- Enjoy a wide variety of offers and deals, including travel, food and wine, dining, shopping, sports, entertainment and more.

Benefits

More convenience with SimplyGo

Pay for public bus and train rides directly with your UOB One Debit Card via contactless and mobile payment.

Spend control and no more monthly bills

Have your purchases debited directly from your account!

See how UOB One Debit Card compares to a UOB ATM Card

-

Statement Date and Min. Monthly Spend

-

UOB One Debit Card

-

UOB ATM Chip Card

| Statement Date and Min. Monthly Spend | UOB One Debit Card | UOB ATM Chip Card |

| Withdraw cash from UOB and OCBC ATMs in Singapore | ✓ | ✓ |

| Withdraw cash worldwide | ✓ | ✓ |

| Pay for PIN-based purchases locally | ✓ | ✓ |

| Pay for purchases locally and overseas eg. Online, Mail Order and Phone Order | ✓ | ❌ |

| Conduct fast and secure contactless payment | ✓ | ❌ |

| Turn your mobile device into an electronic wallet with Google Pay, ApplePay™ and more | ✓ | ❌ |

| Get up to 3% cashback on Shopee Singapore, Dairy Farm International, SimplyGo and Grab transactions | ✓ | ❌ |

| Enjoy UOB Cards shopping, entertainment and dining privileges | ✓ | ❌ |

| Pay with NETS contactless | ✓ (not available for One Debit Mastercard) |

| Statement Date and Min. Monthly Spend |

| Withdraw cash from UOB and OCBC ATMs in Singapore |

| Withdraw cash worldwide |

| Pay for PIN-based purchases locally |

| Pay for purchases locally and overseas eg. Online, Mail Order and Phone Order |

| Conduct fast and secure contactless payment |

| Turn your mobile device into an electronic wallet with Google Pay, ApplePay™ and more |

| Get up to 3% cashback on Shopee Singapore, Dairy Farm International, SimplyGo and Grab transactions |

| Enjoy UOB Cards shopping, entertainment and dining privileges |

| Pay with NETS contactless |

Privileges

Visa

Visa Platinum Privileges

Mastercard

World Debit Mastercard Privileges

- Enjoy exclusive discounts on ride-hailing, food delivery, online shopping and more.

- Get peace of mind with Mastercard’s protection from identity theft and fraudulent purchases.

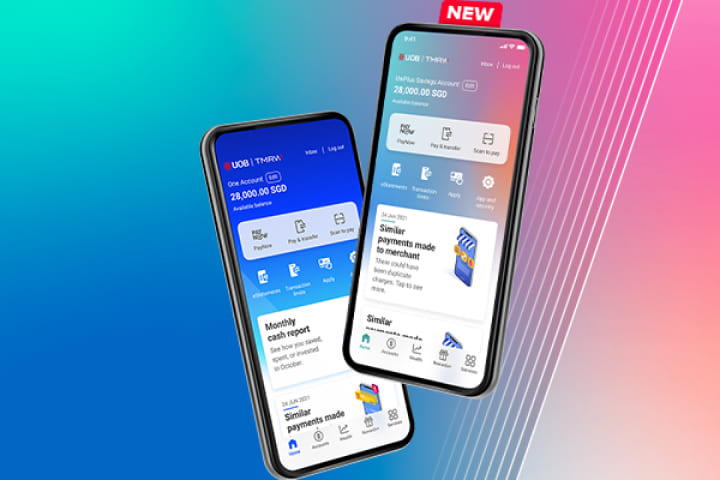

UOB TMRW

Make TMRW yours

Start banking your way with an app built around your personal habits, needs, and goals

- Check your account balance anytime instead of waiting for your monthly statement

- Manage your money easily with UOB Insights, where you can track spend by categories and get informed when your UOB One Card cashback are credited

- Pay your bills conveniently in the comfort of your home

- Over 13,000 deals, weekly UOB Coupons up for grabs and dining inspirations within Rewards+

Fuel Savings

Pump at SPC and save with UOB One Debit Card

Mobile Pay

Pay with your mobile phone

Add your UOB One Debit Card to your mobile payment applications to tap and pay securely with your mobile phone at more than 10,000 retail outlets in Singapore. What’s more, you can earn the same cashback on mobile payment as you do with your physical UOB One Debit Card.

Things you should know

Eligibility and fees

Eligibility and Fees:

Minimum 16 years old

For Singaporeans/PR/Foreigners

- No minimum income requirements

- Holds a UOB Savings Account/Current Account

Annual Fees

S$18.34 yearly (First 3 years card fee waiver)

Annual fee waiver with 12 Visa/Mastercard transactions per year

Important Notice

Sales representatives, if any, may be remunerated for the recommendation or sale of this card.

