You are now reading:

Stay ahead of inflation

Inspire the globetrotter in you with the first one-stop travel portal in Southeast Asia designed by a bank that inspires, helps you plan, and lets you book in one place.

Find out more

Skip to higher interest of up to 6% p.a. interest in just two steps. T&Cs apply. Insured up to S$100k by SDIC.

Find out more

Get instant cash at 0% interest and low processing fees. Enjoy S$100 cash rebate* on your approved loan amount!

Find out more

Invest in funds powered by Private Bank CIO – United CIO Income Fund and United CIO Growth Fund.

Learn more

Join us for exciting Pokémon experiences and learn about insurance solutions designed to grow with your family.

Find out more

Meet UOB TMRW, the all-in-one banking app built around you and your needs.

Bank. Invest. Reward. Make TMRW yours.

you are in Personal Banking

You are now reading:

Stay ahead of inflation

Mr Michael Tan, 32, used to spend freely. Fancy dinners with friends? Sure. Cafe lunches with colleagues? Why not?

But that was before inflation began to bite. “I wasn’t tracking my spending, but I started noticing that I had less money in my bank account at the end of each month last year.”

“It made me uncomfortable,” says the communications executive, who is single and lives with his family in a four-room Housing Board flat.

Core inflation in Singapore, which excludes private transport and accommodation, reached a peak of 5.5 per cent in January 2023. It eased to 2.7 per cent in August.

For Mr Tan, the wake-up call came when he received his credit card statement. He had spent more than he expected, and needed to use all the money he had set aside for essential expenses to pay the credit card bill in full.

That was when he decided that it was time to cut back on his spending.

A recent survey shows Mr Tan isn’t alone in tightening his belt; 43 per cent of Singapore residents say they have spent less on non-essentials due to inflation, according to the UOB Asean Consumer Sentiment Study 2024.

The study, in May and June, polled 1,000 Singapore residents between the ages of 18 and 65.

Not everyone coped by spending less. The same study found that nearly 1 in 4 (23 per cent) say they set aside less money for savings, investments and insurance instead.

“Without adequate savings, consumers may need to rely on high-interest rate loans or credit to cover medical emergencies or job loss,” says Mr Abel Lim, head of wealth management advisory and strategy at UOB.

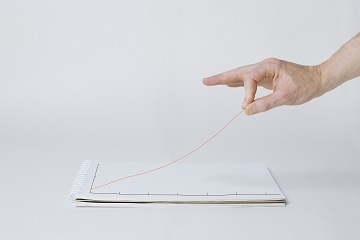

Reducing your investments also means missing out on the benefits of compounding returns, he says, which could delay retirement or force a drastic cut in your living expenses later.

Compounding is what happens when the capital gains and interest earned from your initial sum is reinvested, generating more money over time.

Start with the basics: Regularly review your budget and prioritise essential spending over non-essential expenses, says Mr Lim.

Digital tools can provide deeper insights into your financial habits. The UOB TMRW app, for example, enables users to budget effectively by analysing their spending habits and offering personalised insights into their cash flow. It categorises expenses, highlights trends, and provides tailored recommendations to help you identify areas where you can save and earn more.

Once you’ve got your basics covered, you can explore ways to beat inflation. Here are some of them.

Savings: Traditional savings accounts often lag behind inflation due to the low interest rates they offer, says Mr Lim.

Some accounts pay higher interest rates if specific criteria are met, such as crediting your salary and maintaining a minimum credit card spend. Examples include the UOB One Account.

Investing: Investing for the long term can also help, but it’s important to assess your risk tolerance first.

Risk tolerance refers to how much risk you are willing to take with your investments. You should consider your current financial situation, your investment goals, and time horizon, says MoneySense, the national financial education programme.

Understanding your risk tolerance helps you align your investments with your comfort level, so you don’t invest more than you can afford to lose.

A tip from Mr Lim: “If you are constantly worrying about the status of your investment, it is probably not appropriate for your risk profile.”

Investment-grade bonds (issued by companies with strong credit ratings) and bond funds are options to explore as they still offer attractive yields. They can also appreciate in value as central banks globally start cutting interest rates, notes Mr Lim.

