Foreword by CIO

We are pleased to present our 1Q 2025 Investment Outlook.

2024 is a year proven to be exceptional for risk assets. Despite geopolitical conflicts and a busy election calendar globally, the Morgan Stanley Capital International World (MSCI) Index rose by an impressive 24%. Even as China continues to face intensifying trade tensions with the United States (US), Chinese stocks reversed the previous year's losses to clock in a 20% return, mostly gained in April and September 2024.

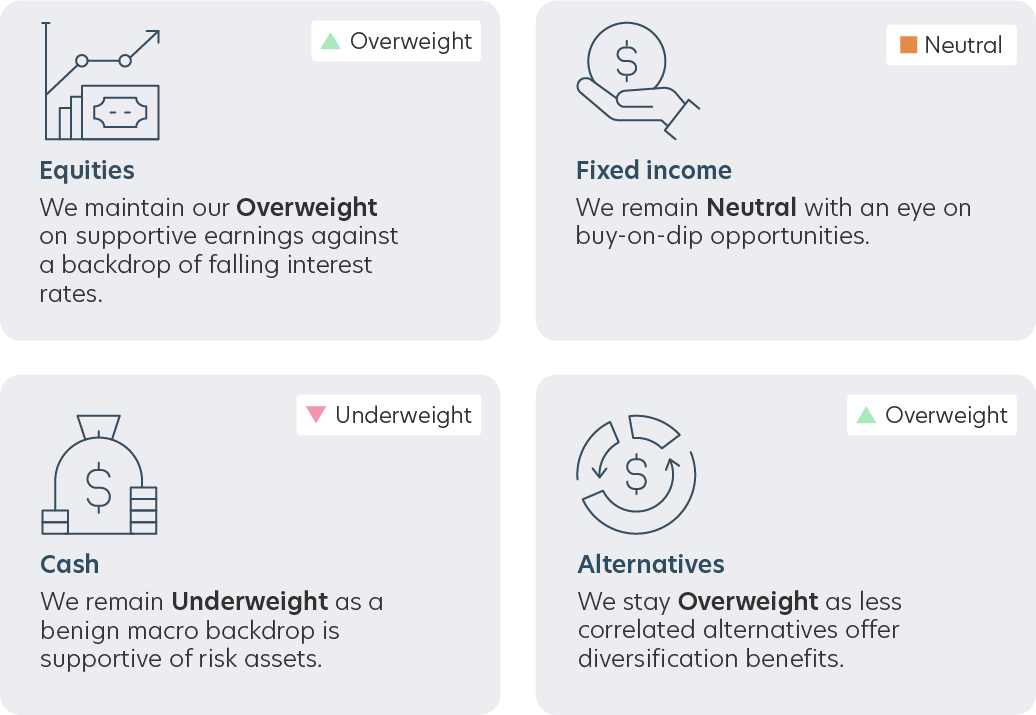

Looking ahead, we expect that markets would be volatile but stay supported in 2025. The outlook for equities remain positive and would justify an overweight in a mixed asset portfolio. The economy has shown surprising resilience despite tight monetary policy. The Federal Reserve is projected to implement two to three more rate cuts this year. It is important to note that we see these cuts as not recessionary in nature but rather a fine-tuning of policy to reflect the current inflation and growth outlook.

However, investors should be prepared for periods of volatility given policy uncertainties against the backdrop of relatively expensive valuations and stretched investor positioning, especially in the US. While the risk of a short-term correction is rising, the market remains one that investors should be buying into weakness.

Our outlook report provides valuable insights into key macroeconomic trends, asset class views and portfolio allocation strategies to help you make informed decisions in today's investment landscape.

As markets continue to evolve, it is important to adapt your portfolio strategy while staying aligned with your long-term aspirations. The start of a new year offers a timely opportunity to review your portfolio with your Senior Client Advisor, ensuring your investments are well-positioned to capture emerging opportunities. With thoughtful adjustments and expert guidance from our dedicated team of specialists, you can approach 2025 with clarity and confidence.