Terms and conditions

W.e.f. 1 October 2024, transactions with the transaction description “AMAZE*” and Merchant Category Codes 5965 Direct marketing –Combination Catalog and Retail Merchants, 5993 Cigar Stores and Stands, 8699 Membership Organizations (Not Elsewhere Classified) and 8999 Professional Services (Not Elsewhere Classified) will be excluded from the awarding of cashback

W.e.f 1 January 2024, the One Debit Card annual fee will be adjusted to S$18.34 yearly (inclusive of 9% GST)

W.e.f. 1 August 2022, payments to IPAYMY, RWS-LEVY, SMOOVE PAY, SINGPOST – SAM, Razer Pay and CardUp will be excluded from the awarding of cashback.

W.e.f. 1 March 2022, please be informed that transactions with transaction description “AMAZE* TRANSIT*” will be excluded from the awarding of cashback.

“Most generous debit card” is based on (i) up to 3% cashback awarded on the UOB One Debit Card for purchases of daily spend and (ii) up to 6% p.a. interest on the UOB One Account with a retail spend of S$500 per month, when compared against other cashback debit cards issued in Singapore as at 1 April 2024. Terms and conditions apply

^McDonald’s S$3 off Coupon Promotion

McDonald’s coupons will be released on every Friday on Rewards+ via UOB TMRW app till 28 March 2025 (inclusive of the date mentioned). Coupons are valid for redemption within 30 days from the relevant release dates via McDonald’s app. Coupons can be used to enjoy S$3 off at McDonald’s any day with minimum S$10 spend on UOB One Credit or Debit Cards via McDonald’s app. McDonald’s coupon expiry dates and terms and conditions apply. Click here for FAQs.

1Enjoy 3% cashback on McDonald's, 3% cashback on DFI Retail Group transactions (Cold Storage, CS Fresh, Giant, Guardian, 7-Eleven, Jasons and Jasons Deli), 3% cashback on Shopee Singapore transactions (excludes ShopeePay), 3% on SimplyGo (bus and train rides) & 1% cashback on Grab transactions (excludes mobile wallet top-ups) with a minimum monthly spend of S$500. Cashback is capped at S$20 per calendar month across McDonald’s, DFI Retail Group, Shopee Singapore, SimplyGo & Grab transactions. McDonald's is with effect from 1 October 2023. With effect from 21 July 2024, transactions with the transaction description “NORWDS*” will be excluded from the awarding of UNI$, cashback, and KrisFlyer Miles. Please click here for the full terms and conditions.

2Get Up to S$260 cash credit comprising:

1) Either S$100 or S$60 or S$30 cash credit

AND

2) up to S$160 cash credit

1) UOB Online Account Opening Weekly Promotion (1 April to 30 June 2025)

Valid from 1 April to 30 June 2025 (“Promotion Period”). Limited to the first 100 customers of each Promotion Week, namely the week between 1 and 6 April 2025 and every calendar week between 7 April 2025 and 30 June 2025, (i) who submit an online account opening application during a Promotion Week for a new Eligible UOB Account, and (ii) whose application is successfully approved during the Promotion Period, and (iii) deposit min. S$5,000 of Fresh Funds into their new Eligible UOB Account within the same calendar month as their new account opening calendar month, and (iv) maintain a balance of at least S$5,000 in their new Eligible UOB Account till the end of the following calendar month. For existing UOB deposit customers, the Fresh Funds deposited into their new Eligible UOB Account must result in a corresponding increase of at least S$5,000 when compared against the total month-end balance of all their other UOB current accounts and/or savings accounts as at 29 March 2025 and such increase must also be maintained till the end of the following calendar month. Eligible new-to-UOB customers will be eligible to receive S$100 cash credit, eligible new-to-UOB deposit customers will be eligible to receive S$60 cash credit, and eligible existing-to-UOB deposit customers will be eligible to receive S$30 cash credit. “Fresh Funds” means funds (a) in the form of non-UOB cheques or non-UOB cashier’s order; (b) that are not transferred from any existing UOB current/savings or fixed deposit account; and (c) that are not withdrawn from any existing UOB current/savings or fixed deposit account and re-deposited (whether part or all of the amounts withdrawn) into the new Eligible UOB Account at any time during the Promotion Period. T&Cs apply. Click here for full terms and conditions.

Eligible UOB Account means: (i) for the period commencing from 1 April 2025 to 30 April 2025 (both dates inclusive), a UOB Stash Account, UOB Uniplus Account, KrisFlyer UOB Account or UOB One Account; and (ii) for the period commencing from 1 May 2025 to 30 June 2025 (both dates inclusive), a UOB Stash Account, UOB Uniplus Account, KrisFlyer UOB Account, UOB Lady’s Savings Account or UOB One Account.

