UOB One Account Tax Saver Promotion

Income tax season is here! From 1 April 2025 to 31 March 2026, get up to S$600 cash rebates when you choose to pay your personal income tax with UOB One Account.

No pre-registration required.

Just 3 steps to get started

Step 1:

Apply for the GIRO Monthly Tax Payment Plan through the IRAS website and select UOB One Account as the deduction account. Use eGIRO to skip paper form filling.![]() You’ll need a UOB One Account, so apply here if you don’t have one already.

You’ll need a UOB One Account, so apply here if you don’t have one already.

Plus, accelerate your cash rebate by an additional 0.5% when you open or hold a UOB Child Development Account (CDA).

Here’s how you can earn up to S$600 in cash rebates

| One Account Monthly Average Balance(MAB) | Tax Payment Rebate (When you have registered for PayNow & activated Money Lock) |

Tax Payment Rebate (When you have registered for PayNow, activated Money Lock and hold a UOB Child Development Account) |

Monthly Cash Rebate Cap | Total Annual Cash Rebate Cap |

| ≥ S$30,000 | 6.0% | 6.5% | S$10 | S$120 |

| ≥ S$75,000 | S$25 | S$300 | ||

| ≥ S$150,000 | S$50 | S$600 |

Don’t have a UOB One Account? Hurry, sign up now.

Promotion ends 31 March 2026. This Promotion is only open to Personal Banking, Wealth Banking, Privilege Banking and Privilege Banking Reserve accountholder(s). T&Cs apply.

Insured up to S$100k by SDIC.

Not sure how to set up new or update your personal income tax GIRO plan? Find out here.

Note: If you are currently on a GIRO payment plan, you may also switch your deduction account to UOB One Account and start enjoying Tax Payment Rebate. Please keep sufficient funds in your existing payment account until the GIRO arrangement is successfully switched over to UOB One Account.

Frequently Asked Questions

Are all payments made to IRAS eligible for tax payment rebate?

No, only personal income tax and individual property taxes are eligible. Tax payments must be deducted via GIRO from One Account.

How are tax payment rebate amount calculated?

The tax payment rebate is 6% of the total personal income and/or property taxes deducted in a calendar month, subject to cap of S$10, S$25 or S$50 per month, based on minimum One Account monthly average balance (MAB) of S$30,000, S$75,000 and S$150,000 respectively.

Monthly average balance (MAB) is the summation of each day end balance for each month divided by the number of calendar days for that month.

If you hold a UOB Child Development Account (CDA), the tax payment rebate rate is 6.5%.

Can I still enjoy the promotion if I do not pay personal income taxes?

Yes, if you pay your individual property taxes via GIRO from your One Account.

Am I eligible for the rebate if my tax payment is debited from another UOB account?

No. This promotion only recognises IRAS tax payments from UOB One Account, and you must be the primary accountholder.

It is easy to switch your IRAS debiting account to One Account. Visit IRAS myTax portal at iras.gov.sg > Payment (under Quick Links) > Select “Individual Income Tax” > Click “GIRO for Individual Income Tax”. To learn more, please visit IRAS website.

When will the tax payment rebate be credited?

Your eligibility will be assessed monthly, and the rebate on qualifying tax payments will be credited into your One Account by the end of the next 2 calendar months. For example, if you have met all qualifying conditions - including IRAS tax payment via GIRO in May 2025, your tax payment rebate will be credited by end of July 2025.

Subsequently, if you continue to pay your taxes via GIRO in June 2025 but did not meet other qualifying conditions (for example, you removed money lock by setting Locked Amount to $0), you will not qualify for tax payment rebate in the month of June 2025.

How do I check my tax payment GIRO application status?

You may view your GIRO plan application details directly on IRAS myTax portal.

I have yet to receive my Notice of Assessment in April 2025, may I still participate?

Yes, you may still participate in the promotion.

If you are currently not on a GIRO payment plan, you may start applying to pay your income tax via GIRO with UOB One Account through IRAS myTax Portal. Once you have received your Notice of Assessment and the GIRO plan kicks in, you will start enjoying the Tax Payment Rebate from the first GIRO deduction date until 31 March 2026.

If you are currently on a GIRO payment plan, you may also switch your deduction account to UOB One Account and start enjoying Tax Payment Rebate. Please keep sufficient funds in your existing payment account until the GIRO arrangement is successfully switched over to UOB One Account. You will enjoy the Tax Payment Rebate from the first GIRO deduction date in your UOB One Account until 31 March 2026.

Please note that GIRO payment plan application is subject to IRAS approval.

