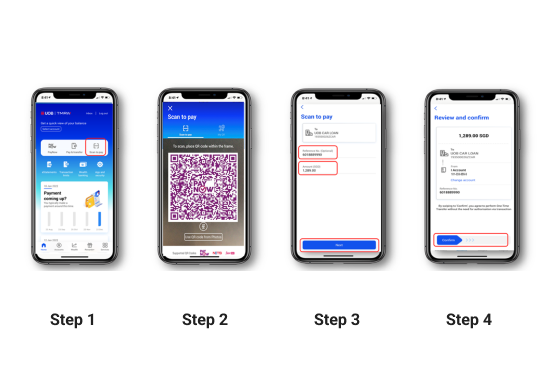

6. By Scan and Pay

Download UOB TMRW from App Store or Google Play, launch the app and log in. Tap on Scan to Pay.

Step 2:

Scan the UOB Car Loan QR Code.

Note: If you have the image of the QR code in your phone photo library, you could also tap on "Use QR Code from Photos" and select the image.

Step 3:

Fill in:

1. Reference No: 10-digit Car Hire Purchase Agreement No. / Car Loan Account No.

2. Amount (SGD): Loan amount

3. Click 'Next'

Step 4:

Review & confirm details are correct, then slide Confirm to make the payment.

Notes:

- Any loan payment made before 10.30pm on a weekday or on a Saturday, Sunday or Public Holiday will be credited into your loan account on the next working day.

- Any loan payment made after 10.30pm on a weekday or on a Saturday, Sunday or Public Holiday will be credited into your loan account on the next second working day.

- If your loan account is in default, any payment received is on a "Without Prejudice" basis.

- Any loan payment made without a valid Loan Account Number or Agreement Number in the Reference Number field will be rejected. Applicable charges/interests may be imposed on the loan account.

- The bank may at its absolute discretion reject any loan payment made from a bank account that is not in the name of the borrower/hirer.

Can I change my car loan instalment due date?

Yes, change of due date is allowed. However, there is a processing fee of S$1,000 for changing monthly instalment due date.

How much can I borrow?

The loan amount is dependent on the Open Market Valuation (OMV) of the financing car:

Open Market Value (OMV) ≤S$20,000

• 70% of the purchase price or valuation price, whichever is lowerOpen Market Value (OMV) >S$20,000

• 60% of the purchase price or valuation price, whichever is lowerWhat is the maximum loan period?

The maximum loan period is 7 years.

What is my current outstanding amount for redemption of my car loan?

You may request for the car loan full settlement amount via the following mode of communication:

1. Call UOB Contact Centre at 1800-388 2121

2. Email the written request to RLOC Car Loan Redemption at CarRedemptionRLOC@UOBgroup.com

3. Fax in written request to RLOC Car Loan Redemption at fax no. 6439 2604

Note: You may download a copy of the Car Loan Redemption Request Form from UOB website.

For Commuters

Solutions for your everyday transport use made simple and convenient.

Travel made simple

Enjoy contactless payment for bus and train rides directly with your:

- UOB Visa / Mastercard / ATM Cards

- Mobile / wearable payment*

Say hello to more convenience with SimplyGo.

Be rewarded when you spend on bus and train rides

-

UOB Card

-

Rewards on your rides

| UOB Card | Rewards on your rides |

| UOB One Card | Up to 10% cashback1 |

| UOB One Debit Card | 3% cashback2 |

| UOB EVOL Card | Up to 10% cashback when you tap with your mobile/wearable device3 |

| UOB PRVI Miles Visa# / Mastercard | 1.4 miles per S$1 spend (UNI$3.5 per S$5 spend)4 |

| UOB Lady's Card / UOB Lady's Solitaire Card | 15X UNI$ for every S$5 spent (equivalent to 6 miles per S$1)5 |

| KrisFlyer UOB Credit Card | Up to 3 miles per S$1 spend6 |

| KrisFlyer UOB Debit Card | Up to 6.4 miles per S$1 spend7 |

| UOB Preferred Platinum Visa# / Mastercard and UOB Visa Signature Card# | 1X UNI$ per S$5 spend8 |

| UOB Card |

| UOB One Card |

| UOB One Debit Card |

| UOB EVOL Card |

| UOB PRVI Miles Visa# / Mastercard |

| UOB Lady's Card / UOB Lady's Solitaire Card |

| KrisFlyer UOB Credit Card |

| KrisFlyer UOB Debit Card |

| UOB Preferred Platinum Visa# / Mastercard and UOB Visa Signature Card# |

Things You Should Know

Terms and conditions

*UOB Visa/Mastercard Cards (except UOB ATM Contactless Card) can be used for SimplyGo via Apple Pay, Google Pay and Samsung Pay via Visa/Mastercard. Click through for T&Cs and step-by-step guide on how to add your card for mobile payments.

1Visit UOB One Card Website for details and full terms and conditions.

2Visit UOB One Debit Card Website for details and full terms and conditions.

3Visit UOB EVOL Card Website for details and full terms and conditions.

4Visit UOB PRVI Miles Card Website for details and full terms and conditions.

5Visit UOB Lady’s Card Website for details and full terms and conditions.

6Visit KrisFlyer UOB Credit Card Website for details and full terms and conditions.

7Visit KrisFlyer UOB Debit Card Website for details and full terms and conditions.

8Visit UOB Preferred Platinum Visa Card and UOB Visa Signature Card Website for details and full terms and conditions.

#Cardmembers earn UNI$ for every S$5 spent on SimplyGo Transactions per submission by the merchant, except for SimplyGo Transactions performed on UOB Visa Cards, where UNI$ are earned based on the accumulated spend on SimplyGo Transactions per calendar month, and awarded to Cardmembers on the 7th calendar day of the following month.