Scam Alert

Scam Alert

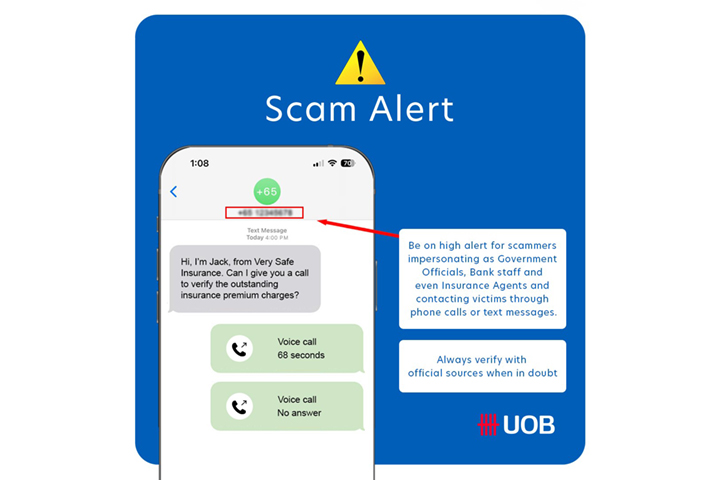

Beware of scammers impersonating government officials, bank staff, and insurance agents, contacting victims via phone or video calls for payments. Scammers, who speak with local accent, may wear government uniforms and display official logos to deceive victims. They may also show bank accounts opened for victims, fake identity card or arrest warrants to intimidate victims to comply. Click here for details. Call our dedicated 24/7 Fraud Hotline 6255 0160 if unsure. Subscribe to our UOB Facebook page for the latest update and advice on scams.

Security

Your online banking security remains our top priority, and we are committed to protecting you from scams.

Latest alerts and announcements

Alert

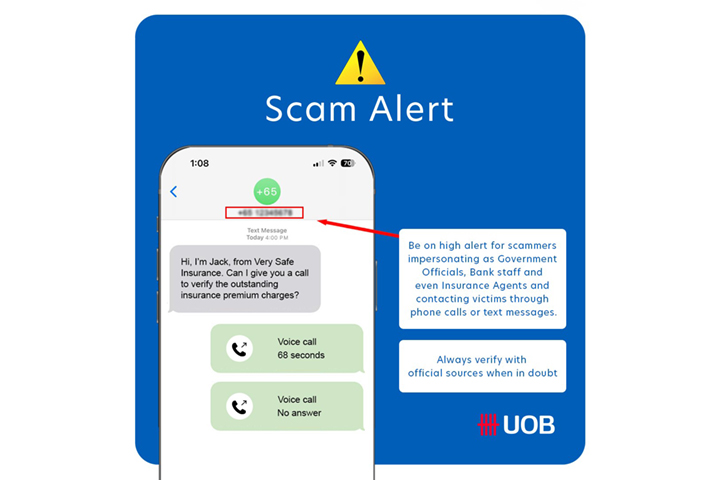

Impersonation Scam

Beware of scammers impersonating as government officials, bank staff, and insurance agents contacting victims via phone or video calls for payments. Scammers, who speak with local accent, may wear government uniforms and display official logos to deceive victims. They may also show bank accounts opened for victims, fake identity card or arrest warrants to intimidate victims to comply. Victims may be asked to pay outstanding charges, or transfer funds to a bank account which the authorities have supposedly set up for the victims. While the bank account will show the victim’s name, it does not belong to the victim but to a person controlled by the scammers.

Announcement

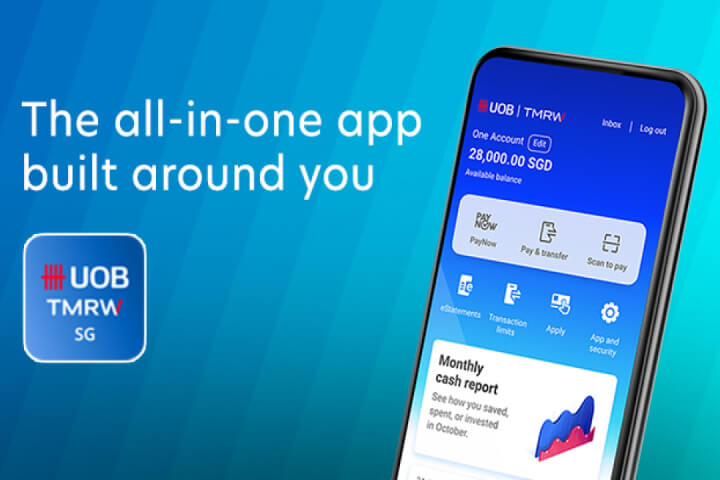

Enjoy secure banking with instant notifications NEW!

