Building Your Portfolio

When building your portfolio, start by considering your risk tolerance and investment time horizon. You should prioritise your risk tolerance over seeking potential returns. A well-rounded portfolio blends Core and Tactical investments, tailored to your investment objectives and risk appetite (Figure 14).

The core strategy is to invest for the long term to meet financial goals while staying ahead of inflation. Historical evidence shows that time in the market beats timing the market![]() . As Core investments are less reliant on market cycles, investors who buy and hold generate better long-term returns compared to those trying to time the market.

. As Core investments are less reliant on market cycles, investors who buy and hold generate better long-term returns compared to those trying to time the market.

By adopting a long-term investment horizon, you can also harness the power of compounding returns and navigate market volatility. Compounded returns, achieved through reinvesting gains and income, can significantly grow your initial investment over time.

Stay proactive and diversify your portfolio to capture opportunities in changing market trends. While we expect stocks to do well in the second half of 2024, a discerning approach is necessary as stock market leadership may shift. Be prepared for potential rotations into more attractively valued regions and sectors. Multi-asset strategies can help you capture such opportunities across different asset classes, regions and sectors when market trends change.

To enhance investment income, complement bond funds and investment grade bonds with quality dividend-paying stocks in your portfolio.

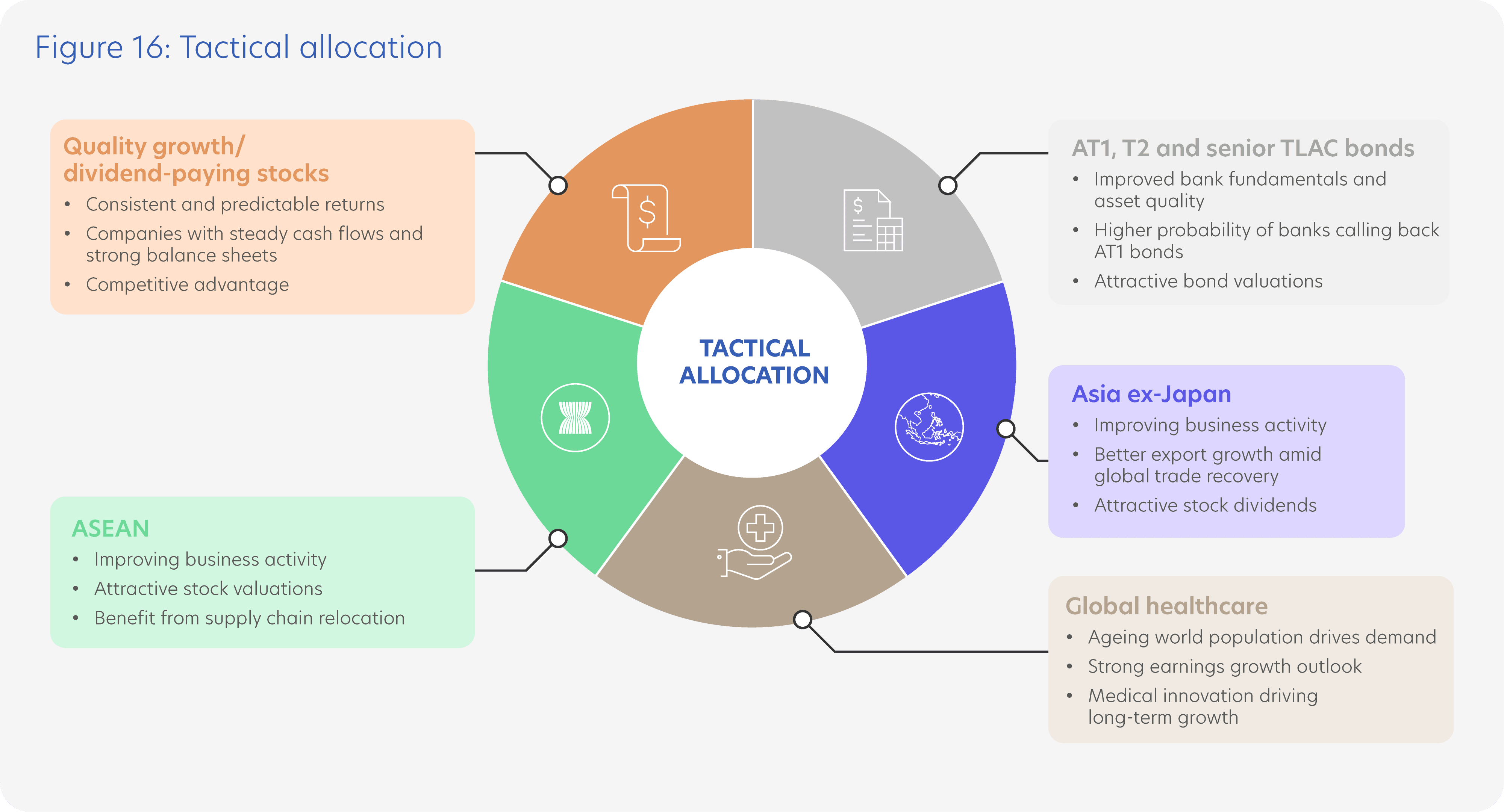

Tactical investments provide the opportunity for potentially higher returns, often through short-term to mid-term investments, but it can also represent greater risk. You should be aware of your current financial situation, long-term aspirations and how much risk you are willing and able to take. Tactical investments like global healthcare, Asia ex-Japan and ASEAN stocks, Additional Tier 1 (AT1)![]() , Tier 2 (T2)

, Tier 2 (T2)![]() and senior Total Loss-Absorbing Capacity (TLAC)

and senior Total Loss-Absorbing Capacity (TLAC)![]() bonds are also discussed in detail below.

bonds are also discussed in detail below.

Other Tactical investments include accumulating quality growth stocks on dips, particularly quality dividend-paying stocks in Asia ex-Japan. Quality stocks are favoured due to their strong revenue growth, robust earnings and lower debt levels.

Core Allocation

Multi-asset strategies

Diversification is crucial, and Core investments like multi-asset strategies provide diversification across different asset classes, regions and sectors. These strategies allow you to capture market opportunities as they arise, while simultaneously lowering portfolio volatility.

