1 of 3

What do you need help with?

1 of 3

you are in GROUP WHOLESALE BANKING

Enhance and speed up traceability of your outgoing and incoming remittances.

Trace and track your outgoing and incoming remittances via UOB Infinity with a UETR.

Achieve greater visibility on payment charges and agent bank fees.

Receive real-time SMS or email alerts upon successful crediting of funds.

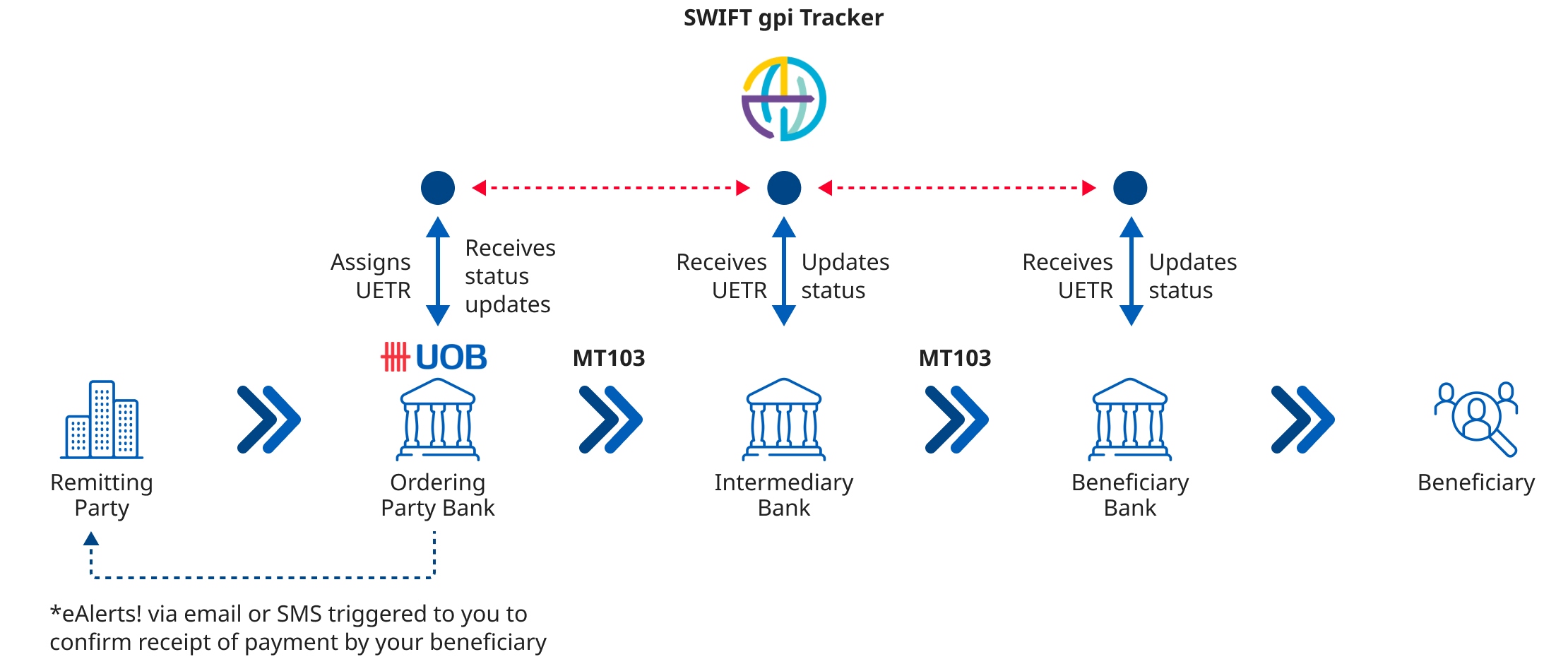

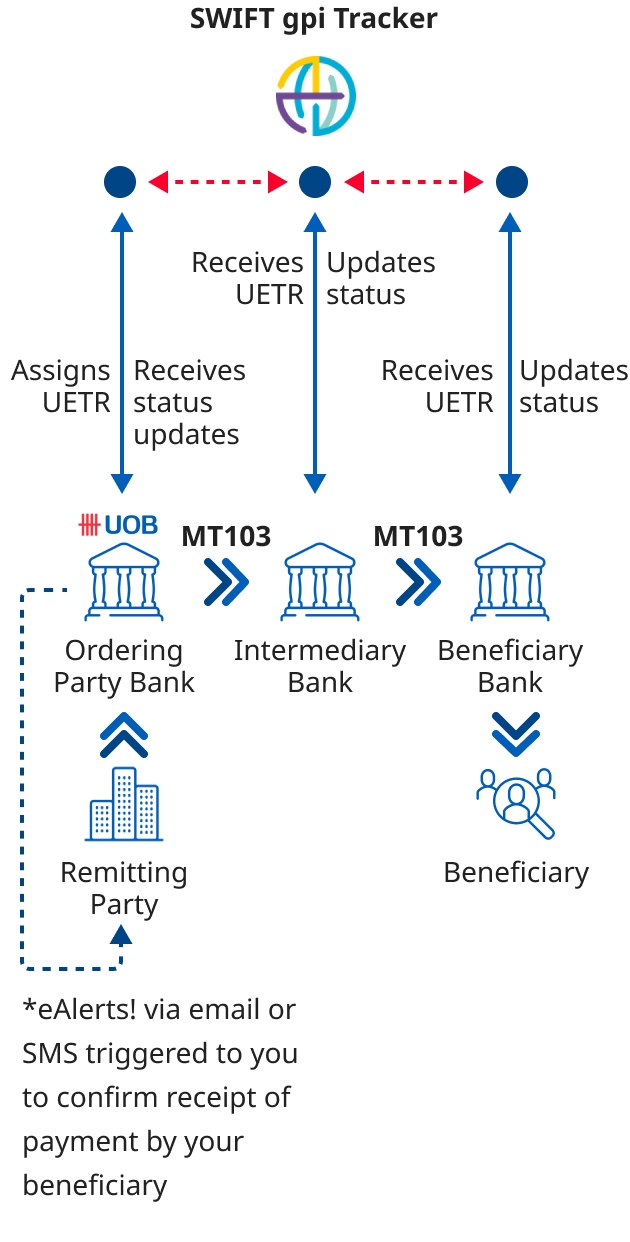

A unique end-to-end transaction reference (UETR) is included in the header of the payment message and is carried across the payment route up until the receipt of funds by the beneficiary bank

*Note: eAlerts! will only be enabled if the beneficiary bank is a SWIFT gpi participant.

| Types | Features |

| UOB Infinity | Business Digital banking | Track incoming and outgoing remittances end-to-end and enjoy full visibility of the payment status, charges, and FX rates applied (where applicable) anytime, anywhere. Find out more here. |

| UOB eAlerts | Receive email and/or SMS alert notifications when your payment has been successfully credited to your beneficiary's account. Find out more here. |

| SWIFT gpi via UOB API Enquiry | If your company is API-enabled with UOB, utilise our API enquiry service to automate real-time retrieval of SWIFT payment and receipt statuses 24x7. Find out more here. |

| SWIFT gpi GFD Reports | Receive a daily end-of-day consolidated report of payments successfully credited to your beneficiaries' accounts to facilitate reconciliation. |

