You are now reading:

4 ways to strengthen your trading business amid the pandemic

1 of 3

you are in GROUP WHOLESALE BANKING

You are now reading:

4 ways to strengthen your trading business amid the pandemic

COVID-19 has had a significant impact on the outward-oriented trade sectors in the past year. Lockdowns and border closures have affected external demand and prolonged global supply chain disruptions.

What does this mean for wholesale businesses?

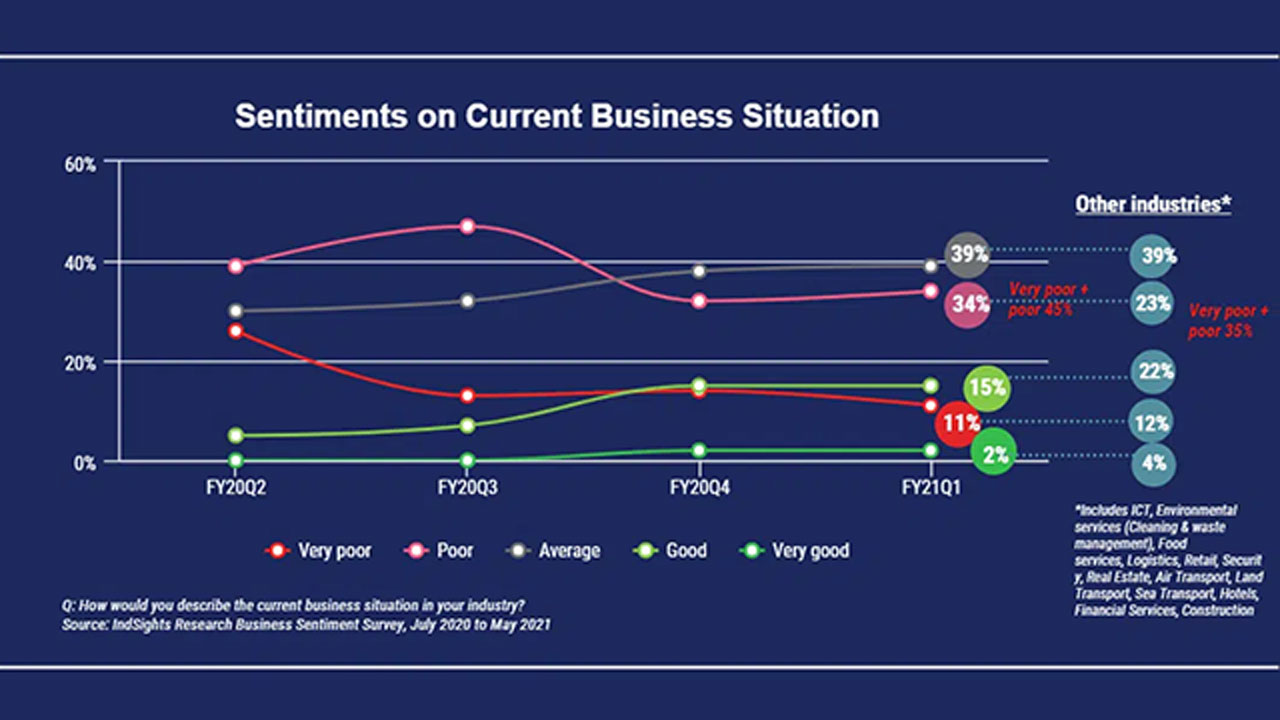

According to data from IndSights Research’s Business Sentiment Survey (BSS) between July 2020 and May 2021, wholesalers hold a less optimistic, cautious view about their industry (45 per cent) compared to their peers in other industries (35 per cent).

Image Source: IndSights Research

But, not all is doom and gloom for wholesale businesses in Singapore amid the pandemic.

Despite the current challenging business environment, the BSS found:

This all adds up to good news for Singapore trading businesses. Trade isn’t going away; in fact, it’s becoming increasingly feasible to grow and even turn a bigger profit during this uncertain environment.

With this in mind, what do business growth opportunities look like now? And how can you strengthen and protect your business amid the pandemic? Here are four actions to consider in the near future.

Due to the pandemic, more import/export businesses face challenges in managing their cash flow or liquidity. They face the risks of significant upfront costs by paying suppliers, custom duties and import taxes upfront.

Managing these risks is crucial. Here’s how your banking partner can help.

Importers now face higher credit terms and need to provide more assurance of payment. Your supplier may have more stringent credit terms to protect their own cash flow.