From April 2025, the existing SMS alerts will be progressively changed to push notifications via UOB TMRW and email alerts for impacted digital, banking and card transactions.

The threshold for transaction alerts will also be set to the bank’s default settings for these impacted transactions![]()

To ensure your transaction notifications are not disrupted, please enable push notifications in your phone settings and update your email address today.

Note: Ensure you have the latest app version of UOB TMRW for the latest updates.

Announcement

New ScamShield Suite to block scam calls and SMSesNEW!

The ScamShield app has been enhanced with features such as scam message and call checks, AI-powered call blocking and SMS filtering, and scam reporting across WhatsApp, Telegram, SMS, calls and other channels.

Enhance your scam protection with the ScamShield app today!

ScamShield is a joint effort by the Ministry of Home Affairs, the Singapore Police Force, Open Government Products, and the National Crime Prevention Council. Click the button to find out more.

Announcement

Access to UOB TMRW app will be restricted if USB/Wireless debugging is enabled on your Android device NEW!

To protect your exposure to scams, access to the UOB TMRW app will be restricted once we detect USB/Wireless debugging is enabled on your device, as it might be used by fraudsters to enable remote screen viewing and execute unauthorised transactions.

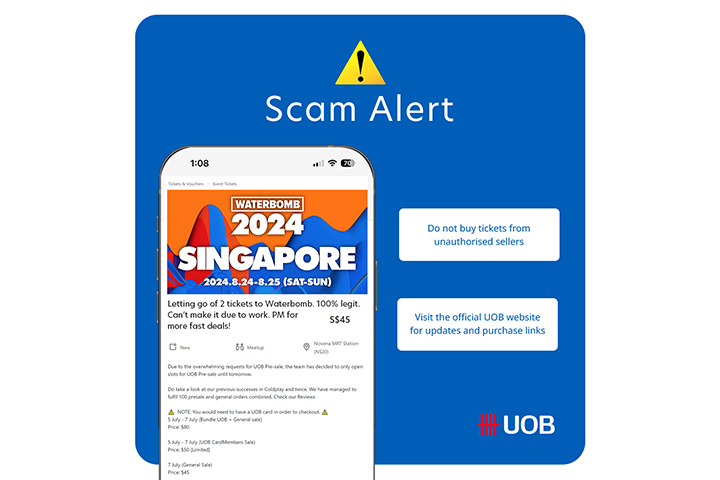

Alert