And

2) Up to S$160 cash credit for customers who participate in the UOB SalaryPlus Promotion (1 April 2025 to 30 June 2025) by successfully submitting an online participation form (available at the official UOB website) between 1 April 2025 to 30 June 2025, both dates inclusive, to receive the following cash rewards:

*Participate in the UOB SalaryPlus Promotion (1 April 2025 to 30 June 2025) by successfully submitting an online participation form (available at the official UOB website) between 1 April 2025 to 30 June 2025, both dates inclusive, to receive the following cash rewards:

- S$30 cash credit for customers who successfully perform a bill payment of min. S$30 per transaction from their designated Eligible UOB savings account in this Promotion via GIRO, or/and who successfully perform a loan repayment transaction for their UOB car loan^ or UOB home loan^ from their designated Eligible UOB savings account for this Promotion, in each case, within the next two calendar months from the date of submission of the online participation form.;

- S$80 cash credit for customers who successfully credit their monthly salary of min. S$1,600 (for all customers other than full time National Serviceman) or at least S$500 (for customers who are full time National Serviceman) into their designated Eligible UOB savings account for this Promotion via GIRO or PayNow# within the next two calendar months from the date of submission of the online participation form; and

- S$50 cash credit for customers who successfully credit their CDP dividends of min. S$50 per transaction into their designated Eligible UOB savings account for this Promotion via Direct Credit Service~ within the next two calendar months from the date of submission of the online participation form.

Eligible UOB savings account: UOB Passbook Savings Account, UOB Uniplus Account, UOB Stash Account, UOB One Account, UOB Lady’s Savings Account or KrisFlyer UOB Account

Customers must not have received any prior reward (whether in the form of cash credit or otherwise) in similar UOB promotions, or have the respective transaction history in any UOB current or savings account during the period between 1 October 2024 to 31 March 2025.

Full terms and conditions apply and can be accessed here.

^Repayment of your UOB car and home loan instalment must be reflected with the transaction description “Misc Debit” and bank reference of "Trf. Wd. Loans” to be eligible.

~ CDP dividends must be credited from the Central Depository with the transaction description “CDP Dividend” to be eligible.

#Salary must be credited with the transaction description as "GIRO-SALA" or "PAYNOW SALA" to be eligible.

Insured up to S$100k by SDIC.

3There is no transaction fee charged for withdrawing cash at UOB ATMs in Malaysia, Indonesia and Thailand. A S$5 service charge per cash withdrawal will be charged for cash withdrawals on non-UOB ATMs. The amount of cash drawn is subject to foreign exchange rates. For the foreign exchange rate used for your cash withdrawal transaction, please refer to your statement of accounts for the Foreign and home currency withdrawal details. For more information, please click here.

4Total interest is equivalent to Base Interest plus Bonus Interest; where current Base Interest is 0.05% p.a., Bonus Interest is paid up to S$150,000 in your One Account. Base Interest is calculated at the end of each day based on each day-end balance and Bonus Interest is calculated at the end of each calendar month based on the monthly average balance. Monthly average balance is the summation of each day end balance for each month divided by the number of calendar days for that month.

Maximum effective interest rate (EIR) on the One Account is 0.65% p.a. for deposits of S$75,000, provided customers meet criterion of S$500 eligible card spend in each calendar month.

Maximum effective interest rate (EIR) on the One Account is 2.40% p.a. for deposits of S$125,000, provided customers meet both criteria of S$500 eligible card spend AND 3 GIRO debit transactions in each calendar month.

The maximum annual interest for deposits of S$150,000 in the One Account is S$6,000 and is calculated based on the maximum effective interest rate (EIR) of 4.00% p.a., provided customers meet both criteria of S$500 eligible card spend AND a min. S$1,600 salary credit via GIRO/PAYNOW (with the transaction reference “SALA” / “PAYNOW SALA”) in each calendar month.

Bundle up for even more benefits

Earn higher interest on your savings with One Account –up to 6.0% p.a. in just two steps

Skip to the good part with UOB One Account. Get up to 6.0% p.a. interest when you spend min. S$500 monthly on an eligible UOB Card AND credit your salary OR make 3 GIRO transactions monthly.![]()

Visit go.uob.com/online-exclusive for the latest sign-up offer!

With effect from 1 May 2025, please be informed that the interest rates for One Account will be revised. Find out more.

Related products and services

UOB One Card

You're a savvy spender and getting the most out of your card is your forte. The UOB One Card gives you the most cashback and helps you grow your savings. It's the smarter way to spend.

Metro-UOB Card

The card for your shopping desire. Get the most out of your shopping at Metro with Metro-UOB Card.

UOB EVOL Card

Own every evolution with the UOB EVOL Card. Get rewarded for shopping at all your go-tos, in-app or online.

Other useful links

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Please refer to UOB Insured Deposit Register for a list of UOB accounts / products that are covered under the Scheme.