1 of 3

What do you need help with?

1 of 3

you are in GROUP WHOLESALE BANKING

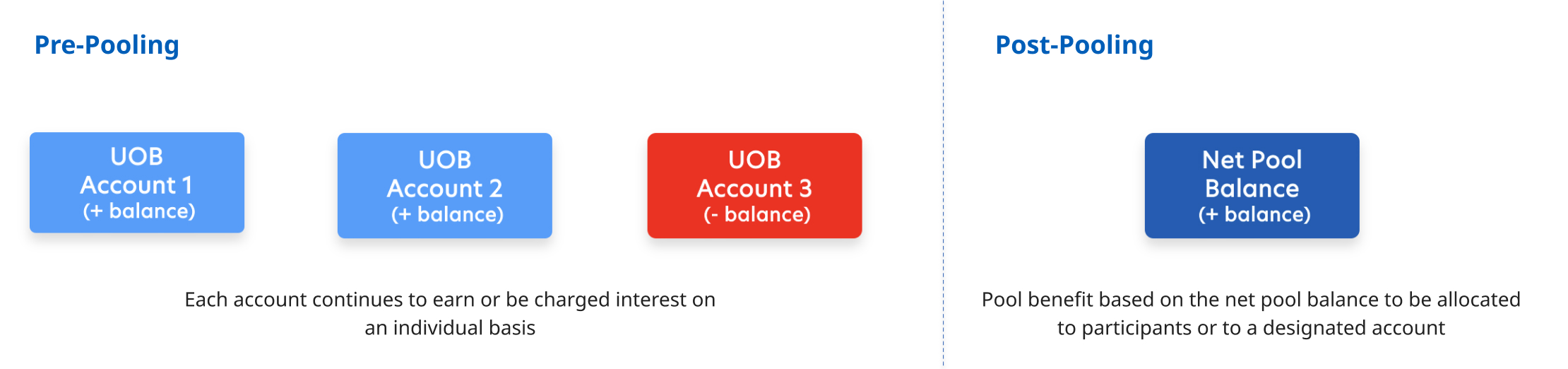

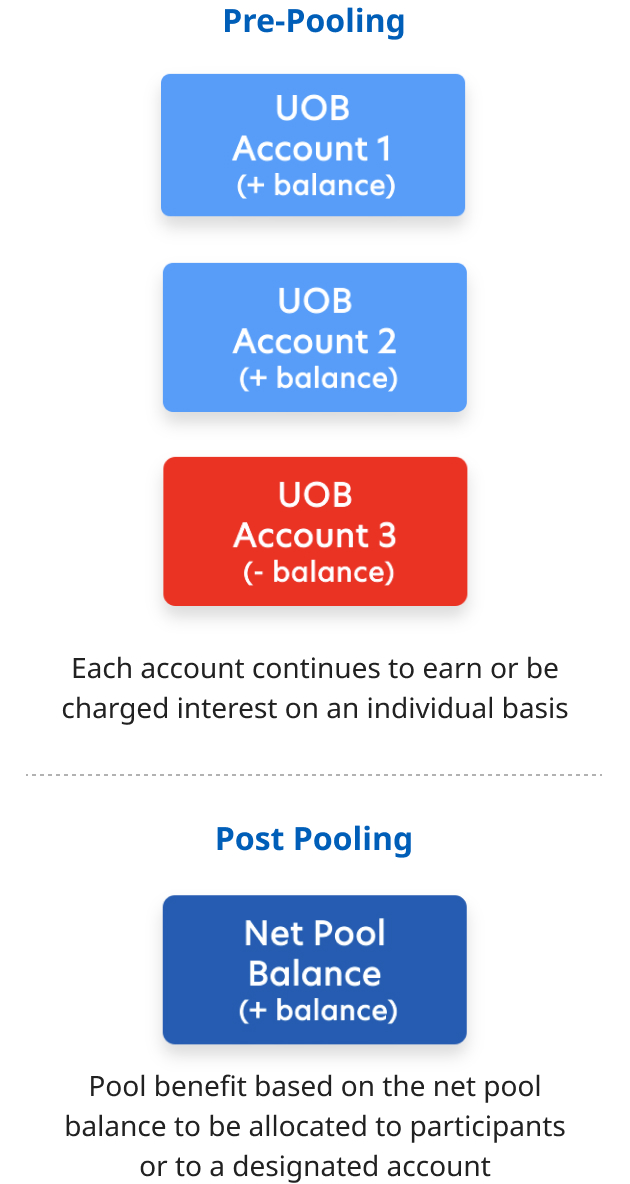

Optimise liquidity across accounts held in a single location without physical movement of funds by notionally offsetting your debit and credit balances.

Notional pool optimises overall liquidity across multiple accounts in a single currency or multiple currency structure without involving the physical movement of funds. Debit balances and credit balances are notionally offset automatically to derive the interest on the net balance. Benefits derived from notional pooling can be allocated to all participating accounts or to a designated account within the cash pool.

Notional pooling is supported in various locations, subject to local regulatory requirements. Please get in touch with the Bank to find out more.

UOB supports the following notional pool structures:

Single entity and multi-entity notional pool

Single-currency and multicurrency notional pool

In locations where notional pool structures can be supported, both the jurisdictions’ respective local currency and various major foreign currencies can participate in a notional pool.

We use cookies to improve and customize your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.