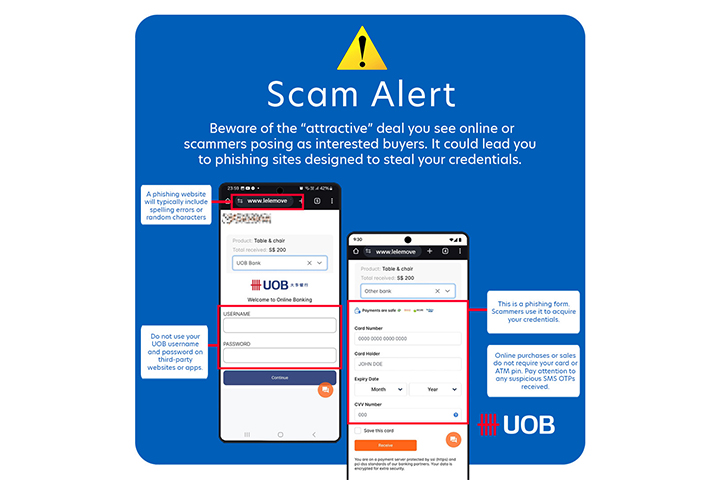

Phishing scam

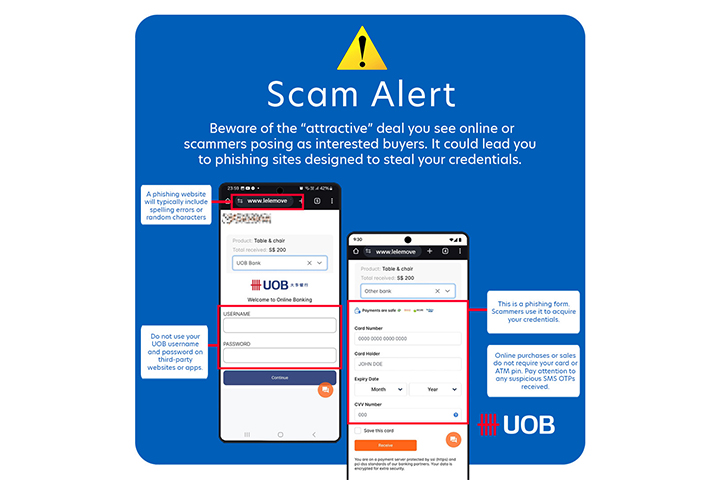

Be on high alert for scammers who typically offer “attractive” deals to phish your personal banking information using fake payment websites or through social media messages. Sometimes, scammers may impersonate interested buyers or government officials to phish your personal banking information.

Sharing online banking credentials such as credit card details, OTPs, card or ATM Pin could potentially expose you to unauthorised banking transactions including ATM withdrawals.

Alert

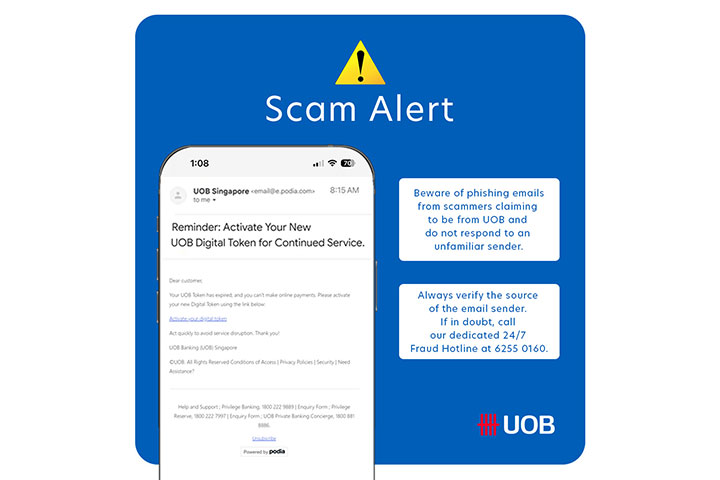

Phishing scam

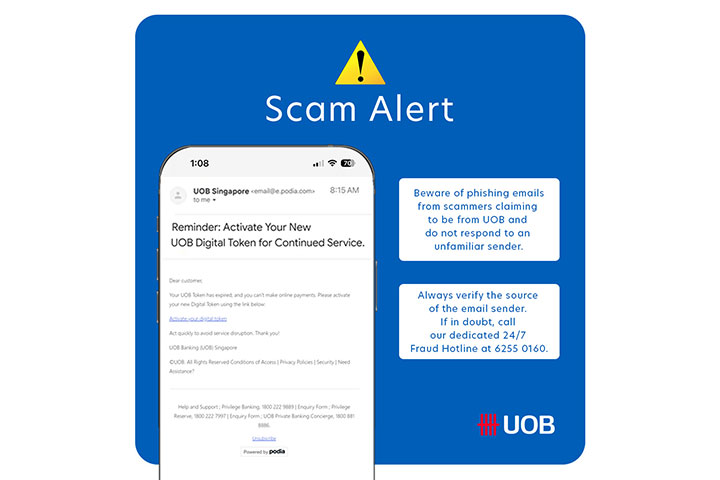

Beware of phishing emails from scammers claiming to be from UOB requesting you to activate your Digital Token via email. Verify the identity of the email sender by hovering over the sender’s name. The sender’s name may not match the email address. Be vigilant as scammers may be spoofing our UOB official email address to do so.

Announcement

12-hour cooling period for transfer limit change NEW!

From December 2024, there may be a 12-hour cooling period* when you submit a request to change your limit (3rd party local and overseas fund transfer). This is to combat online banking fraud and protect your accounts.

*This is in addition to the 12-hour cooling period for the activation of your new digital token.

Note: Customers will need to update to new app version of UOB TMRW 17.18.0 and above to see the new changes.

