You are now reading:

How to build your own comprehensive financial plan

Inspire the globetrotter in you with the first one-stop travel portal in Southeast Asia designed by a bank that inspires, helps you plan, and lets you book in one place.

Find out more

Skip to higher interest of up to 6% p.a. interest in just two steps. T&Cs apply. Insured up to S$100k by SDIC.

Find out more

Get instant cash at 0% interest and low processing fees. Enjoy S$100 cash rebate* on your approved loan amount!

Find out more

Invest in funds powered by Private Bank CIO – United CIO Income Fund and United CIO Growth Fund.

Learn more

Join us for exciting Pokémon experiences and learn about insurance solutions designed to grow with your family.

Find out more

Meet UOB TMRW, the all-in-one banking app built around you and your needs.

Bank. Invest. Reward. Make TMRW yours.

you are in Personal Banking

You are now reading:

How to build your own comprehensive financial plan

Save for rainy days. Invest a portion of your income. Be protected with insurance.

Marketing executive Wong Li Ying is familiar with these financial planning basics. But that doesn’t immediately translate to doing.

The 28-year-old saves diligently, setting aside 30 per cent of her four-figure salary every month. But she struggles with investing and choosing the right insurance policy.

“I know that I should start looking into these,” admits Ms Wong, who is single and lives with her parents and sister in a four-room Housing Board flat. “But I don’t really know where to start. Money isn’t something that my friends or even my family and I talk about.”

Like Ms Wong, 35 per cent of Singapore consumers say they meet just one out of four norms in a basic financial planning guide, suggests UOB’s Asean Consumer Sentiment Study 2024.

The guide, launched by the Monetary Authority of Singapore (MAS) and industry partners, includes these norms:

The study polled 1,000 Singapore respondents aged between 18 and 65 in May and June. Only 10 per cent said they meet at least three of the four norms, while nearly one in five (18 per cent) did not meet any of the four.

“Financial planning is more than just managing money,” says Mr Winston Lim, Singapore and regional head of deposits and wealth management, Personal Financial Services, UOB. “It is a cornerstone of an individual’s overall well-being, especially in a country like Singapore with a high cost of living and an ageing population.”

Having sufficient emergency funds, for example, can help provide peace of mind. “It gives us clarity on how to handle short-term liabilities and focus on longer-term goals, putting us in a better position to act when the unexpected happens,” says Mr Lim.

The basic financial planning guide is a helpful starting point, says Mr Lim, “but it is good to delve deeper and create a personalised, comprehensive plan as everyone is different”.

Here’s how you can do so.

Assess your financial situation: Start tracking your monthly cash flow. If you have debt, clear that first. MoneySense, Singapore’s national financial education programme, recommends prioritising high-interest debts such as credit card bills to avoid additional costs.

Budget wisely: Once you know what you have been spending on, it’s time to separate your needs from wants. This enables you to identify areas where you can spend less.

Digital tools can help. The UOB TMRW app, for example, helps with budgeting by analysing your spending habits and offering personalised insights into your cash flow. It categorises expenses, highlights trends, and provides tailored recommendations to help you save and earn more.

Craft your goals: Think about short-term needs like paying for your next holiday or celebrating an anniversary, and medium- to long-term financial goals like retirement.

You can set, edit your goals and track them digitally, such as through the UOB TMRW app.

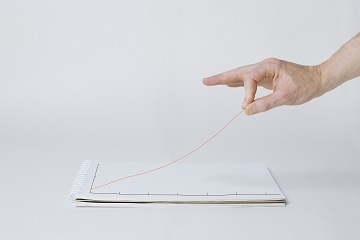

Investing plays a crucial role in meeting longer-term goals. “The compounding of potential returns can steadily grow a small sum into a bigger amount, helping us secure longer-term goals like retirement,” says Mr Lim.

Before you start, understand your financial situation and the investment product, advises MoneySense. Consider your investment horizon, risk appetite, and the investment product’s features, terms, benefits and risks.

The higher the potential returns, the higher the risks, says MoneySense.

Ms Wong says she wants to buy her first home when she turns 35, and is thinking of working out a financial plan with a professional this year.

UOB bankers use its proprietary Portfolio Advisory Tool to better monitor and optimise customers’ wealth portfolios, says Mr Lim. The tool incorporates data from the Singapore Financial Data Exchange (SGFinDex), allowing for real-time analysis of customers’ consolidated wealth holdings across multiple financial institutions.

The goal is to help customers make better investment decisions and reach their financial targets more effectively.

Inflation is the general increase in prices of goods and services. This means a decrease in spending power, where your income does not cover as much as it once did as years go by.

Core inflation in Singapore, which excludes private transportation and accommodation costs to better reflect the expenses of regular households, was 2.5 per cent in July.

MAS considers a core inflation rate of “just under 2 per cent” on average to be consistent with overall price stability in the economy.

Inflation also impacts your savings and long-term goals such as retirement, as your cash loses value over time. “Individuals need to find ways to grow their wealth,” says Mr Lim.

This can include investing in funds, stocks, and bonds, though Mr Lim cautions that these options carry risks, particularly in uncertain economic times.

Our finances and needs change over time. This is why reviewing your financial plan at least once a year is recommended by experts as a general rule of thumb.

Economic and market conditions can also affect your investment and retirement plans in the short term, says Mr Lim. “Monitoring these factors ensures that you are taking advantage of new opportunities and protecting against potential risks.

“As always, consider risks before returns so that you do not take on more risk than you are able or willing to.”

Mr Lim shares the following tips and potential key events in each stage of life.

Focus on building a solid financial foundation. This is the time to pay off your student loan, carefully manage your budget and save for emergencies.

An early start to financial planning can help you build wealth to support your life goals and aspirations. These could include big events like buying your first home, which needs a down payment and monthly mortgage, or getting married and having kids, which might mean getting extra life insurance.

While retirement may seem far off, it’s wise to start financial planning early to compound your retirement nest egg over a longer period.

This phase often involves increasing savings or investing towards retirement, planning for your children’s education, and paying off housing loans.

A major life event, like having children or dealing with medical expenses incurred by elderly parents, may require adjustments to your financial plan.

Your priorities should now shift towards preserving your wealth and generating retirement income.

Financial plans typically focus on earning income through investments, monetising property and preparing for healthcare costs as you get older. Key life events in this stage include retirement and the death of a spouse.

First published in Rethink Your Wealth, a series that provides practical insights and answers on wealth-related topics, to help you transform the way you approach finances.

IMPORTANT NOTICE AND DISCLAIMERS:

This publication shall not be regarded as an offer, recommendation, solicitation or advice to buy or sell any investment product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. Any description of investment products is qualified in its entirety by the terms and conditions of the investment product and if applicable, the prospectus or constituting document of the investment product. Nothing in this document constitutes accounting, legal, regulatory, tax, financial or other advice. If in doubt, you should consult your own professional advisers about issues discussed herein.

The information contained in this publication, including any data, projections and underlying assumptions, are based on certain assumptions, management forecasts and analysis of known information and reflects prevailing conditions as of the date of the article, all of which are subject to change at any time without notice. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, United Overseas Bank Limited (“UOB”) and its employees make no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for its completeness or accuracy. As such, UOB and its employees accept no liability for any error, inaccuracy, omission or any consequence or any loss/damage howsoever suffered by any person, arising from any reliance by any person on the views expressed or information in this publication.

10 Mar 2025 • 4 MIN READ

10 Mar 2025 • 4 MIN READ

28 Feb 2025 • 5 min read