| Types |

| UOB Infinity | Business Digital banking |

| UOB eAlerts |

| SWIFT gpi via UOB API Enquiry |

| SWIFT gpi GFD Reports |

In order to facilitate tracking, each individual SWIFT MT103 payment initiated by banks will carry a Unique End-to-End Transaction Reference (UETR). The UETR will be included in the payment message throughout the routing of the payment from the initiating bank up to the beneficiary bank.

Banks along the payment chain will be required to provide updates on the payment and are subjected to the agreed SWIFT Service Level Agreements (SLA). The SLA requires banks to provide an update on the payment status within 4 hours.

There is no action required on your part. SWIFT gpi is automatically enabled for all eligible MEPS and cross-border payments sent by UOB Singapore.

No, SWIFT gpi information flow is dependent on the participation level of individual banks. Where banks are SWIFT gpi-enabled, they are subjected to SWIFT service level agreements to ensure compliance with information flow requirements. Find out which banks are SWIFT gpi-enabled with the following external URL.

Please refer to https://www.swift.com/our-solutions/swift-gpi/the-digital-transformation-of-cross-border-payments/members for the list of SWIFT gpi participating banks.

The following payment information will be made available to you:

The following charges are applicable to our SWIFT gpi-related services:

We use cookies to improve and customize your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.