To adjust to your suppliers’ stricter credit requirements, draw on a trade credit facility with a bank, like UOB’s Import Letter of Credit (LC). This assures your sellers of payment when UOB issues an LC according to the terms of your transaction. It’s a safer mode of payment, as UOB only carries out your payment after we receive trade documents.

With UOB’s Export Letter of Credit (LC), the bank also helps exporters reduce the risk of transacting with overseas buyers.

With an LC, the bank assures payment once your documents meet the conditions stated in the letter, allowing you to reduce payment risks. Here, UOB helps assure your buyer’s LC is legitimate before you complete the transaction.

Supply chain resilience has become a top priority for trading businesses, given the increasing incidence of supply chain disruptions.

Only 40 per cent of global freight transport arrived on schedule in 2021 so far--a marked decrease from 2020, where more than 70 per cent of ships arrived on time. Shipments faced an average delay of six days, a longer delay compared to the previous two years where over 70 per cent of ships arrived on time.

As supply chains are growing more complex, the entire system can be completely disrupted by a single weak link. Trading business owners now need to balance cost and efficiency with supply chain resilience as a result.

How do you develop supply chain resilience?

Keeping enough cash flow and liquidity to keep businesses running is a challenge for most SMEs during COVID-19. Our ASEAN SME Transformation Study 2020 found that 55 per cent of Singaporean SMEs considered maintaining cash flow during the pandemic as a top business concern.

SMEs are more vulnerable to the economic impact of the pandemic compared to multinational corporations (MNCs).

They have comparatively less access to financial reserves or investment capabilities. With this in mind, how can SME business owners optimise cash flow and ensure enough funds to run your business smoothly?

Adopt technology to digitalise and automate manual processes to reduce your fixed costs. Here are some common business processes that you can automate and save money on:

Accounts payable (AP) processes:

Goldman Sachs estimates manual processing and labour costs for AP staff at USD 22.26 for small businesses per invoice. This falls to USD 6.89 with automation, reducing costs by 60 per cent.

Late payment reminders:

In Singapore, late payments to SMEs added up to SGD4.146 billion in 2018. Only 39.45 per cent of payments to SMEs are on time, according to research in Hong Kong and Singapore by accounting software firm Xero.

Adopt accounting software like Xero available through the UOB BizSmart programme, to automate payments on invoices and schedule reminders. Late payments impact cash flow and cause businesses to miss out on revenue-generating activities like earning bank interest.

During cyclical downturns, it may be a challenge to manage cash flow. Consider taking out a business loan to free up enough funds to pay for operational and staff costs. It also helps you build long-term flexibility.

Taking out a loan can help support business growth by strengthen your business cash flow. UOB Business loan offers Temporary Bridging Loan, a government-assisted loan that can help provide extra working capital to sustain your daily business operations. The package allows SMEs to secure a higher loan of up to S$800,000 with no monetary or property collaterals required.

The pandemic has shown that organisations need to weather major, unforeseen disruptions and have the agility to pivot where needed.

Shifting to e-commerce may help kick off your trading business’ next growth spurt and strengthen your enterprise during uncertain times.

The boom in Southeast Asia e-commerce presents many opportunities for trading businesses like yours. Statistics from The Drum show digital retail in the region grew 85 per cent year-on-year. The region is on track to see almost 80 per cent of consumers go digital by end-2021.

Yet, SMEs are less inclined to operate online and adopt e-commerce. SME owners cite a lack of knowledge of e-commerce, internet security and financial barriers for their hesitation.

However, schemes are available for SMEs who want to embrace e-commerce but aren’t sure how.

Enterprise Singapore re-introduced an E-commerce Booster Package programme on May 16 this year. The programme subsidises 80 per cent or up to SGD 8,000 to help retailers and SMEs reduce the cost of setting up online sales channels on Amazon Singapore, Lazada Singapore, Qoo10 and Shopee.

Other schemes available to help SMEs reduce the cost of digital-first solutions:

No one knows how long the pandemic will last. Its impact on businesses, digitisation, supply chains and finances will persist beyond 2021.

But SMEs can be nimble and adapt to change.

Knowing how to strengthen your trading business even during a pandemic, combined with the right support from your banking partner, will put you in a position of strength in the years to come.

Contact us today to learn more about how you can get support from our specialist teams for your business.

The terms and conditions governing Temporary Bridging Loan apply and are contained in the application form and other offer documents, including the facility letter.

Copyright © 2021 United Overseas Bank Limited Co. Reg. No. 193500026Z. All Rights Reserved

25 Sep 2024 • 20 mins read

13 Aug 2024 • 5 mins read

30 Jul 2024 • 5 mins read

16 Jul 2024 • 5 mins read