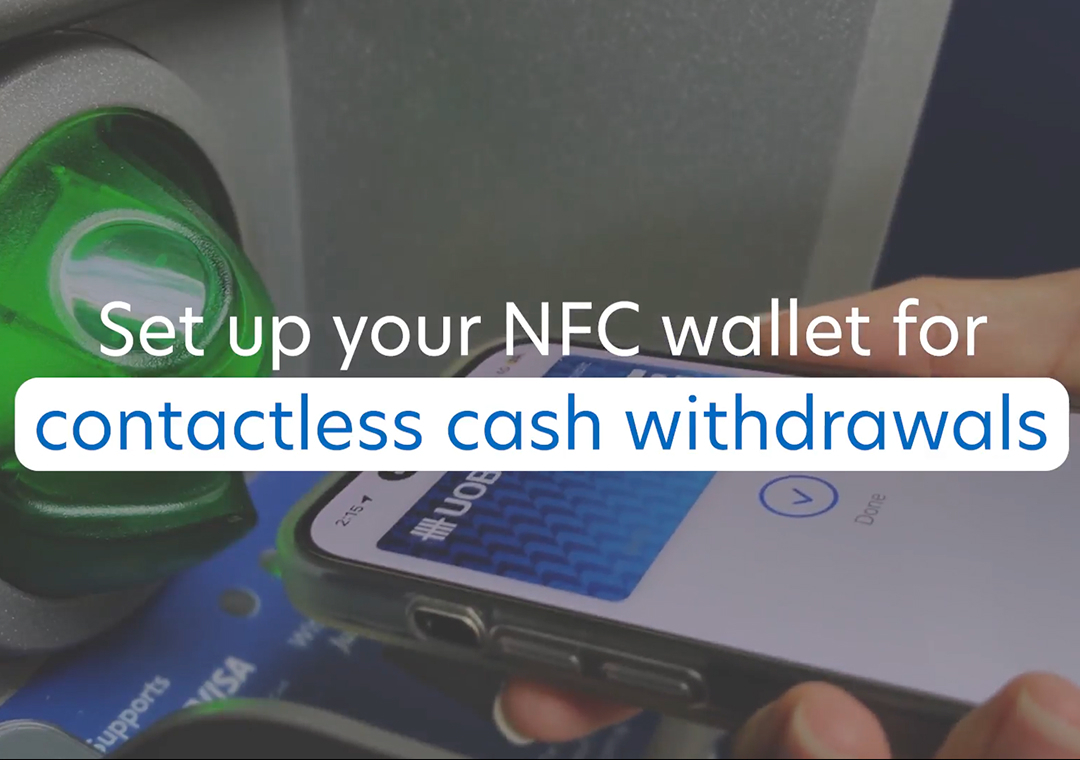

This service allows you to withdraw cash from an ATM using your phone instead of your card. Simply tap your phone device on the contactless symbol found on the ATM machine, select the card you wish to withdraw from, and enter your ATM PIN.

The same Visa or Mastercard that you are using for ATM cash withdrawals today are supported. You can add the card to your respective wallet and start enjoying Contactless ATM withdrawals.

Preset withdrawal settings allow you to indicate your withdrawal amount, account to withdraw from and balance display or receipt, so that there is no need to make those selections on the ATM screen. You will get your cash right after you key in your ATM pin, making your cash withdrawal even easier. You can choose to preset your withdrawal settings via UOB TMRW.

You can enable and disable this preset withdrawal setting function with the toggle in your Contactless ATM setting within UOB TMRW. When this setting is turned off, you will be guided by the ATM to enter the amount you wish to withdraw each time.

Yes. If you have more than one card enabled for Contactless ATM cash withdrawal, you can preset individual preset withdrawal settings for each card.

If your Visa or MasterCard credit card is not linked to any of your Current / Savings Account, you will not be able to use the card for Contactless ATM withdrawal

Log in to UOB TMRW to link your card to your current or savings account instantly. Click here to learn how. Alternatively, you may visit the nearest branch to link your UOB Visa and MasterCard Credit Card to your current or savings account, if you wish to enable Contactless ATM withdrawals for this credit card.

No. It is not considered a cash advance transaction, if you have linked your UOB Visa and MasterCard Credit Card to your current or savings account. By doing so, your cash withdrawal is made from your current or savings account, and not your credit card.

No. There are no additional charges applicable for Contactless Cash Withdrawal.

Depending on your alerts setting, you will receive SMS and email alerts based on your current setting on ATM cash withdrawal threshold.

To update your alerts setting for your transactions, please log in to UOB Personal Internet Banking > Account Services > Manage Notifications.

Just add your UOB Visa or Mastercard Debit card on ApplePay™/Google Pay/Samsung Pay. The card you add needs to be linked to a UOB current or savings account.

Click here to visit the nearest UOB ATM for your contactless ATM withdrawal. Simply tap your phone device on the contactless symbol found on the ATM machine, select the card you wish to withdraw from, and enter your ATM PIN.

If you wish to change the settings for your contactless withdrawal transactions, simply log in to UOB TMRW app, tap on ‘Services’ on the bottom navigation bar and select ‘Contactless ATM settings’ to change your current settings.

You may call our 24-hour Customer Service Hotline at 1800 222 2121 (or +65 6222 2121 when calling from overseas). Alternatively, please use your physical card first for your cash withdrawals.

Please note that some of the listed transactions may be pending charges, which are temporary and are subject to change (for instance, pre-authorisations at restaurants and hotels).

To view or download your cards transactions statement, please follow these simple steps:

- Log in to UOB TMRW

- Select your respective card and tap "Services". Under "Others", tap on "View eStatement" and select the month of the statement you would like to view or download. Your eStatement will appear on your screen.

- You may tap on the "Download" button on the top left hand corner of the screen to save a copy of your eStatement.

If you suspect that there has been fraudulent activity on your account, click here for immediate steps to take to prevent further losses or call our dedicated 24/7 Fraud Hotline 6255 0160 if unsure.