Stocks may seem risky, but historical data shows that a buy-and-hold strategy in a diversified portfolio often beats inflation. You can consider investing in quality companies that pay consistent and rising dividends.

Gold is another asset commonly used to hedge against inflation due to its limited supply. As the US cuts interest rates, the weaker dollar typically boosts gold prices, says Mr Lim.

No matter what you invest in, always diversify across different types of assets. This helps you capture market opportunities while managing risk and reducing portfolio volatility.

MoneySense also recommends understanding your investment horizon, risk appetite, and the investment product’s features, terms, benefits and risks before investing.

Seek professional financial advice: For more assurance, you can work with a financial adviser to create a portfolio tailored to your needs and risk profile. Financial advisers can guide you on how to allocate your assets, managing risk and craft savings strategies to outpace inflation.

You can also receive timely updates about market movements with expert analyses such as UOB Wealth Insights, through a UOB banker or the UOB TMRW app, says Mr Lim. These offer insights into economic data and market dynamics so you can make informed decisions.

The UOB Asean Consumer Sentiment Study revealed that 20 per cent of Singapore consumers say they changed their investments to products that gave higher or faster returns. These are typically more volatile and carry higher risks.

Mr Lim advises caution: “As much as there is an allure in chasing higher returns, there is also the possibility of quick and significant losses if an unexpected market or economic shock occurs.”

Chasing quick returns can lead to impulsive decisions and poor risk management, he adds, which may harm your long-term financial goals.

So what can you do? Instead of trying to “time the market”, MoneySense suggests dollar-cost averaging – investing a fixed amount regularly, no matter the market conditions. This strategy helps lower your average investment cost over time.

Diversifying your investments can also reduce the impact of a poor-performing asset and prevent emotional decision-making, says Mr Lim.

He shares how UOB’s Core-Tactical approach works. It includes:

Taking a long-term view helps you benefit from compounding returns and better manage market volatility, Mr Lim adds. Once your portfolio is anchored in core investments, you can explore tactical options for growth.

Remember to regularly review your portfolio to make sure it matches your risk profile, goals, and the current market conditions.

As you age, your risk tolerance generally changes from aggressive to conservative.

Younger investors often have a higher risk tolerance due to their longer investment timelines, says Mr Lim. This lets them invest in growth-focused assets like stocks and real estate, which offer higher returns but come with more risk.

Closer to retirement, a conservative approach may be needed to protect savings and maintain a stable lifestyle.

Digital tools, combined with in-person advice, can help you refine your financial strategies especially as your needs change.

“At UOB, our holistic approach ensures access to real-time financial information, allowing investors to monitor their investments and market conditions consistently,” he says.

He adds that the UOB TMRW app allows you to set up, edit and track your goals, and provides relevant financial market insight to help you make informed financial decisions.

“With the support of a dedicated financial adviser, personalised recommendations can then be tailored to align with evolving risk tolerances.”

First published in Rethink Your Wealth, a series that provides practical insights and answers on wealth-related topics, to help you transform the way you approach finances.

IMPORTANT NOTICE AND DISCLAIMERS:

This publication shall not be regarded as an offer, recommendation, solicitation or advice to buy or sell any investment product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. Any description of investment products is qualified in its entirety by the terms and conditions of the investment product and if applicable, the prospectus or constituting document of the investment product. Nothing in this document constitutes accounting, legal, regulatory, tax, financial or other advice. If in doubt, you should consult your own professional advisers about issues discussed herein.

The information contained in this publication, including any data, projections and underlying assumptions, are based on certain assumptions, management forecasts and analysis of known information and reflects prevailing conditions as of the date of the article, all of which are subject to change at any time without notice. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, United Overseas Bank Limited (“UOB”) and its employees make no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for its completeness or accuracy. As such, UOB and its employees accept no liability for any error, inaccuracy, omission or any consequence or any loss/damage howsoever suffered by any person, arising from any reliance by any person on the views expressed or information in this publication.

10 Mar 2025 • 4 MIN READ

10 Mar 2025 • 4 MIN READ

28 Feb 2025 • 5 min read