1 of 3

What do you need help with?

1 of 3

you are in GROUP WHOLESALE BANKING

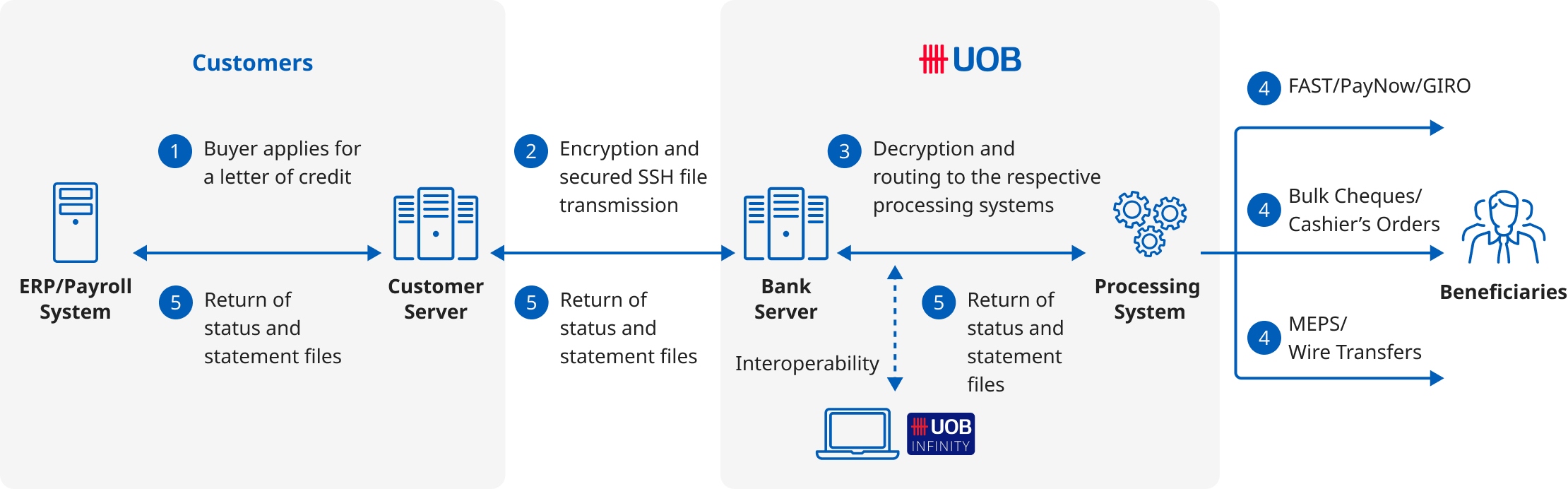

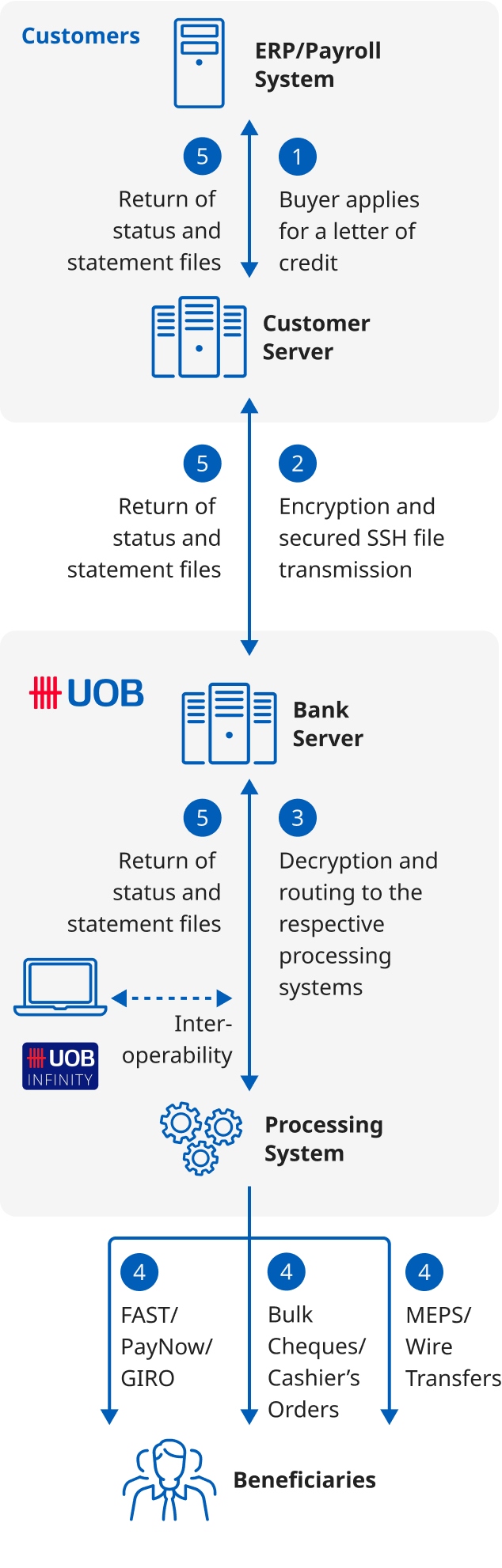

Regional File Transfer Service (RFTS) is a direct host-to-host channel which our customers can use to connect to the Bank using Secured Shell (SSH) infrastructure for sending / receiving bulk payment/collection files, statements and reports.

UOB RFTS service is supported in the key franchise locations – Singapore, Malaysia, Thailand, Indonesia, Vietnam, China and Hong Kong.

UOB RFTS brings the following benefits to your business:

The following products and services are supported through UOB Regional File Transfer Service

With UOB Regional File Transfer Service, your business use a single connection to send payments/collection files and receive statements/reports for your accounts in the locations where RFTS is supported.

With UOB Regional File Transfer Service, security and confidentiality are ensured using industry accepted security standards such as Secure File Transfer Protocol (SFTP) and Privacy Good Privacy (PGP) to ensure data confidentiality.

Through UOB RFTS, customers can transact with the UOB in 2 modes – Direct Straight-Through-Processing (STP) or Interoperable with UOB Infinity.

RFTS is a direct connection with UOB to efficiently and securely send payment files and receive status / statement files from the Bank. Initiate payment instructions through RFTS in the following formats:

Receive End-of-Day or Intraday Account Statements in the following formats:

Direct Straight-Through Processing

In this mode, bulk payment / collection files are fully authorised in Customers’ own ERP system before they are sent to UOB. UOB will process the files without further authorisation from the Customer.

Interoperability with UOB Infinity

In this mode, bulk payment / collection files are routed to UOB Infinity as Transactions Pending client’s Authorisation. The appointed approvers in UOB Infinity are required to log in, review and approve these bulk transactions so they can be released to the bank for processing.

We use cookies to improve and customize your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.