Investment grade bond funds

Investment grade bonds offer attractive total returns. This appeal stems from attractive bond yields and potential capital appreciation when central banks cut interest rates. They can also act as portfolio stabilisers if economic weakness emerges.

Tactical Allocation

Quality growth/dividend-paying stocks

Accumulate quality growth stocks and quality dividend-paying stocks on dips when they are cheaper.

Although the global economy remains resilient, inflation persists, geopolitical tensions remain unresolved and political concerns may arise. Against this backdrop, quality companies with resilient revenues and strong cash flows will continue to perform well.

Companies that pay consistent dividends will be even more attractive, as they offer the potential for both investment income and capital appreciation.

We favour dividend-paying stocks in Asia ex-Japan that offer consistent dividend payouts. While these stocks have outperformed their global peers year-to-date, we believe this outperformance will continue for the rest of the year.

Global healthcare

While the MSCI World Health Care Index has lagged in 2024, rising just 3.2% versus the 4.8% gain in the MSCI World Index, we remain positive on global healthcare as earnings growth is anticipated to accelerate later this year.

Long-term trends support the healthcare sector, particularly advancements in treating lifestyle diseases, like weight-loss drugs (GLP-1), as well as the rise of medical technology and equipment. These factors enhance growth prospects in the sector.

Furthermore, the healthcare sector’s diversity provides access to defensive pharmaceutical companies, together with high-growth areas such as life sciences tools and services, healthcare technology and healthcare equipment.

Asia ex-Japan/ASEAN

We continue to favour Asia ex-Japan and ASEAN stocks. Resilient foreign demand has brightened the export outlook for the region. Business activity across both manufacturing and services sectors has improved, while inflation remains more muted compared to developed countries.

Tourism is poised to be a supportive factor moving forward. Chinese tourists are embracing international travel once again, with global Chinese tourist numbers projected to reach 130 million in 2024, 84% of pre-pandemic levels. Furthermore, Chinese tourists are beginning to spend more on their travels. The World Travel and Tourism Council expects Chinese holidaymakers to spend CNY1.8 trillion on international trips this year, a 10% increase from 2019. Countries like Singapore, Malaysia and Thailand are well-positioned to benefit most from China’s tourism recovery as they have either waived visa requirements or are offering electronic visas upon arrival.

