You are now reading:

Get a cash advance with sales invoice purchasing solutions

1 of 3

you are in GROUP WHOLESALE BANKING

You are now reading:

Get a cash advance with sales invoice purchasing solutions

One of the key factors to finding success in today’s fast-paced business environment is maintaining a healthy cash flow. In an earlier article on Purchase Invoice Financing, we talked about how businesses can finance the payments of their suppliers’ invoices in order to pay the suppliers on time while deferring the payment dates.

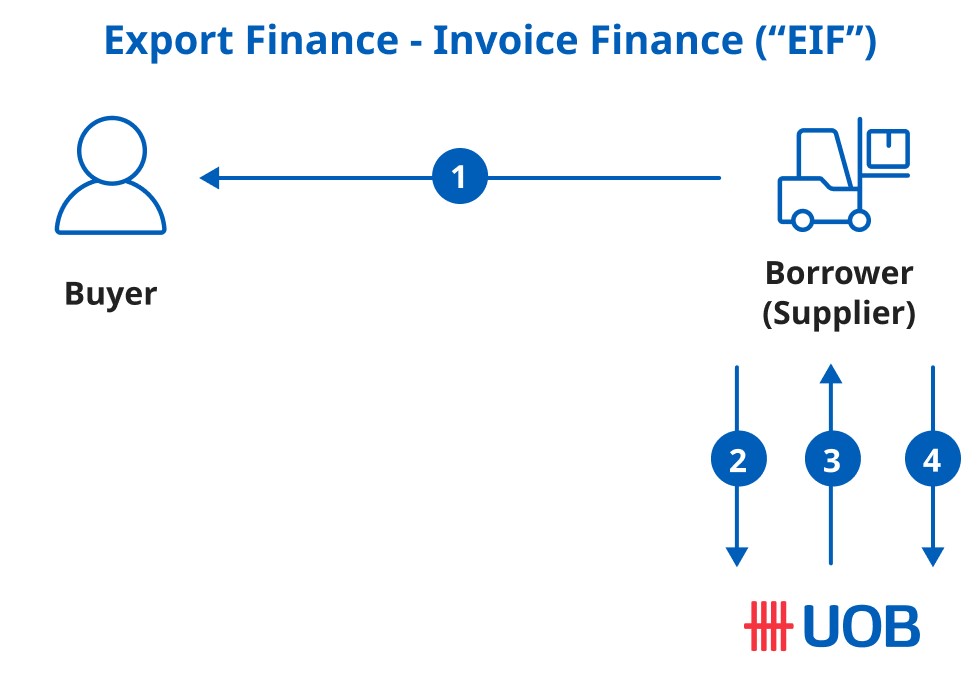

From a supplier’s perspective, you can also tap on Sales Invoice Financing to leverage unpaid invoices and receive a cash advance from UOB. This cash advance on your sales, typically 70% to 90% of the invoice value after deduction of interest and fees, is particularly helpful when you are required to provide extended payment terms to your customers.

To ascertain if this solution is the right one for you, answer the following questions:

If your answer is "yes" to most of these questions, sales invoice financing might be suitable for you.

Company Y, a mid-sized company specialising in custom machinery parts, has been experiencing steady growth, with a significant increase in orders from both existing and new clients. However, the payment terms for these orders often extend to 60 or even 90 days, creating a cash flow challenge for Company Y.

Company Y applies for sales invoice financing with UOB for their latest invoice sent to a buyer with a 90 days credit term, and upon approval, receives a significant portion of the invoice value prior to the receipt of proceeds from the customer. With this cash injection, Company Y is able to purchase more raw materials, prepare for upcoming orders and maintain a stable cash position while waiting for the customer to make their payment.

To find out more on how UOB can support your business growth with Sales Invoice Financing, click here or book an appointment at a UOB branch of your choice via the UOB SME app.

IMPORTANT NOTICE AND DISCLAIMER

The information contained in this publication is based on certain assumptions and analysis of publicly available information and reflects prevailing conditions as of the date of the publication. Any opinions, projections and other forward-looking statements regarding future events or performance of, including but not limited to, countries, markets or companies are not necessarily indicative of, and may differ from actual events or results.

The views expressed within this publication are solely those of the author’s and are independent of the actual trading positions of United Overseas Bank Limited, its subsidiaries, affiliates, directors, officers and employees (“UOB Group”). Views expressed reflect the author’s judgment as at the date of this publication and are subject to change.

UOB Group may have positions or other interests in, and may effect transactions in the securities/instruments mentioned in the publication. This publication is not an offer, recommendation, solicitation or advice to buy or sell any product or enter into any transaction and nothing in this publication constitutes accounting, legal, regulatory, tax, financial or other advice. Please consult your own professional advisors about the suitability of any transaction/ investment product/securities/ instruments for your investment objectives, financial situation and particular needs.

UOB Group may have also issued other reports, publications or documents expressing views which are different from those stated in this publication. Although every reasonable care has been taken to ensure the accuracy, completeness and objectivity of the information contained in this publication, UOB Group makes no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability relating to any losses or damages howsoever suffered by any person arising from any reliance on the views expressed or information in this publication.

This publication has not been reviewed by the Monetary Authority of Singapore.

Stay on top of your business with the UOB SME app.Download here now

Start your UOB eBusiness account today, and enjoy zero fees* and more than S$500 of annual savings on FAST and GIRO transaction fees.

10 Dec 2024 • 20 mins read

25 Sep 2024 • 20 mins read

13 Aug 2024 • 5 mins read