Alert

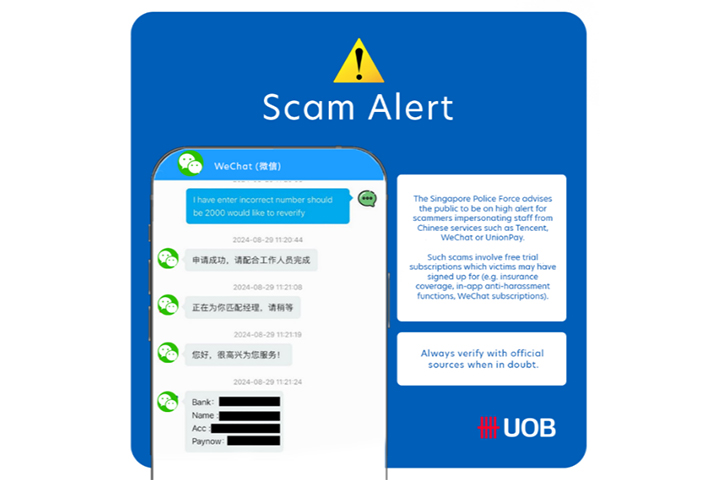

Chinese digital subscription services Impersonation Scam

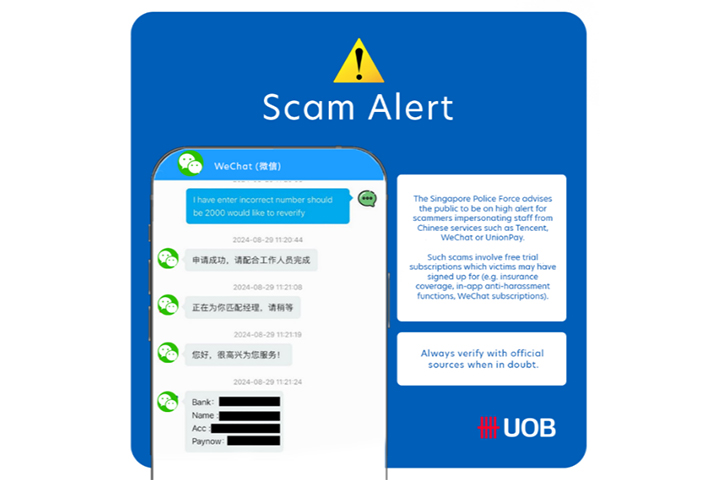

The Singapore Police Force advises the public to be on high alert for scammers impersonating as staff from Chinese services such as Tencent, WeChat or UnionPay. Such scams involve free trial subscriptions which victims may have signed up for (e.g insurance coverage, in-app anti-harassment functions, WeChat subscriptions)

Announcement

Protect your savings from digital scams with Money Lock

Set a Money Lock amount in your existing UOB accounts to prevent unauthorised withdrawals.

Rest assured, your money continues to earn the same interest (up to 6% p.a. for UOB One Account). Simply use the UOB TMRW app or visit any UOB ATM in Singapore to lock any amount, anytime. You can unlock your funds at any UOB ATM in Singapore.

SGD deposits are insured up to S$100k by SDIC.

Announcement

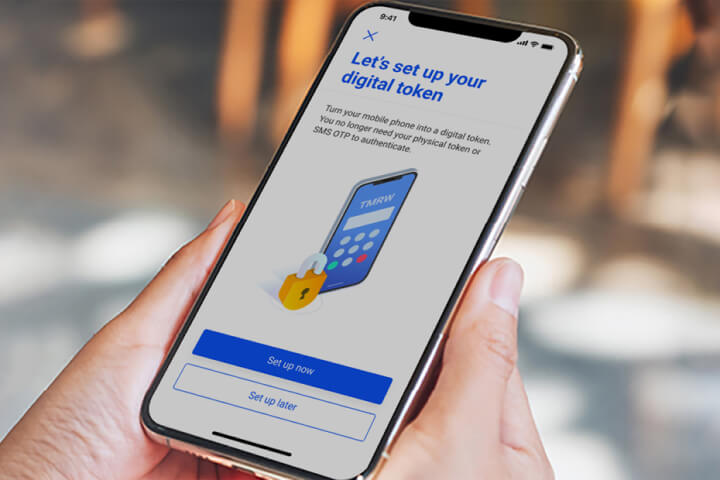

Introducing Singpass Face Verification (SFV) to protect you against phishing scams

As part of the latest industry move to strengthen the resilience against phishing scams, we have introduced Singpass Face Verification (SFV) as part of the Digital Token set-up.