If Donald Trump wins the US presidential election and imposes universal tariffs on all imports and higher tariffs on Chinese goods, ASEAN may stand to benefit from shifts in the global supply chain. This is due to ASEAN countries rapidly upgrading their production infrastructure while offering lower production costs. There is also the benefit of a free trade agreement with other Asia-Pacific countries through the Regional Comprehensive Economic Partnership (RCEP). Vietnam is increasingly an electronics manufacturing hub, Malaysian factories are producing desktop computers, Thailand has become a regional automobile manufacturing base while Indonesia is aiming to be a battery production hub for electric vehicles.

Stock markets in Asia ex-Japan and ASEAN will benefit from attractive valuations and the potential for higher corporate earnings. These regional stock markets will also likely benefit from capital inflows once the US Federal Reserve (Fed) begins cutting interest rates.

AT1, T2 and senior TLAC bonds

Finally, other Tactical opportunities exist in Additional Tier 1 (AT1) bonds, also known as Contingent Convertible (CoCo) bonds, Tier 2 (T2) bonds and senior Total Loss-Absorbing Capacity (TLAC) bonds. As these bonds come with higher risk, consider how much risk you are willing and able to take before going ahead with such investments.

Bank fundamentals have improved significantly since the Global Financial Crisis because of deleveraging, de-risking and restructuring. Asset quality has also improved markedly over the past decade, supported by historically high capital buffers that can absorb unexpected losses. Many banks are expected to deliver strong earnings which will help mitigate any deterioration in asset quality in periods of unexpected financial stress.

AT1 bonds currently offer attractive valuations due to relatively wide spreads against investment grade bonds and high yield bonds. There is also a higher probability of banks redeeming their AT1 bonds at the first available call date, with European AT1 redemptions projected at USD29 billion this year.

Should central banks cut interest rates and bond yields fall, there is potential for total returns of these bonds to be positive.

In Conclusion

To achieve your long-term financial objectives, build a portfolio with Core investments before considering Tactical investments. Prioritise risk tolerance over seeking potential returns.

Stay proactive, plan your next move and review your portfolio regularly to capture opportunities in changing market conditions.

Credits

Credits

Managing Editor

- Winston Lim, CFA

Singapore and Regional Head,

Deposits and Wealth Management

Personal Financial Services

Editorial Team

- Abel Lim

Singapore Head,

Wealth Management

Advisory and Strategy - Michele Fong

Head, Wealth Advisory and Communications

Editorial Team (cont’d)

- Tan Jian Hui

Investment Strategist,

Investment Strategy and Communications - Low Xian Li

Investment Strategist,

Investment Strategy and Communications - Zack Tang

Investment Strategist,

Investment Strategy and Communications - Sarah Sng

Intern

Important notice and disclaimers

The information contained in this publication is given on a general basis without obligation and is strictly for information purposes only. This publication is not intended to be, and should not be regarded as, an offer, recommendation, solicitation or advice to buy or sell any investment or insurance product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. Any description of investment or insurance products, if any, is qualified in its entirety by the terms and conditions of the investment or insurance product and if applicable, the prospectus or constituting document of the investment or insurance product. Nothing in this publication constitutes accounting, legal, regulatory, tax, financial or other advice. If in doubt, you should consult your own professional advisers about issues discussed herein.

The information contained in this publication, including any data, projections and underlying assumptions, are based on certain assumptions, management forecasts and analysis of known information and reflects prevailing conditions as of the date of the publication, all of which are subject to change at any time without notice. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, United Overseas Bank Limited (“UOB”) and its employees make no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for its completeness or accuracy. As such, UOB and its employees accept no liability for any error, inaccuracy, omission or any consequence or any loss/damage howsoever suffered by any person, arising from any reliance by any person on the views expressed or information contained in this publication.

Any opinions, projections and other forward looking statements contained in this publication regarding future events or performance of, including but not limited to, countries, markets or companies are not necessarily indicative of, and may differ from actual events or results. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. Investors may wish to seek advice from an independent financial advisor before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider whether the investment or insurance product in question is suitable for you.