1 of 3

What do you need help with?

1 of 3

you are in GROUP WHOLESALE BANKING

Streamline receivables through customisable payer identification.

Improve cash flows by reducing Days Sales Outstanding.

Greater operational efficiencies with the automation of reconciliation processes.

Better sales cycles with the timely release of customer credit lines.

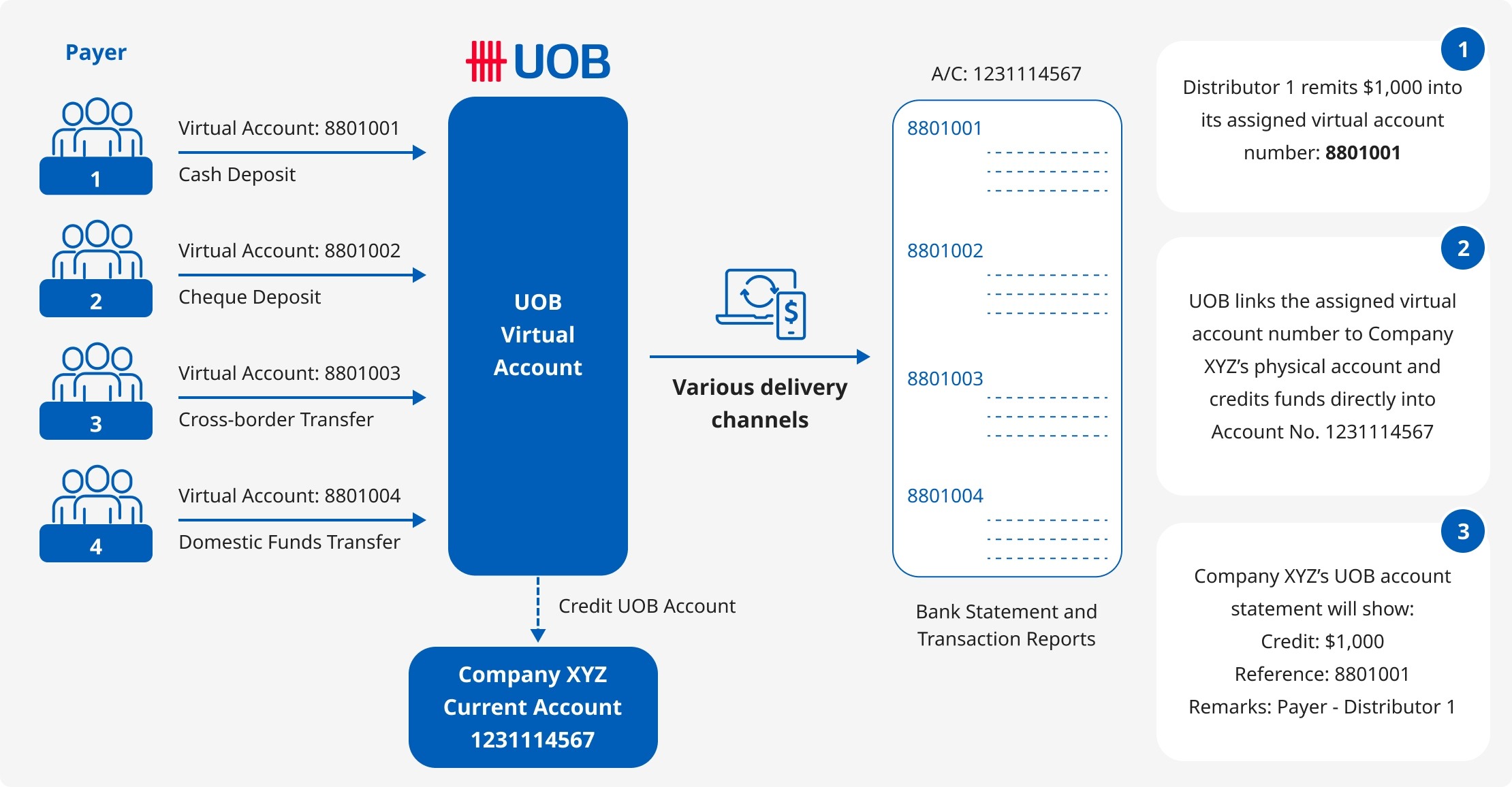

With UOB Virtual Account Services, unique virtual account numbers (VANs) are assigned to each of your customers or payers, allowing them to make payments directly to their designated VANs. A range of VANs will be assigned by the bank for your application. Alternatively, you can decide the range of VANs to be assigned to your customers, which are then set up by the bank (e.g., using customer number as part of the virtual account number).

Your customers can then indicate their assigned VAN as the crediting account number when making payments either through manual or electronic payment channels.

Upon receiving these payments, the bank will credit the funds directly to your UOB bank account linked to the VAN. The respective VANs corresponding to each of your customers will also be shown in your bank statement, enabling you to identify the payers with greater ease during your AR reconciliation.

1. Streamline receivables and reconcile with greater accuracy

Company M owns various F&B outlets. To facilitate their reconciliation at individual branch outlet level, the company opened separate current accounts for each F&B outlet, resulting in the need to manage 22 separate accounts. With UOB Virtual Account, Company M only needs to open a single account, and assign a different virtual account number to each outlet. Leveraging the unique virtual account number assigned to each outlet, all collections credited to that single account can then be easily reconciled back to the respective individual outlets.

2. Identify payers more easily for easy reconciliation

Company N has started to push for the digitalisation of their collections. However, as most customers do not indicate a specific transaction reference when making payments, reconciliation has become a challenging task, which resulted in the manual matching of payments received to the corresponding payer. UOB Virtual Account provides Company N with the flexibility of defining account numbers unique to each of their customers, such as using its customer ID as part of the virtual account number. This allows Company N to enjoy greater ease and process efficiencies when reconciling their collections.

Terms and Conditions for UOB Virtual Account.

We use cookies to improve and customize your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.