This additional layer of authentication will be prompted if there is any unusual or suspicious activity detected during the Digital Token setup process, which will make it harder for scammers to gain access to your accounts.

Alert

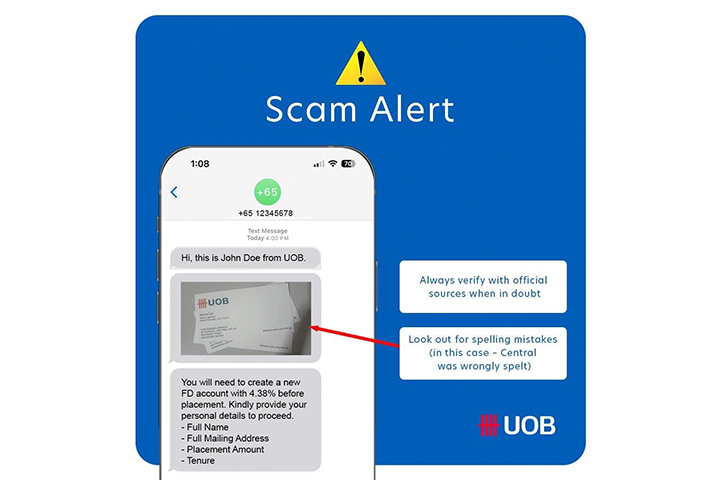

Is this an authentic fixed deposit promotion from UOB?

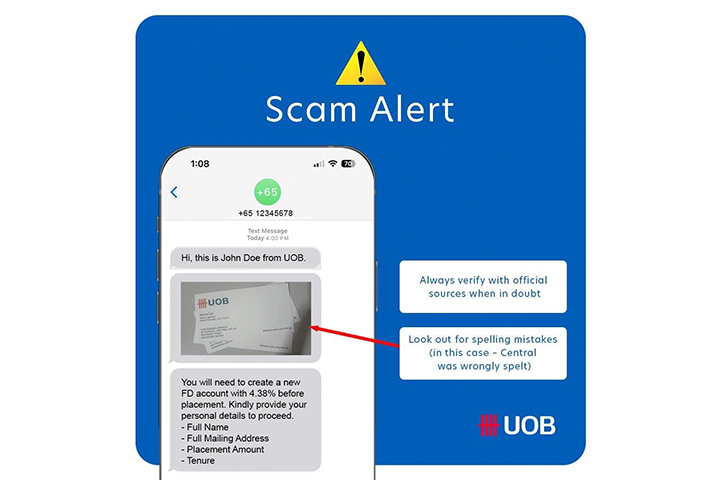

Be on the lookout for scammers offering fake fixed deposit promotions and sharing fake UOB name cards to impersonate themselves as a UOB employee. We will not send you promotional messages or request for your personal information from a mobile number. If in doubt, always verify with official UOB sources such as our websites or branches.

Alert

Fake Loans Platform Phishing Scam

Be on high alert for fake UOB websites offering loans that may trick you into giving away your banking credentials and card details. You can verify the authenticity of UOB Singapore websites by verifying if the web domain comes from “uob.com.sg” or “uobgroup.com”.

Latest alerts and announcements

Alert

Impersonation Scam

Beware of scammers impersonating as government officials, bank staff, and insurance agents contacting victims via phone or video calls for payments. Scammers, who speak with local accent, may wear government uniforms and display official logos to deceive victims. They may also show bank accounts opened for victims, fake identity card or arrest warrants to intimidate victims to comply. Victims may be asked to pay outstanding charges, or transfer funds to a bank account which the authorities have supposedly set up for the victims. While the bank account will show the victim’s name, it does not belong to the victim but to a person controlled by the scammers.

Announcement

Enjoy secure banking with instant notifications NEW!

From April 2025, the existing SMS alerts will be progressively changed to push notifications via UOB TMRW and email alerts for impacted digital, banking and card transactions.

The threshold for transaction alerts will also be set to the bank’s default settings for these impacted transactions![]()

To ensure your transaction notifications are not disrupted, please enable push notifications in your phone settings and update your email address today.

Note: Ensure you have the latest app version of UOB TMRW for the latest updates.

Announcement

New ScamShield Suite to block scam calls and SMSesNEW!

