1 of 3

What do you need help with?

1 of 3

you are in GROUP WHOLESALE BANKING

Access, view and transact from any UOB account across countries with a single login.

Enjoy a consolidated view of your balances and transactions for all your UOB accounts across countries.

Access a full suite of payment and collection services including single and bulk fund transfers via PayNow, FAST/GIRO, telegraphic transfers and more.

Upload bulk files with ease for bulk payments, payroll and collections.

Intuitive tool that recommends suitable payment modes based on the payee details.

Enter the payee information, transaction amount and payment date for the Pay & Transfer Wizard to recommend the appropriate payment modes.

Track incoming and outgoing cross-border payments from end-to-end. Enjoy full visibility of the payment status, charges and FX rates applied.

View status of all transactions in a single location. Transactions are grouped according to their status for easy reference.

Apply for a UOB business account today to help to manage your business:

Find out more about UOB business accounts

If you are interested in registering for Financial Supply Chain Management (FSCM):

Please contact your relationship manager or our Infinity enquiry team at 1800 226 6121 (for Singapore) or +65 6226 6121 (for Overseas) from Mondays to Fridays, 9.00am to 6.30pm, excluding public holidays.

For standard transaction approval settings only:

Apply here. Click here to see a sample.

For customised transaction approval settings:

Download the app from the iOS App Store or Android Google Play Store to bank on the go.

Log in to UOB Infinity via the mobile app and follow the instructions to activate Infinity Secure.

Sign up for:

You can use the same token to access other Singapore accounts in the same company.

Apply now

Sample filled form

With Global View and more customisation, you can:

Please contact us for more assistance via:

Please contact your relationship manager or our Infinity enquiry team at 1800 226 6121 (for Singapore) or +65 6226 6121 (for Overseas) from Mondays to Fridays, 9.00am to 6.30pm, excluding public holidays.

Personalise your dashboard with information that matters most to you.

Learn how to customise the dashboard for your convenience.

Learn how to access consolidated account details and download reports with ease.

Learn how easy it is to add new payees and make cross-border payments.

Learn how to authorise payments on the go and track cross-border payments from end-to-end.

Personalise your dashboard with information that matters most to you.

Learn how to customise the dashboard for your convenience.

Learn how to access consolidated account details and download reports with ease.

Learn how easy it is to add new payees and make cross-border payments.

Learn how to authorise payments on the go and track cross-border payments from end-to-end.

Attend our remote training workshops designed to help you get started on UOB Infinity.

Attend our remote training workshops designed to help you get started on UOB Infinity.

Download the UOB Infinity App from the Apple App Store or Google Play Store to bank on the go.

Log in to the UOB Infinity App and follow the instructions to activate Infinity Secure (digital token).

Log in to start using UOB Infinity.

Create and initiate payment instruction

To initiate a payment instruction in UOB Infinity, from the top menu bar, select Pay and Transfer > select the payment type and follow the on-screen instructions accordingly.

For a step-by-step guide, you can access the user guide here or by clicking the question mark icon ( ) located at the top left of the screen.

) located at the top left of the screen.

The Payee List shows the 10 most recent payees from the same user with the most recent listed first . There is no filtering by debit account or transaction type.

Payment service to your service order

This is offered free of charge. To initiate a bill payment transaction to a billing organisation, from the top menu bar, Select Pay & Transfers > Bill Payment.

You will need to enter your bill reference. If you are not sure which is your bill reference, please contact the billing organisation.

Pay & Transfer Wizard

Pay & Transfer Wizard is an intuitive payment feature that recommends the most suitable payment mode(s) based on the payee details provided when creating the payment instruction. This feature is specially designed to help users who are not familiar with the various payment modes (e.g. FAST, GIRO, Telegraphic Transfers, etc).

Pay & Transfer Wizard is accessible from the top menu bar:

) from the account that you wish to make the payment from > Make Payment

) from the account that you wish to make the payment from > Make PaymentYes, you can restrict users to creating/approving payment to specific payees only by allowing them to access pre-approved payees (PAP) only. The Company Administrator can set the user’s access by selecting “PAP Only” under the user’s account setup.

The latest date that your staff can expect their salary in their account will be one day after the value date i.e. 23 Feb 2024. This is because some banks may credit the funds at the end of the day on the Value Date.

To ensure that the salary is available to your staff on the Value Date, please submit the transaction before the following cut-off times:

You can find out which authoriser is next to approve the transaction from Approval Status:

)

)You can approve a payment instruction from:

If you need a step-by-step guide, please log in to UOB Infinity, click the user icon ( ) at the top menu bar and click "Need Help?".

) at the top menu bar and click "Need Help?".

If you are authorised to approve your own payment, you will have the option to approve the payment immediately by selecting “Submit Now”. Alternatively, you may approve the payment later by selecting “Add to My Tasks

Set up or update authorisation mandate

To set up or update your approval mandate, or change the authorisers’ authorisation groups, please submit a maintenance form.

