Building Your Portfolio

2025 looks set to offer both opportunities and challenges as United States (US) President-elect Donald Trump lays out his domestic and foreign policies.

Before building your portfolio, you should consider your financial goals, risk tolerance and investment time horizon. Having done so, build a diversified portfolio given the prospect of unpredictable policy shifts. Anchor your portfolio with Core investments that are less reliant on market cycles before considering Tactical investments that are of higher risk but offers potentially higher returns over the short and medium term.

There are a few things that investors will need to be mindful of in the year ahead. While the global stock market outlook remains positive, volatility may increase in the short term due to US policy uncertainties.

Build a base of quality stocks via global diversified equity funds. Stock market leadership may shift away from large-cap stocks, so a flexible market-cap approach can allow investors to slowly gain exposure to mid-cap and small-cap stocks.

Developed market financials, technology and US small-cap stocks are expected to do well in light of President-elect Trump’s pro-growth policies. To enhance long-term returns that beat inflation, it will be essential to build portfolio income through quality dividend stocks, investment grade bonds, and Additional Tier 1 (AT1) bonds, Tier 2 (T2) bonds and senior Total Loss-Absorbing Capacity (TLAC) bonds![]() .

.

It will also be important to be agile and proactive, as different Tactical investment opportunities will present itself as global policies shift. Expect more divergence in returns of different stock markets, offering potential opportunities for investors. Above and beyond all else, it is important to stay invested. History shows that staying invested for the long-term delivers better returns than trying to time the market. If investors try to time the market but miss out on just a few of the best-performing days which typically happens around the market bottom, overall portfolio returns will be significantly reduced. Being invested for the long-term also allows investors to harness the power of compounding reinvested capital gains and dividends.

Another strategy to keep in mind is dollar-cost averaging, where investing a fixed amount at regular intervals help investors smooth out market volatility over time.

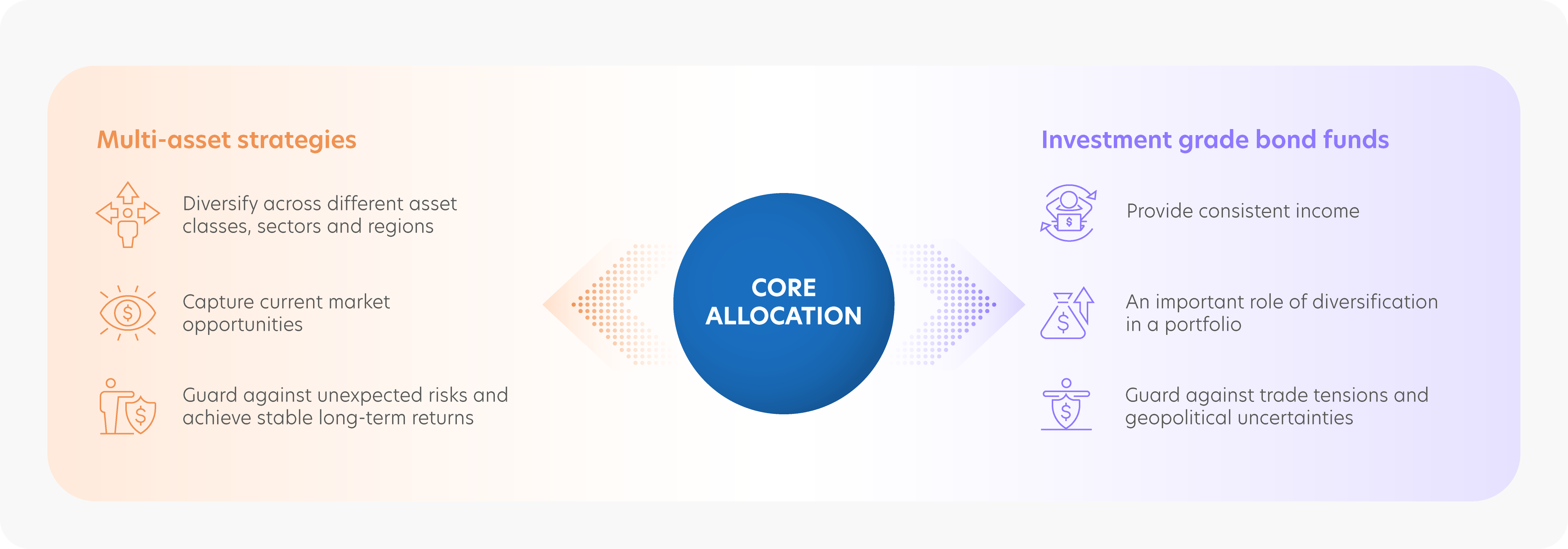

Core Allocation

Multi-asset strategies

Diversification is a fundamental strategy to guard against unexpected investment risks, achieve stable and consistent returns, and capture opportunities to meet your long-term financial goals. Core investments like multi-asset strategies will help you diversify across different asset classes, regions and sectors.

