UOB LockAway AccountTM

Digital scams are on the rise. Give your savings an added layer of security with the all-new UOB LockAway Account and transfer in money to keep it locked away from digital scams.

Add on the UOB LockAway Account today for greater peace of mind, for money you don’t need everyday access to. Any withdrawal of funds must be done in-person at any of our UOB branches in Singapore.

Lock away any amount. No minimum, no maximum, no fall-below fees.

Get extra protection for your money, now

Add on the UOB LockAway Account today for greater peace of mind, for money you don’t need everyday access to.

Lock away any amount

No minimum or maximum deposit requirements, plus no fall-below fees

View your account or top it up 24/7

This can be done anytime on the UOB TMRW app or Personal Internet Banking

How it works

For customers with an existing UOB savings account:

Already have a UOB savings account? You can go ahead and open a UOB LockAway Account instantly.

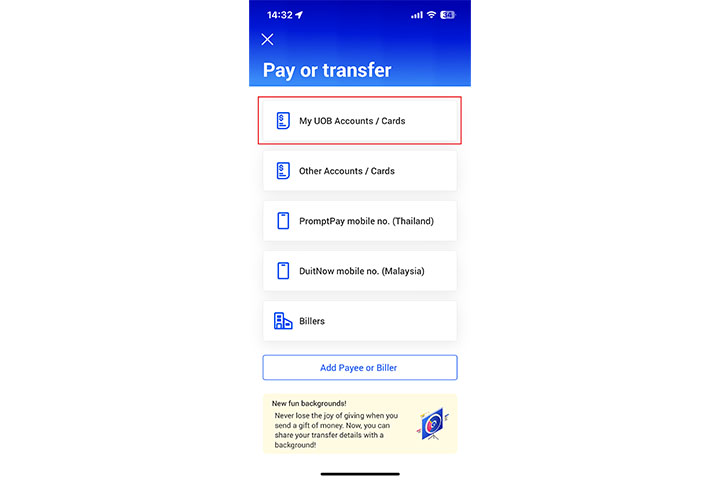

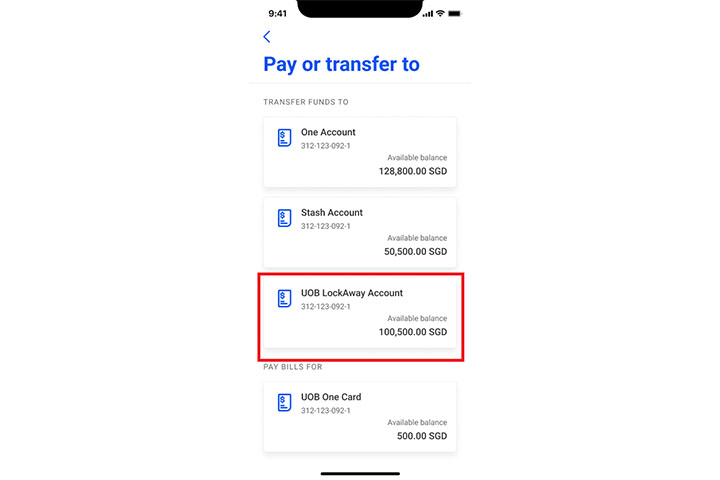

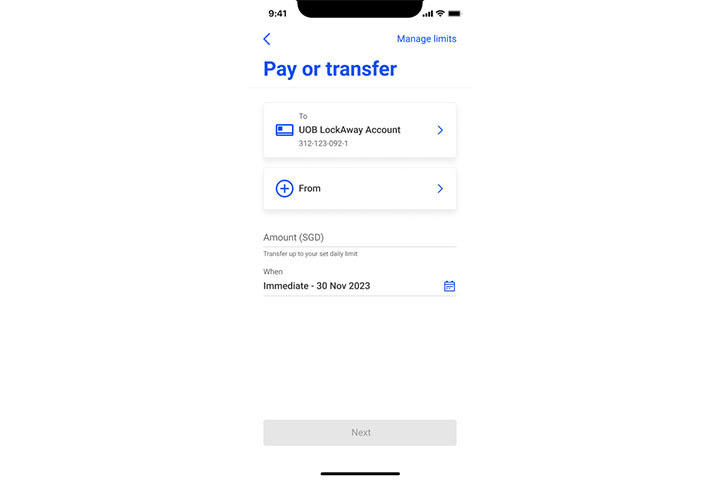

Step 1: Open your UOB LockAway Account instantly online or via the UOB TMRW app. On the TMRW login page, tap on More > Deposit Accounts > UOB LockAway Account.![]()

Step 2: Transfer in money you don’t need access to everyday using UOB TMRW app or internet banking, and keep your money locked away from digital scams.