Who can approve the payment?

Any authoriser indicated according to the company’s approval mandate can approve the payment, even if the authoriser that you notified to approve the payment is not available to approve it.

Every monetary transaction can only be approved according to the approval mandate in the authorisation profile. In addition, you can also set up the following limit controls:

Note: If you do not indicate a limit in the Registration Form, the Bank will set $999,999,999.99 as the default limit.

To recall a payment after it has been sent to the Bank for processing, please contact UOB at 1800 226 6121 (for Singapore) or +65 6226 6121 (for overseas) immediately.

You can check the transaction status by selecting Accounts > Approval Status from the top menu bar.

Approval Status provides a consolidated view of all transaction statuses in a single location. The transactions are classified by their status for easy reference:

Status

In addition, the Company Administrator can also set up email or SMS alerts to notify the transaction makers and/or authorisers when a transaction has been successfully processed or rejected.

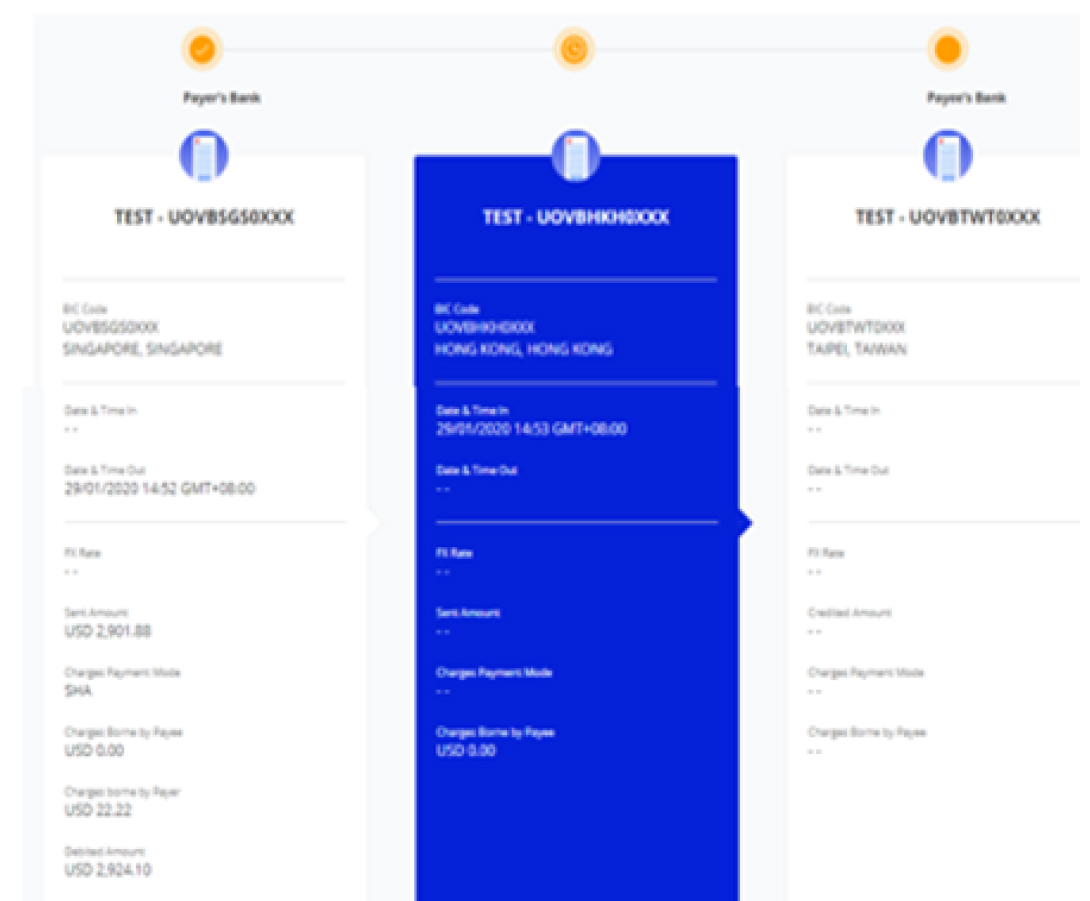

Yes, you can track your cross-border and cross-currency transactions from "Track Payments (SWIFT gpi)". To access “Track Payments (SWIFT gpi), from the top menu bar, select Pay & Transfer > Track Payments (SWIFT gpi).

SWIFT Global Payment Innovation (SWIFT gpi) is a service offered by SWIFT, aimed at transforming the customer experience in tracking cross-border payments. SWIFT is a global provider of secure financial messaging services.

Using the "Track Payments (SWIFT gpi)

This feature allows users to do end-to-end tracking of their incoming/outgoing cross-border payments, which includes Telegraphic Transfers/MEPS/MT202 transactions. There is no cost to using Track Payments (SWIFT gpi).

