1 of 3

What do you need help with?

1 of 3

you are in GROUP WHOLESALE BANKING

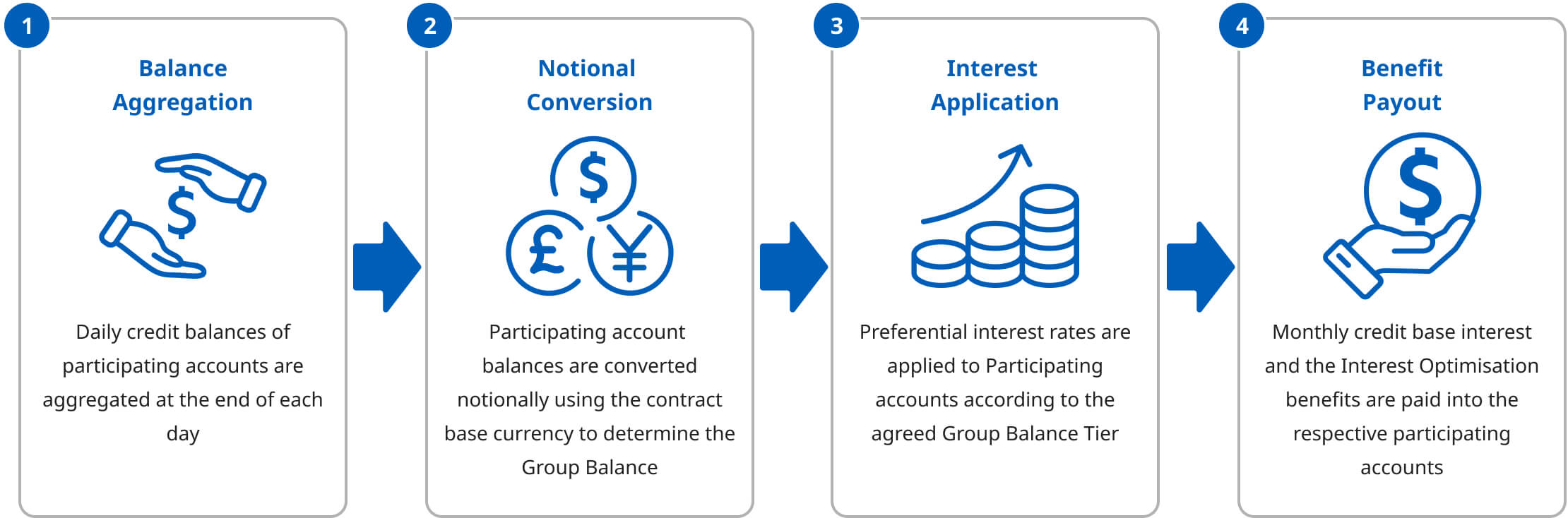

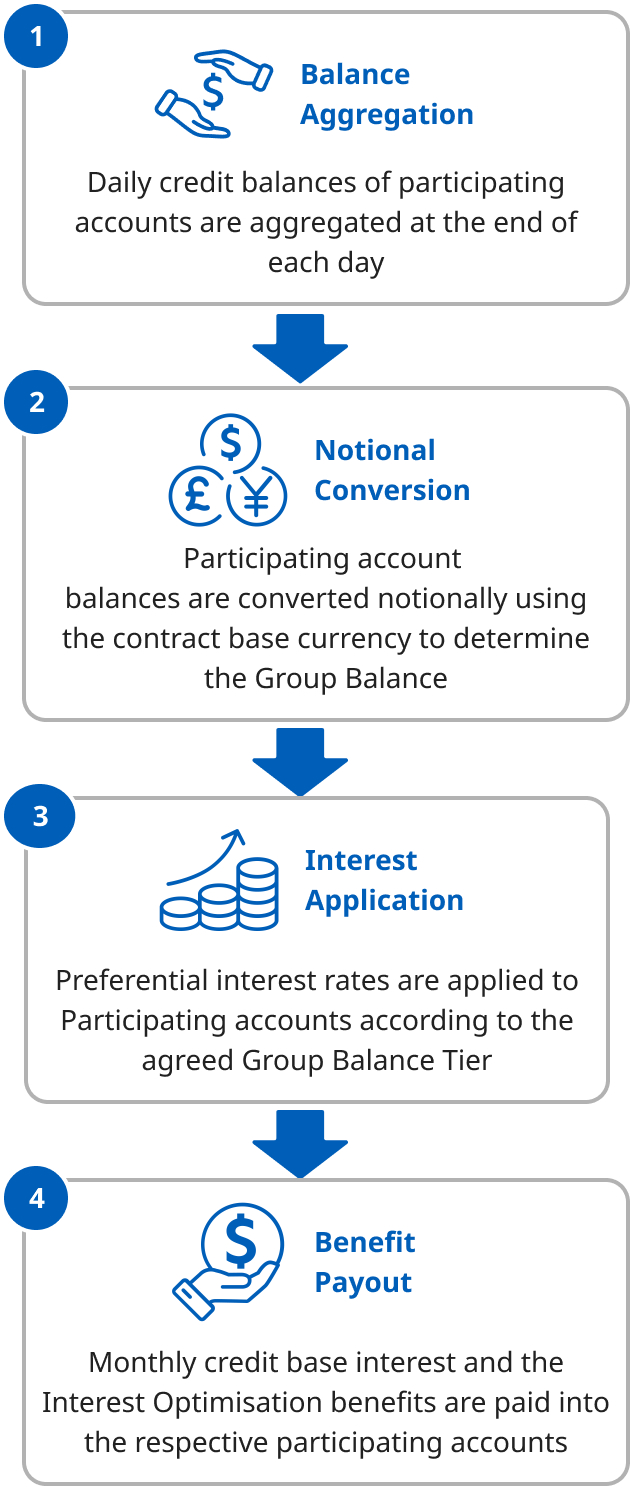

Interest Optimisation service allows you to mobilise your portfolio of credit balances across markets to enhance yields at total group level. Your daily account balances held with UOB in multiple currencies and across locations are converted and notionally aggregated to a selected base currency, treating the balances as an entire portfolio.

The interest benefit derived from the notionally pooled credit balances is awarded through preferential interest paid to participating accounts or to a designated account, where permissible by country regulations.

Interest Optimisation is offered by UOB in many locations, please get in touch with us to find out more.

We use cookies to improve and customize your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.