The ScamShield app has been enhanced with features such as scam message and call checks, AI-powered call blocking and SMS filtering, and scam reporting across WhatsApp, Telegram, SMS, calls and other channels.

Enhance your scam protection with the ScamShield app today!

ScamShield is a joint effort by the Ministry of Home Affairs, the Singapore Police Force, Open Government Products, and the National Crime Prevention Council. Click the button to find out more.

Announcement

Access to UOB TMRW app will be restricted if USB/Wireless debugging is enabled on your Android device NEW!

To protect your exposure to scams, access to the UOB TMRW app will be restricted once we detect USB/Wireless debugging is enabled on your device, as it might be used by fraudsters to enable remote screen viewing and execute unauthorised transactions.

Alert

Phishing scam

Be on high alert for scammers who typically offer “attractive” deals to phish your personal banking information using fake payment websites or through social media messages. Sometimes, scammers may impersonate interested buyers or government officials to phish your personal banking information.

Sharing online banking credentials such as credit card details, OTPs, card or ATM Pin could potentially expose you to unauthorised banking transactions including ATM withdrawals.

Alert

Phishing scam

Beware of phishing emails from scammers claiming to be from UOB requesting you to activate your Digital Token via email. Verify the identity of the email sender by hovering over the sender’s name. The sender’s name may not match the email address. Be vigilant as scammers may be spoofing our UOB official email address to do so.

Announcement

12-hour cooling period for transfer limit change NEW!

From December 2024, there may be a 12-hour cooling period* when you submit a request to change your limit (3rd party local and overseas fund transfer). This is to combat online banking fraud and protect your accounts.

*This is in addition to the 12-hour cooling period for the activation of your new digital token.

Note: Customers will need to update to new app version of UOB TMRW 17.18.0 and above to see the new changes.

Alert

Chinese digital subscription services Impersonation Scam

The Singapore Police Force advises the public to be on high alert for scammers impersonating as staff from Chinese services such as Tencent, WeChat or UnionPay. Such scams involve free trial subscriptions which victims may have signed up for (e.g insurance coverage, in-app anti-harassment functions, WeChat subscriptions)

Announcement

Protect your savings from digital scams with Money Lock

Set a Money Lock amount in your existing UOB accounts to prevent unauthorised withdrawals.

Rest assured, your money continues to earn the same interest (up to 6% p.a. for UOB One Account). Simply use the UOB TMRW app or visit any UOB ATM in Singapore to lock any amount, anytime. You can unlock your funds at any UOB ATM in Singapore.

SGD deposits are insured up to S$100k by SDIC.

Announcement

Introducing Singpass Face Verification (SFV) to protect you against phishing scams

As part of the latest industry move to strengthen the resilience against phishing scams, we have introduced Singpass Face Verification (SFV) as part of the Digital Token set-up.

This additional layer of authentication will be prompted if there is any unusual or suspicious activity detected during the Digital Token setup process, which will make it harder for scammers to gain access to your accounts.

Alert

Is this an authentic fixed deposit promotion from UOB?

Be on the lookout for scammers offering fake fixed deposit promotions and sharing fake UOB name cards to impersonate themselves as a UOB employee. We will not send you promotional messages or request for your personal information from a mobile number. If in doubt, always verify with official UOB sources such as our websites or branches.

Alert

Fake Loans Platform Phishing Scam

Be on high alert for fake UOB websites offering loans that may trick you into giving away your banking credentials and card details. You can verify the authenticity of UOB Singapore websites by verifying if the web domain comes from “uob.com.sg” or “uobgroup.com”.

Funds from the UOB LockAway Account can only be withdrawn in person and not by any other means, including but not limited to online transactions, Personal Internet Banking, Mobile Services, cheque, ATM withdrawals and debit instructions given through the Call Centre Service. For the avoidance of doubt, debit instructions will only be accepted for the UOB LockAway Account if you provide the debit instruction in person at any of our branches in Singapore. Watch this space for more information and refer to our FAQs

Digital banking made safe

How UOB protects you

Enjoy full convenience and peace of mind when you bank online with our multi-layered security programme. Learn more about how we keep your transactions safe.

How you can protect yourself

Stay safe with extra measures that you can do simply from anywhere - at home, at work, from your phone.

Kill Switch

(Disable digital access and block your cards)

This will disable your digital access to Personal Internet Banking, UOB TMRW app and block all your UOB Debit/Credit cards instantly. Note that Kill Switch does not suspend these services. Learn more.

