1 of 3

What do you need help with?

1 of 3

you are in GROUP WHOLESALE BANKING

Get your account balance and transaction history through your applications.

Make real-time payments, refunds, and start instant collections via your apps.

Collaborate with your customers and partners through better workflows.

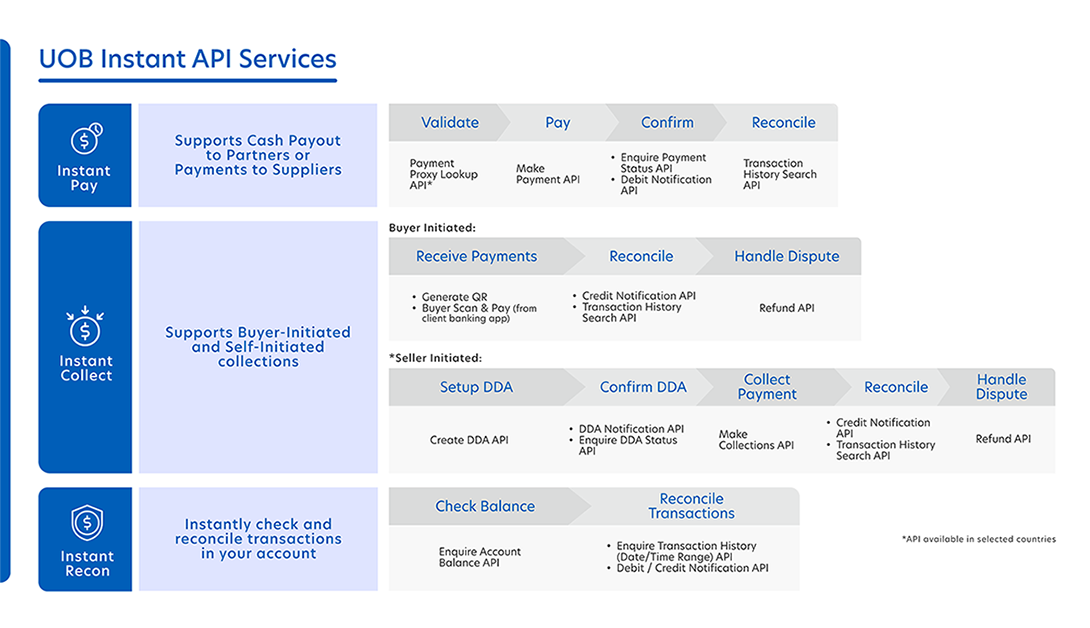

UOB API Services main capabilities are Account Services, Payments and Collections Services, and Foreign Exchange (FX) Services.

Account Services include:

Payment and Collections Services:

Foreign Exchange (FX) Services:

Get FX Rates for you to transact via REST API. Have a wide range of options to customise and integrate our API into your business workflow.

With FX API you can:

*Available on FIX protocol only

API (Application Programming Interface) is a set of formalised commands that allow software applications to communicate with each other in a seamless and secure manner. An API is akin to a messenger that takes an instruction from the initiator and further instructs and triggers the system to return an instantaneous response back to the initiator. For instance, when you Google “UOB”, Google returns to you search results from the Internet on information related to UOB. The ability to return information to you on UOB is enabled via API.

API services enable instant communication between you and UOB, facilitating instant payments and notifications.

UOB offers a set of API services that allow our clients to connect to us and retrieve real-time information in relation to their accounts, as well as send domestic payments and collections (in markets where direct debit services are available) instructions to us instantaneously.

An overview of our API services offered in Singapore is appended below:

| Customer to Bank API Services | |

| Account Services | Payment and Collection Services |

|

|

| Bank to Customer API Services | |

| Account Services | Collection Services |

|

|

Yes. API services are live in the following UOB locations: Singapore, Malaysia, Indonesia, Thailand, Vietnam, China and Hong Kong. The range of API services available may vary across the UOB locations depending on local clearing and market nuances. Please reach out to your TB Cash Sales partners for more details and information

Any corporate (non-individual) client can sign up for our API services.

The use of API services can deliver the following benefits to clients:

You can explore and learn more about our API services via our API Developers Portal (https://developers.uobgroup.com/en/), a self-service platform that provides clients an overview of our API product capabilities.

Additionally, you will be able to experiment with and validate API messages through this portal. If you are keen to further explore our API services, they can send an email enquiry to UOB via the same portal. The email enquiry will be routed to the appropriate cash management sales manager who will reach out to the client to discuss further.

We use cookies to improve and customize your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.