Wishing you a prosperous and successful year ahead.

Dr Neo Teng Hwee

Chief Investment Officer and

Head of Investment Products and Solutions

UOB Private Bank

Outlook at a glance

Key themes to watch

Trump 2.0: Opportunities in volatility

While markets are expected to stay supported, be prepared for higher volatility against the backdrop of relatively expensive valuations and stretched investor positioning. Trump 2.0 and a Republican sweep will result in continued US outperformance and uncertainties for the rest of the world.

AI-powered innovation

While AI remains a core theme, we expect returns to eventually broaden out to companies that could extract value through applications such as software companies. Sectors that are key to the multi-year built-up in physical infrastructure build such as industrials and utilities will enjoy strong sales.

The cycle continues

Geopolitics will drive risks for some but present opportunities for others. Continue to advocate an allocation to Gold as a hedge. Any potential forthcoming Chinese fiscal stimulus presents some upside risks, while equity valuation is relatively undemanding.

Asset allocation for 1Q 2025

Discover more insights

Report

A New Paradigm

Explore our investment outlook report for in-depth insights on macro trends, asset class views, and asset allocation strategies.

Podcast

Trump 2.0, AI and the road ahead for investors

In this podcast episode, Dr Neo Teng Hwee dives into the 1Q 2025 investment outlook, focusing on key themes such as the potential market implications of Trump 2.0, transformative opportunities in AI and strategies to stay ahead in the ever-evolving economic landscape.

Article

Outlook 2025: opportunities and risks

In this edition of The Business Times' CIO Corner, Dr Neo Teng Hwee shares his perspectives on the resilience of equities, the impact of tight monetary policy and the potential market implications of geopolitical and economic shifts.

Things you should know

Important notice and disclaimers

The information contained in this publication (and any articles, materials or video content relating to this publication) is given on a general basis without obligation and is strictly for information purposes only. This publication (including any articles, materials or video content relating to this publication) is not intended to be, and should not be regarded as, an offer, recommendation, solicitation or advice to buy or sell any investment or insurance product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. Any description of investment or insurance products, if any, is qualified in its entirety by the terms and conditions of the investment or insurance product and if applicable, the prospectus or constituting document of the investment or insurance product. Nothing in this publication (including any articles, materials or video content relating to this publication) constitutes accounting, legal, regulatory, tax, financial or other advice. If in doubt, you should consult your own professional advisers about issues discussed therein.

The information contained in this publication (and any articles, materials or video content relating to this publication), including any data, projections and underlying assumptions, are based on certain assumptions, management forecasts and analysis of known information and reflects prevailing conditions as of the publication date of the relevant materials or content, all of which are subject to change at any time without notice. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained therein, United Overseas Bank Limited ("UOB") and its employees make no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for its completeness or accuracy. The views expressed in this publication (and any articles, materials or video content relating to this publication) are solely those of the authors', reflect the authors' judgment as at the relevant date of publication and are subject to change at any time without notice. As such, UOB and its employees accept no liability for any error, inaccuracy, omission or any consequence or any loss/ damage howsoever suffered by any person, arising from any reliance by any person on the views expressed or information contained in this publication (and any articles, materials or video content relating to this publication).

Any opinions, projections and other forward looking statements contained in this publication (and any articles, materials or video content relating to this publication) regarding future events or performance of, including but not limited to, countries, markets or companies are not necessarily indicative of, and may differ from actual events or results. The information provided should not be construed as research or advice and has no regard to the specific objectives, financial situation and particular needs of any specific person. Investors may wish to seek advice from an independent financial advisor before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider whether the investment or insurance product in question is suitable for you.

Copyright © 2025 United Overseas Bank Limited All Rights Reserved United Overseas Bank Limited Co Reg No 193500026 Z