Get up to 6% p.a. interest in just two steps.

- Spend min. S$500 on your UOB One Card and/or any other eligible UOB Cards to earn 0.65% p.a. interest

- Credit your salary or make 3 GIRO payments monthly to maximise the interest earned on your UOB One Account

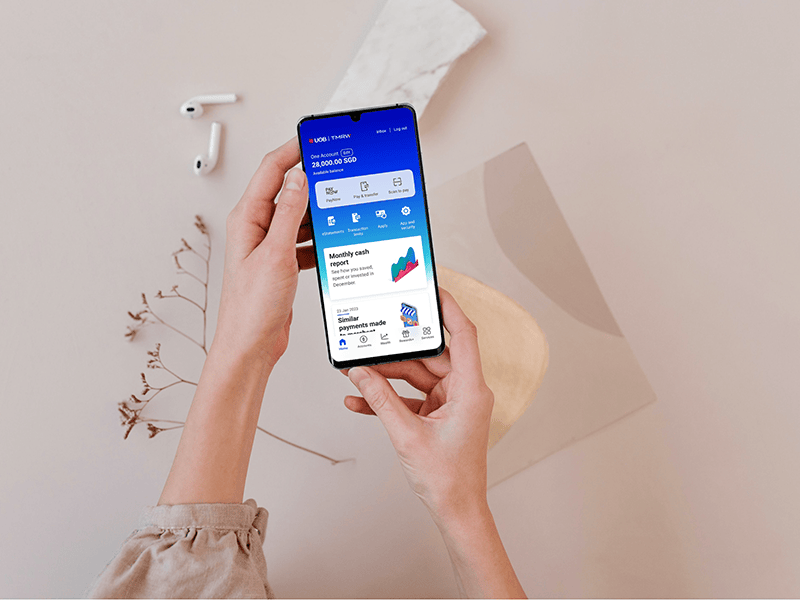

- Plus, never miss out on your bonus interest when you track your progress monthly on the UOB TMRW app.