2 ways to do so:

- Call our 24-hour Fraud Hotline at 6255 0160 › Press 4 to activate Kill Switch Learn how

- Call General Hotline at 1800 222 2121, press 1 (for English) or 2 (for Chinese) > press 1 > press 2

Upon activating our self-service "kill switch" feature, you will receive two SMS notifications confirming the activation of the Kill Switch, which disables your digital access and blocks all your UOB Debit/Credit cards.

Any active digital login session will be terminated.

To re-activate your digital access, please call our General Hotline at 1800 222 2121 or visit your nearest UOB branch for assistance.If you wish to re-enable all your UOB Debit/Credit cards, please unlock them via the UOB TMRW app, or call our General Hotline at 1800 222 2121, or visit your nearest UOB branch for assistance.

Things you should know

Our security best practices and policies

Frequently asked questions

Click here to read more.

| Category | Impacted Transactions | Default notification mode | Default Threshold (S$) |

| Online transfers and payments | Digital transactions including all types of fund transfer, telegraphic transfer, QR payment (local and overseas), bill payments, online cash advance, eNETs payments | Push notification and email | 100 |

| Adding of payee, biller or beneficiary | No threshold | ||

| GIRO setup approval | SMS and Email | No threshold | |

| GIRO payments and standing orders (including Electronic Direct Debit Authorisation) | Unsubscribe | 1,000 | |

| No threshold | |||

| Upcoming GIRO payments and standing orders reminders (including Electronic Direct Debit Authorisation) | |||

| Card activity* | Card charges (includes payments and cash advances) | SMS and email | 500 |

| SmartPay, LuxePay, Instalment Payment Plan and UOB Personal Loan monthly instalments | 1,000 | ||

| NETS chip payments | 1,000 | ||

| NETS contactless and online payments | 1,000 | ||

| NETS transaction made on the CDA account | 0.1 | ||

| Low credit limit reminder | Unsubscribe | No threshold | |

| Upcoming card bill payment reminders | |||

| Confirmation of card bill payments received | |||

| Investments, fixed deposits and insurance | Instructions for securities, bonds, unit trusts and insurance products (includes Electronic Payment for Shares (EPS) and Share payments via ATMs) | Push notification and email | No threshold |

| Fixed or structured deposits placements | |||

| CPF or SRS accounts top-ups. | |||

| Buy/sell gold and silver | 1 | ||

| Securities and bonds allocation and redemption updates | Unsubscribe | No threshold | |

| eStatement | eStatement is ready for viewing | Push notification and email | No threshold |

| Security and money lock | Transfer and payment limit updates | Push notification and email | No threshold |

| Money lock limits update | |||

| When available balance is lower than money lock limit, and when transactions fail due to money lock | |||

| Mailing address update | |||

| ATM | Cash withdrawal in Singapore and Overseas | SMS and email | 500 |

| ATM transactions - funds transfer, bill payment | 1,000 | ||

| Top-ups to CashCards or NETS FlashPay cards/ Apply rights application/Apply SGS/Apply SSB/Apply T-bills | No threshold | ||

| Cheques, cashier's orders and demand drafts | Demand drafts and cashier’s orders | Push notification and email | 1,000 |

| Adding of beneficiary for cashier’s orders and demand drafts. | No threshold | ||

| When cheques are cashed in | SMS and email | 1,000 | |

| Others | Certain payments, refunds, and payment reversals made outside of UOB TMRW and Personal Internet Banking | Unsubscribe | 1,000 |

* For Card activity alerts, customers’ preferred alert mode of “SMS” or “Email” will be upgraded to “SMS and Email”, Customers’ preferred alert threshold, where applicable, will be retained.

Below is the list of transaction alerts which customers are unable to change their notification mode.

| Impacted Transactions | New notification mode (after 19 April 2025) |

| FX+ currency conversion (via UOB TMRW) | Push notification and email |

| Contact details update (via UOB PIB and UOB TMRW) | Push notification and SMS |

| Unsubscribe from GIRO and Standing Order alert, and certain payments alert via PIB/TMRW | Push notification and email |

| Change eStatement subscription | Push notification and SMS |

| 1 |

Push notification, SMS and email |

| Block/Unblock card (via UOB TMRW) | Push notification and email |

| Kill Switch (disable digital access and block cards) | SMS and email |

We use cookies to improve and customise your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.