The blue column indicates where the payment is at currently.

A coloured circle can be found on top of each bank’s column indicating the status of the transaction at each bank:

You can use the feature to track Telegraphic Transfers submitted over the counter as long as you know the originating account number of the payments.

For a more detailed explanation of this feature, please log in to UOB Infinity, click the user icon ( ) at the top menu bar, and click "Need Help?".

) at the top menu bar, and click "Need Help?".

You can export the transaction details as a PDF or CSV file. The CSV file format is only applicable for bulk transactions. For the PDF file format, you can choose to export the transaction details with or without the audit trail information.

How to export transaction details

To export transaction details:

), select “View Details”

), select “View Details”For single transactions:

For bulk transactions:

Transaction details are kept in UOB Infinity for 6 months. If you need to obtain the details of payments made more than 6 months ago, please contact the Bank at 1800 226 6121 (for Singapore) or +65 6226 6121 (for overseas).

For other reconciliation/statement reports (e.g. MT940):

You can request for the report to be made available in UOB Infinity through your relationship manager or by visiting the nearest UOB branch.

To download the report:

Yes, there are payment advices generated for Telegraphic Transfers. To locate the advice, from top menu bar:

You can also view and export the inward remittance details using the same steps.

Payments via QR code

You can use the “Scan & Pay” feature in the UOB Infinity mobile app to initiate PayNow transactions.

Before using “Scan & Pay”, please note the following:

Collections via QR code

You can create/generate the QR code to allow your clients to pay using PayNow. This feature is available on both UOB Infinity platforms (web browser and mobile app).

Please note that you will need to register for UOB PayNow Corporate before you can collect funds from your clients using the QR code.

Register for UOB PayNow Corporate

You can register for UOB PayNow Corporate in UOB Infinity via your web browser.

Book Foreign Exchange (FX) contracts

You can utilise your existing FX contracts when you submit cross-currency payments. To utilise existing FX contracts when initiating cross-currency payments:

Please note:

Monitor Foreign Exchange (FX) contracts

You can view and monitor your FX contract utilisation by adding the “FX Contracts & Balances” widget to your Dashboard. To add/remove a widget in Dashboard, click “Customise Dashboard” at the top right corner of the screen.

For a step-by-step guide to add the “FX Contracts & Balances” widget into your Infinity Dashboard, please log in to UOB Infinity, click the user icon ( ) at the top menu bar and click “Need Help?”.

) at the top menu bar and click “Need Help?”.

The biometric feature allows you to access the mobile app quickly and securely by using your mobile device’s fingerprint / face recognition function. With this feature, you do not need to enter your password to log in to the UOB Infinity mobile app.

For a step-by-step guide to setup the fingerprint / face recognition authentication, please log in to UOB Infinity, click the user icon ( ) at the top menu bar and click “Need Help?”.

) at the top menu bar and click “Need Help?”.

Enable biometric login on 1 device only

For security reasons, each user is allowed to enable the fingerprint / face recognition function on one mobile device only. If you are switching to a new mobile device, you need to re-enable your fingerprint / face recognition function on the new device. The fingerprint / face recognition function set up on the existing device will be removed automatically once it has been set up on the new mobile device.

Re-enable biometric login if uninstall UOB Infinity mobile app

For security reasons, your fingerprint / face recognition setup in the app will be removed when you uninstall the app or clear the app data. You will need to re-enable your fingerprint / face recognition function on your mobile device.

Failed attempts for biometric login

For security reasons, your fingerprint / face recognition function will be disabled after the 5th failed attempt. Please use your password to log in so as to re-enable your fingerprint / face recognition function.

Yes, you can use your overseas contact number in UOB Infinity. UOB Infinity does not have restrictions and can send SMS to all countries' mobile number.

Yes, you can approve all types of transactions using the UOB Infinity mobile app.

No, the UOB Business app will still be available for Business Banking customers. For the Business app users, “Digital Banking” will replace “BIBPlus Mobile” in the bottom menu and will:

Web browser and mobile operating system requirements for UOB Infinity

The minimum supported versions of the different browser types required to access UOB Infinity are:

The minimum supported versions for iOS and Android mobile operating systems are:

These minimum supported versions of the browsers and mobile operating systems have continued security patches and updates provided by the respective manufacturers.

Security

UOB Infinity has a system that provides a high standard of security for banking over the Internet. This security system safeguards the confidentiality of your personal account information and banking transactions by employing:

To further protect your company's account and transaction information while banking via UOB Infinity, we recommend doing the following:

For more details, you may wish to view our best privacy and security practices.

Business Internet Banking (BIB)

Trade & Financial Supply Chain Management (FSCM)

Payments

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Please refer to UOB Insured Deposit Register for a list of UOB accounts / products that are covered under the Scheme.

For more information on the Deposit Insurance Scheme, please click here.

We use cookies to improve and customize your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.