Investment grade bond funds

Investment grade bond funds allow you to diversify across different bonds and gain consistent income that is currently attractively high. In addition, investment grade bonds play an important role of diversification in an investment portfolio. They also help to offset your investment portfolio risk in the event of trade tensions and geopolitical uncertainties.

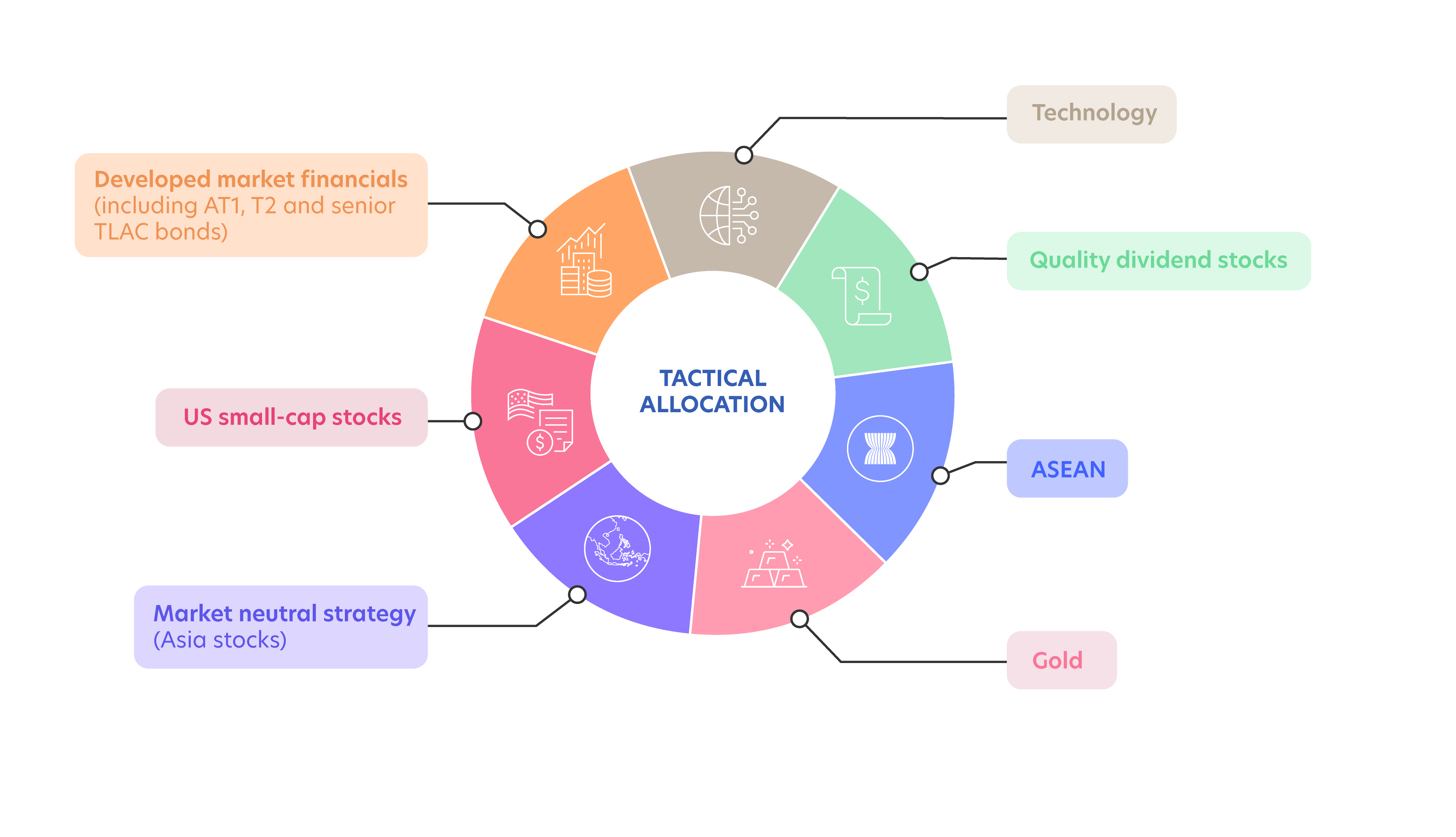

Tactical Allocation

Market neutral strategy (Asia stocks)

The outlook for Asian stocks is uncertain given potential global trade tensions, and increased market volatility is likely in the short term. However, Asia ex-Japan stock valuations remain attractive, corporate earnings are expected to remain robust, while potential fiscal stimulus in China may mitigate some downside risks.

For investors with higher risk appetite, a market neutral strategy designed to potentially generate returns regardless of whether the market goes up or down will allow you to seize opportunities and lower portfolio volatility.

ASEAN

ASEAN will likely benefit from supply chain diversification and changes in global trade if US-China trade tensions rise. In addition, a large and young demographic, ASEAN policy coordination and stable regional politics support the medium to long-term economic outlook. For exposure to ASEAN stocks, investors should consider a diversified exposure via funds.

Singapore stocks have been upgraded as a Tactical investment due to the continued strong performance of banking stocks and attractive dividend payouts from real estate investment trusts (REITs).

