The latest Federal Open Market Committee meeting affirmed the US Federal Reserve's cautious wait-and-see approach. Meanwhile, China unveiled key policies to boost domestic consumption and tech innovation. How can you adjust your portfolio to capture opportunities and mitigate risks?

Featured

Regular financial market insights and analysis to help you make sense of global events, stock and bond movements that may affect your investment journey.

To stay up to date on US Federal Reserve policy, global interest rates and economic data to help you make informed financial decisions, view our Monthly Investment Insights, Breaking Market Updates, and Thinking Ahead reports and videos.

Daily Updates

Macro Outlook

Get the latest insights on key economic developments.

FX Focus

Read the latest insights and UOB's house views on foreign exchange markets.

Wealth Insights

Thinking Ahead

US Federal Reserve decision and Perspectives on China

Thinking Ahead

China's economic priorities: Is it a game changer for investors?

China’s latest National People’s Congress (NPC) meeting unveiled key policy directions shaping China’s economic outlook amidst geopolitical and trade tensions. Stay informed on how these policies could impact markets and your investment portfolio in our latest Thinking Ahead report.

Monthly Investment Insights

March 2025

In our March report, we cover the following topics:

- Tariff 2.0: What’s changed?

- Disruption or acceleration for artificial intelligence?

- Round-up of 4Q 2024 US corporate earnings

Monthly Investment Insights

February 2025

In our February report, we cover the following topics:

- Asset class implications post-elections

- Taking stock of Asia’s opportunities and challenges

- Investor optimism: a reality check

Market Outlook

2025 Market Outlook - Navigate market currents in dynamic conditions

2025 is set to be a year of significant changes in global dynamics especially with the return of United States President-elect Donald Trump to the White House.

What opportunities and challenges will 2025 bring? Discover key trends and strategies to help you navigate the changing economic currents in the year ahead.

Thinking Ahead

A December rate cut: What to expect in 2025

Hear from Abel Lim, Head of Wealth Management Advisory and Strategy as he shares insights on how you can adjust your financial strategies to capture opportunities and mitigate risks in this interest rate environment.

UOB Market Outlook

2025 Market Outlook

Navigate market currents in dynamic conditions

UOB House View

Discover our latest insights on the global macroeconomic environment, asset allocation, equities, fixed income, commodities, foreign exchange and interest rates.

Global Economics and Markets Research

Stay up to date on the latest global and regional news, economic developments and more.

Learn more

Learn about Structured Products

Join John Lau, Head of Treasury, Singapore and Regional, as he talks about how structured products can be customised and the risks involved.

Learn about Foreign Currency Bonds

Join Jonathan Conley, Head of Treasury Advisory as he talks about how investing in foreign currency bonds could potentially enhance income and returns.

Learn about Savings & Protection

Join Garry Chua, Group Head of Bancassurance as he shares how one can remain financially secure in a world of needs and wants.

Learn about Bonds

Join Jonathan Conley, Head of Treasury Advisory as he breaks down the bonds basics in this video.

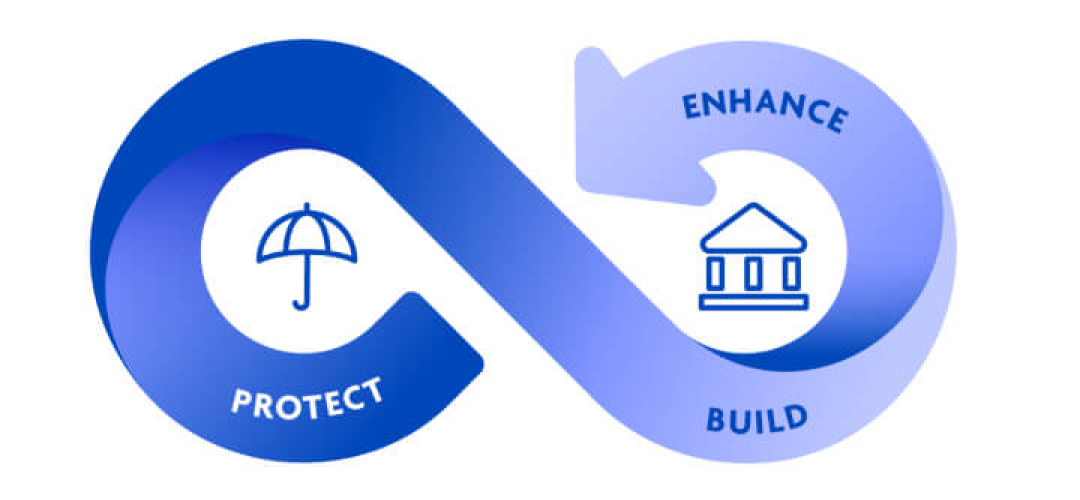

Our Risk-First Approach

Our unique Risk-First Approach ensures that you understand your risk appetite as the starting point in your wealth journey.

Financial Literacy

Learn, grow and evolve. Improve your financial literacy and gain industry insights.

Things you should know

Important notice and disclaimers

The information contained in this publication is given on a general basis without obligation and is strictly for information purposes only. This publication is not intended to be, and should not be regarded as, an offer, recommendation, solicitation or advice to buy or sell any investment or insurance product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. Any description of investment or insurance products, if any, is qualified in its entirety by the terms and conditions of the investment or insurance product and if applicable, the prospectus or constituting document of the investment or insurance product. Nothing in this publication constitutes accounting, legal, regulatory, tax, financial or other advice. If in doubt, you should consult your own professional advisers about issues discussed herein.

The information contained in this publication, including any data, projections and underlying assumptions, are based on certain assumptions, management forecasts and analysis of known information and reflects prevailing conditions as of the date of the publication, all of which are subject to change at any time without notice. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, United Overseas Bank Limited (“UOB”) and its employees make no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for its completeness or accuracy. As such, UOB and its employees accept no liability for any error, inaccuracy, omission or any consequence or any loss/damage howsoever suffered by any person, arising from any reliance by any person on the views expressed or information contained in this publication.

Any opinions, projections and other forward looking statements contained in this publication regarding future events or performance of, including but not limited to, countries, markets or companies are not necessarily indicative of, and may differ from actual events or results. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. Investors may wish to seek advice from an independent financial advisor before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider whether the investment or insurance product in question is suitable for you.

This advertisement has not been reviewed by the Monetary Authority of Singapore.