For foreigners, individuals with only joint UOB accounts, as well as joint LockAway Account opening requests, please visit a UOB branch for assistance.

Once funds are transferred into this account, withdrawals (including withdrawals to transfer funds into your own accounts) can only be done in person, with your NRIC or Passport, at a UOB branch in Singapore, and not by any other means.

For more information, refer to our FAQs.

Access your funds at any UOB branch

For your protection, any withdrawal of funds must be done in person, with your NRIC or Passport, at any of the UOB branches in Singapore during the branch’s usual operating hours. Debit cards and ATM cards will not be issued for this account so you can have peace of mind that your funds stay where they should be.

Frequently Asked Questions

What are the security features of this account?

UOB LockAway Account is a dedicated SGD savings account with a separate account number which restricts all self-service fund transfers and usage. The restricted transactions include but are not limited to digital banking debit fund transfer, ATM withdrawal, debit card purchase and GIRO transfer.

Funds can be transferred into your UOB LockAway Account through FAST transfers, cash deposits and other means. You may decide how much funds to be kept in your UOB LockAway Account.

You are only allowed to access your funds through UOB Singapore bank branches, where we are able to verify you in person. This is a safety net to safeguard against scammers who had illegally obtained access to your phone or banking app.

For more information, refer to our full list of FAQs.

Will I be issued any ATM/Debit Card, Passbook or Chequebook?

ATM card, debit card, passbook or cheque book will not be issued for this account.

You may log into your UOB TMRW app or UOB Personal Internet Banking to view your account balances.

How can I access my funds?

All funds transferred into UOB LockAway Account cannot be withdrawn from ATM, or digital banking, even by yourself. Please ensure sufficient balance in your other UOB accounts to address any immediate need.

If you need to withdraw funds from your UOB LockAway Account, please visit any UOB Singapore branches. Please bring along your NRIC or Passport for identity verification purpose.

You will not be able to utilize funds from UOB LockAway Account for recurring fund transfer transactions (such as GIRO), even if you request this at our branches.

Can I access my funds when I am overseas?

UOB LockAway Account funds can only be accessed through Singapore UOB branches. You will not be able to request for any withdrawal through phone banking, or any other regular UOB channels.

Please ensure that you have sufficient balances in your other UOB accounts before you travel overseas.

I was asked by UOB to download another banking app to apply for UOB LockAway Account. Is this legitimate?

This is most likely a scam. UOB will never send you SMS or email with a clickable link or ask you to download another app to apply for UOB LockAway account. Please contact our dedicated 24/7 Fraud Hotline at 6255 0160 and press “1” to report a case. You will need to provide the following details:

- Date and time of the fraud

- Describe how the fraud occurred

- The fraudulent transactions on your cards or accounts (if any)

- A copy of the police report. To file a police report, please visit your nearest police station or file it online via Singpass.

What should I do if I receive a call from UOB, asking for my banking login details to authorise funds transfer to my UOB LockAway account?

This is most likely a scam. Please do not respond to calls or messages asking for funds transfer or approval on transactions. Please do not disclose your banking login details or OTP to anyone. Please contact our dedicated 24/7 Fraud Hotline at 6255 0160 and press “1” to report a case. You will need to provide the following details:

- Date and time of the fraud

- Describe how the fraud occurred

- The fraudulent transactions on your cards or accounts (if any)

- A copy of the police report. To file a police report, please visit your nearest police station or file it online via Singpass.

Click here for security FAQs.

Eligibility and fees

Eligibility & Fees

Age

• 16 years old and above for online application

• 15 years old and above for application via branch

Early Account Closure Fee

S$30 within 6 months from opening

Fall-below Fee

Waived

Action or Documents required

For Singapore Citizens/Permanent Residents,

Apply online with Myinfo using Singpass login

For Foreigners and customers who are unable to submit the application online,

Please proceed to any UOB Branch for assistance. You will require:

- Passport / Identity Card

- Proof of Local Residential Address

- Employment Pass/S Pass/Dependent Pass (for foreigners only)

Important Notice

Important information on the use of UOB Accounts and Services

Ready to apply?

Ready to apply?

For customers with an existing SGD current/savings account, open your UOB LockAway Account instantly online or via the UOB TMRW app.

For foreigners and individuals with only joint UOB accounts, please visit a UOB branch for assistance.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Please refer to UOB Insured Deposit Register for a list of UOB accounts / products that are covered under the Scheme.