Gold

Gold’s safe haven demand will likely stay strong given ongoing geopolitical risks and potential trade tensions. Consumer demand for physical gold and jewellery remains strong while emerging market (EM) central banks may continue to increase their Gold holdings.

While serving a diversification purpose, investors should keep their Gold allocation to around 5-10% of their portfolio.

US small-cap stocks

Valuations are attractive, while US small-cap companies will be indirect beneficiaries of higher trade tariffs. A potential broadening of US stock market leadership beyond large-cap companies will also support small-cap stocks.

US small-cap stocks will also benefit from potential tax cuts, while a domestic focus for their businesses will mitigate the risk of global trade tensions.

Nonetheless, it is necessary to be selective as not all small-cap companies are profitable. Investors should slowly gain exposure to US small-cap stocks as part of portfolio rotation.

Developed market financials (including AT1, T2 and senior TLAC bonds)

The financial sector will likely benefit from President-elect Trump’s focus on tax cuts and deregulation. This backdrop will boost bank revenues and profits.

Potentially lower United States (US) corporate taxes can lead to higher business investments domestically, boosting bank loan revenues.

In the US, potentially lighter regulations will enable banks and other financial institutions to allocate their capital more efficiently. This can be via business expansion or increased dividend payouts and/or share buybacks. An avenue of building your investment income can be found in Additional Tier 1 (AT1) bonds, also known as Contingent Convertible (CoCo) bonds, Tier 2 (T2) bonds and senior Total Loss-Absorbing Capacity (TLAC) bonds. These bonds come with higher risk, so consider your risk appetite before investing.

Bank capital securities offer attractive yields while bank fundamentals and asset quality have also improved over the past decade, which will mitigate periods of unexpected financial stress.

Technology

Technology stocks will continue to do well as digital transformation and increasing artificial intelligence (AI) demand will sustain the sector’s earnings growth momentum. With AI, cloud computing, data analytics and cybersecurity driving significant innovation, the sector has long-term growth potential.

For US tech companies, they will potentially benefit from lower corporate taxes and President-elect Trump’s pro-growth policies. Trump’s presidency could also lessen regulatory and antitrust concerns for mega-cap tech companies.

Nonetheless, tech market leadership may broaden out beyond mega-cap companies to other companies that benefit from AI innovation.

Quality dividend stocks

Stocks of quality companies with steady cash flows and strong balance sheets that pay attractive and consistent dividends will continue to do well. As part of the strategy of building investment income, these dividend paying stocks will allow you to enjoy income from your portfolio.

In addition, quality dividend stocks can also offer potential capital appreciation and a compounding wealth effect when capital gains and dividends are reinvested.

While there are potential trade tensions ahead, domestic focused companies in Asia ex-Japan still offers attractive and consistent dividend payouts.

In Conclusion

Build a diversified portfolio given the prospect of unpredictable US policy shifts. Anchor your portfolio with Core investments before considering Tactical investments.

To enhance long-term returns, it will be essential to build portfolio income through investment grade bonds and quality dividend stocks.

It will also be important to be agile and proactive, and regularly review your portfolio, as global policies shift.

Credits

Credits

Managing Editor

- Winston Lim, CFA

Singapore and Regional Head,

Deposits and Wealth Management,

Personal Financial Services

Editorial Team

- Abel Lim

Head of Wealth Management Advisory and Strategy,

Deposits and Wealth Management,

Personal Financial Services

Editorial Team (cont’d)

- Tan Jian Hui

Wealth Management Advisory,

Deposits and Wealth Management,

Personal Financial Services - Low Xian Li

Wealth Management Advisory,

Deposits and Wealth Management,

Personal Financial Services - Zack Tang

Wealth Management Advisory,

Deposits and Wealth Management,

Personal Financial Services

Important notice and disclaimers

The information contained in this publication is given on a general basis without obligation and is strictly for information purposes only. This publication is not intended to be, and should not be regarded as, an offer, recommendation, solicitation or advice to buy or sell any investment or insurance product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. Any description of investment or insurance products, if any, is qualified in its entirety by the terms and conditions of the investment or insurance product and if applicable, the prospectus or constituting document of the investment or insurance product. Nothing in this publication constitutes accounting, legal, regulatory, tax, financial or other advice. If in doubt, you should consult your own professional advisers about issues discussed herein.

The information contained in this publication, including any data, projections and underlying assumptions, are based on certain assumptions, management forecasts and analysis of known information and reflects prevailing conditions as of the date of the publication, all of which are subject to change at any time without notice. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, United Overseas Bank Limited (“UOB”) and its employees make no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for its completeness or accuracy. As such, UOB and its employees accept no liability for any error, inaccuracy, omission or any consequence or any loss/damage howsoever suffered by any person, arising from any reliance by any person on the views expressed or information contained in this publication.

Any opinions, projections and other forward looking statements contained in this publication regarding future events or performance of, including but not limited to, countries, markets or companies are not necessarily indicative of, and may differ from actual events or results. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. Investors may wish to seek advice from an independent financial advisor before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider whether the investment or insurance product in question is suitable for you.