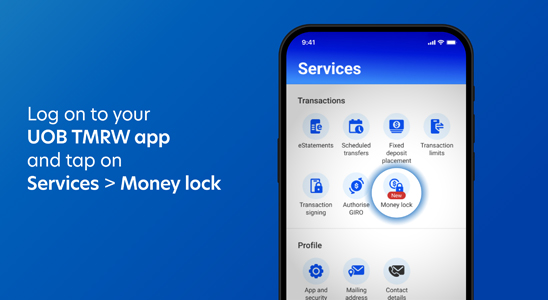

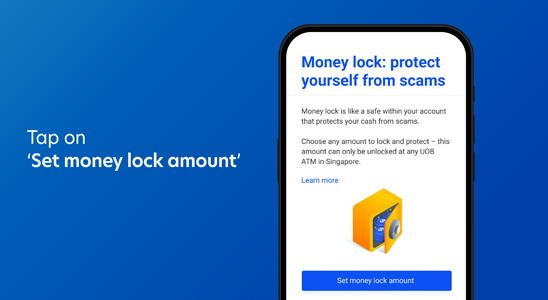

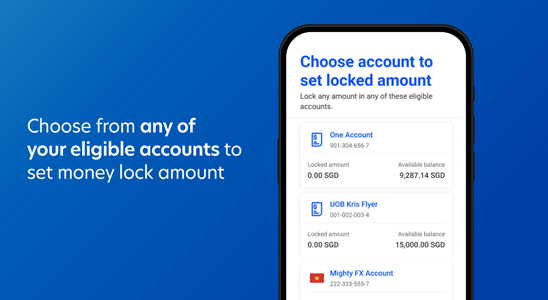

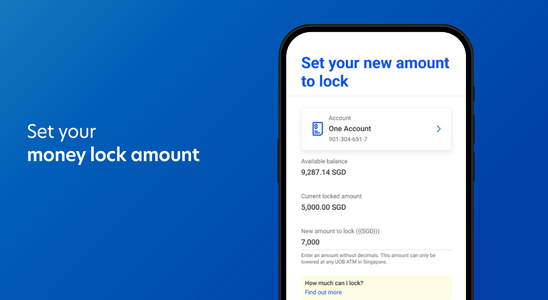

Where can I find user guides to setup PayNow, Money Lock and GIRO payment?

Please visit the following web pages for step-by-step guides.

- Step by step guide to apply for eGIRO at IRAS myTax Portal

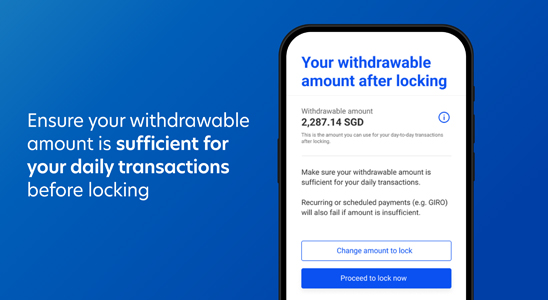

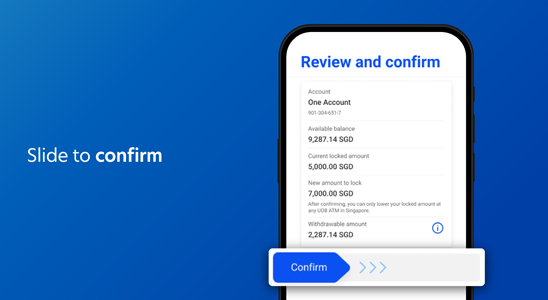

Alternatively, you may visit IRAS myTax portal at iras.gov.sg > Payment (under Quick Links) > Select “Individual Income Tax” > Click “GIRO for Individual Income Tax”. - Money Lock

You must set a minimum Lock Amount of $1 in any of your UOB accounts as the primary accountholder. Please do not lock all funds and leave sufficient withdrawable balance for GIRO transactions to be deducted. - PayNow

You must register your mobile number for PayNow. If your mobile number is currently registered with another financial institution, please deregister your mobile number from PayNow first. PayNow NRIC registration is optional and does not count towards eligibility. - Child Development Account (“CDA”)

If your CDA is with another financial institution, you may visit UOB Child Development Account page, navigate to the section of “Switch your child’s CDA to UOB”, and select “Switch to UOB”.

How do I know if my mobile number is PayNow registered with UOB?

Log in into TMRW application and tap on “PayNow” icon. On the upper right hand corner, tap on the “Setup”. If you are already registered with UOB, you will see your UOB account linked to your mobile number.

My PayNow registration failed as my mobile number is registered with another bank. What do I do?

Please deregister your mobile number from PayNow through the other bank’s internet banking or app (Other Services - Register PayNow or Payments & transfer - Manage PayNow under More tab). Once done, you may login to UOB TMRW app to complete the PayNow mobile registration with UOB. Please contact the other bank if you require further assistance to deregister PayNow.

Do I qualify for Tax Payment Rebate if I pay my tax bill via GIRO on One Time Yearly option?

Assuming you fulfil all other qualifying conditions, you are eligible for the Tax Payment Rebate. However, due to the monthly rebate cap, you will only be awarded a Tax Payment Rebate of up to $50 for the entire promotion period.

To get more out of this promotion, please set up monthly tax payments instead.

I am a secondary accountholder of a joint name One Account. Can I participate in this promotion?

Please request the primary or main accountholder to perform the required banking activities (i.e. register mobile number for PayNow, setup of money lock) to meet the promotion eligibility criteria. Your tax payments deducted from the joint name One Account will be eligible for the Tax Payment Rebate.

If I switch my CDA from another bank to UOB, will I be eligible for higher Tax Payment Rebate?

If your CDA(s) is with other providers, and you successfully switch your CDA to UOB during the Promotion Period, you will be eligible for 6.5% Accelerated Tax Payment Rebate from the month of successful switch to UOB.

How do I know what my MAB is?

Log into UOB Personal Internet Banking to see your account summary. Simply select the account you would like to check, and the last 3 months’ “Monthly Average Balance” will be displayed on the top white panel.

Things you should know

Terms and Conditions

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Please refer to UOB Insured Deposit Register for a list of UOB accounts / products that are covered under the Scheme.